The Racial Gap in Stock Market Participation

Many factors could be behind the large wealth gap between white households and Black households that has been widely documented. In a recent Economic Synopses essay, Research Officer YiLi Chien and Senior Research Associate Julie Bennett looked at one potential contributing factor—the groups’ different stock market participation rates.

“Investment decisions matter for the welfare of households and their ability to accumulate wealth,” the authors wrote. “Therefore, understanding the different financial asset participation decisions made by Black and White households is an important step in understanding the racial wealth gap.”

Stock Market Participation Rates by Race

Chien and Bennett used data from the 2018 Survey of Income and Program Participation (SIPP). Their definition of stock market participation was based on whether the value of a household’s stocks and mutual funds was greater than zero at any point in 2017 (the survey’s reference year), they explained.

Chien and Bennett found a sizable difference between the two groups’ stock market participation rates. In particular, they noted that:

- 24% of white households reported owning stock or mutual funds.

- Less than 8% of Black households reported owning stock or mutual funds.

Stock Market Participation Rates by Race and Income

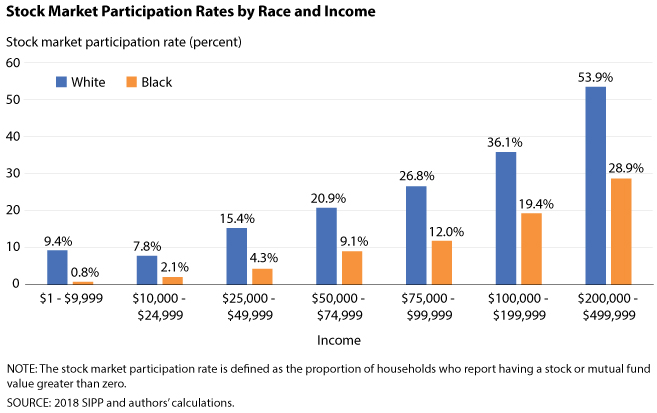

Since the racial income gap may be driving the difference, the authors also examined stock market participation rates after controlling for household income level. They found that the large gap in participation rates remained under this scenario. (This can be seen in the figure below, which is from the Economic Synopses essay.)

“The gap remains large for each group and even appears to widen for higher-income brackets, indicating that household income level does not account entirely for the differences in participation rates between Black and White households,” they wrote.

Chien and Bennett then looked at how much the stock market participation rate gap might close if the income distribution of Black households matched the income distribution of white households. Under this thought experiment, they found that the stock market participation rate among Black households would increase from 8% to about 11.4%—still well below the 24% rate among white households.

“Further attention should be paid to understanding the underlying causes of the difference in stock market participation rates between White and Black households as well as other contributing factors to the racial wealth gap, such as differences in retirement saving,” the authors wrote.

Citation

ldquoThe Racial Gap in Stock Market Participation,rdquo St. Louis Fed On the Economy, May 23, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions