Russia’s Invasion of Ukraine and Its Impact on Stock Prices

Russia’s invasion of Ukraine in February has dominated not only geopolitical news but also economic news in 2022. Both countries are important exporters of many commodities. Russia is a particularly important producer of energy commodities, such as oil, gas and coal; precious metals, such as gold, platinum and palladium; and foodstuffs, such as wheat.Although it is not shown in the following table of key exports, Russia is also an important exporter of palladium, a metal used in catalytic converters, electronics and jewelry. Ukraine also exports large quantities of foodstuffs, such as wheat and sunflower oil, and iron products.

The following two tables shows lists of exports, one from Russia and one from Ukraine, as well as the percentage of global exports and gross domestic product (GDP) for each category.

| Rank by % of GDP |

Russian Exports | Percentage of Domestic GDP |

Percentage of World Exports |

|---|---|---|---|

| 1 | Petroleum oils and oils from bituminous minerals; crude | 10% | 15% |

| 2 | Petroleum oils and oils from bituminous minerals, not crude | 6% | 10% |

| 3 | Commodities not specified according to kind | 5% | 6% |

| 4 | Gold (including gold plated with platinum) | 2% | 5% |

| 5 | Coal; briquettes, ovoids and similar solid fuels from coal | 2% | 16% |

| 6 | Wheat and maslin | 1% | 18% |

| 7 | Platinum | 1% | 12% |

| 8 | Petroleum gases and other gaseous hydrocarbons | 1% | 5% |

| 9 | Iron or non-alloy steel; semifinished products thereof | 1% | 23% |

| 10 | Copper; refined and copper alloys, unwrought | 1% | 7% |

| SOURCES: U.N. Comtrade, World Bank and authors’ calculations. | |||

| Rank by % of GDP |

Ukrainian Exports | Percentage of Domestic GDP |

Percentage of World Exports |

|---|---|---|---|

| 1 | Sunflower seed, safflower or cottonseed oil | 7% | 40% |

| 2 | Maize (corn) | 6% | 13% |

| 3 | Iron ores and concentrates | 5% | 3% |

| 4 | Wheat and maslin | 5% | 8% |

| 5 | Iron or non-alloy steel | 4% | 13% |

| SOURCES: U.N. Comtrade, World Bank and authors’ calculations. | |||

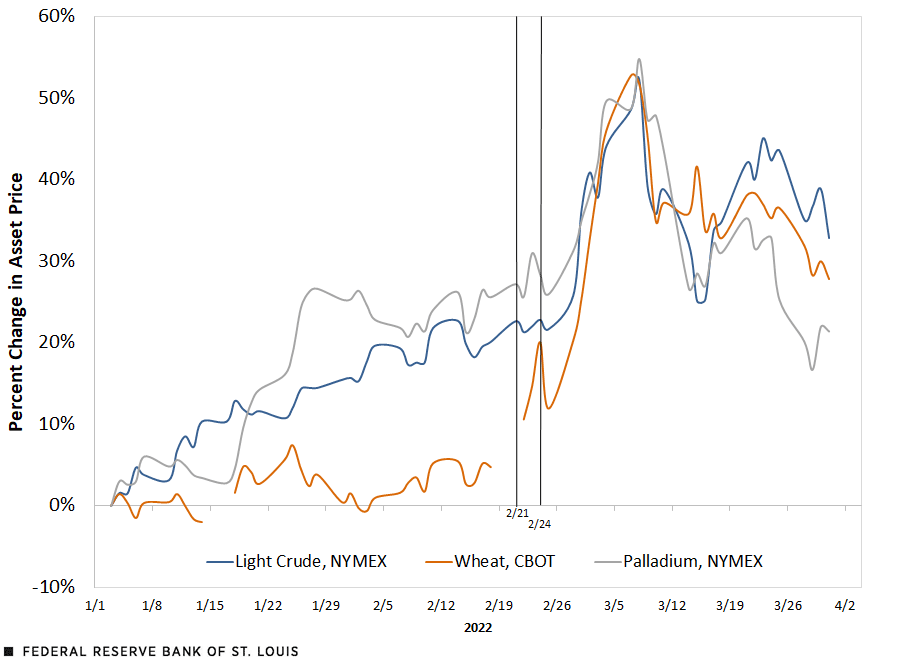

The figure below shows that the prices of oil, wheat and palladium rose sharply in late February and early March. In the figure, two key dates are noted with vertical lines:

- Feb. 21, 2022. Russian military forces enter parts of Ukraine already controlled by Russian-backed separatists.

- Feb. 24, 2022. Russian military forces begin an all-out invasion of Ukraine.

The price increases became particularly pronounced in early March as market participants came to believe that the war would be prolonged and most countries in the Organization for Economic Cooperation and Development would impose serious sanctions on Russia.

Key Commodity Prices Respond to the Russia-Ukraine War

NOTES: Data—which run from Jan. 3, 2022, to March 31, 2022—are based on prices of futures contracts on the New York Mercantile Exchange (NYMEX) or the Chicago Board of Trade (CBOT). The data are normalized relative to Jan. 3, 2022.

SOURCE: Tickdata.

Equity prices in the U.S. and the rest of the world also responded to the changes prompted by the invasion, primarily the changes in commodity prices. Taken as a whole, global equities tended to decline sharply from mid-February to mid-March and then mostly recover later in March.

The commodity price changes benefited some stock prices while reducing others. To determine which stocks benefited and which ones lost, we estimated the average reaction of the top 500 stocks in the Center for Research in Security Prices database to percentage changes in a weighted commodity price index.Percentage changes in the commodity price index were constructed from percentage changes (returns) in the prices of oil, gold, wheat and palladium. The return to each commodity was weighted by the inverse of the return’s standard deviation. That is, we estimated how much a 1% change in a commodity price index would change the equity prices of each of 500 stocks. (See the following table.)

The upper half of the second table shows stocks that moved with commodity prices, while the lower half shows stocks whose prices moved against commodity prices. Stocks in each half were ranked by the sensitivity of the stock price to the commodity price index (commodity beta). The third column shows the commodity betas. A positive commodity beta indicates that the stock price rises with higher commodity prices, while a negative commodity beta indicates that the stock price falls with higher commodity prices. The final column shows the annualized continuously compounded return.A stock’s decline may exceed 100% because the annualized returns are 250 times the mean continuously compounded return, in which 250 is the approximate number of business days in a year. Some stocks with a negative beta may show a gain despite higher commodity prices because of other news and events that affected their share price during the quarter.

| Names | Industry | Commodity Betas |

Annualized Return 2022:Q1 |

|---|---|---|---|

| Occidental Petroleum Corp. | Crude petroleum extraction | 0.68 | 222.6% |

| Devon Energy Corp. New | Crude petroleum extraction | 0.46 | 78.7% |

| Barrick Gold Corp. | Gold ore mining | 0.46 | 136.7% |

| Cheniere Energy Partners LP | Natural gas distribution | 0.45 | 97.6% |

| Cenovus Energy Inc. | Support activities for oil and gas operations | 0.42 | 56.3% |

| Newmont Corp. | Gold ore mining | 0.42 | 127.5% |

| Exxon Mobil Corp. | Petroleum refineries | 0.41 | 60.0% |

| Schlumberger Ltd. | Support activities for oil and gas operations | 0.39 | 46.9% |

| EOG Resources Inc. | Crude petroleum extraction | 0.38 | 59.2% |

| Halliburton Co. | Support activities for oil and gas operations | 0.36 | 137.6% |

| EPAM Systems Inc. | Custom computer programming services | -1.39 | -261.8% |

| Shopify Inc. | Software publishers | -0.81 | -218.1% |

| Deutsche Bank AG | Commercial banking | -0.79 | -31.9% |

| Moderna Inc. | Biological product (except diagnostic) manufacturing | -0.74 | -39.2% |

| Stellantis NV | Commercial and institutional building construction | -0.72 | -138.7% |

| MongoDB Inc. | Software publishers | -0.67 | 66.6% |

| Rivian Automotive Inc. | Offices of other holding companies | -0.64 | -184.2% |

| Delta Air Lines Inc. | Scheduled passenger air transportation | -0.63 | 0.4% |

| Atlassian Corp. PLC | All other business support services | -0.63 | 0.3% |

| Block Inc. | Software publishers | -0.62 | 20.7% |

| SOURCES: Center for Research in Security Prices database and authors’ calculations. | |||

It should not be surprising that firms that sell oil, gas, or gold, or provide services to those industries, benefited from the big increases in the price of oil. It is more difficult to figure out why some firms’ stock prices fell particularly hard, although some are interpretable. Deutsche Bank was among the stocks whose prices lost the most value to commodity price hikes. This bank has (or had) extensive investments in Russia, and the combination of the war and sanctions may have greatly reduced the value of those investments. Delta Air Lines was also among the firms that seemed to have been hard hit by the increases in commodity prices. This makes sense because higher oil prices mean higher jet fuel prices, and Delta also had a partnership with Aeroflot, the Russian national airline.

Notes

1 Although it is not shown in the following table of key exports, Russia is also an important exporter of palladium, a metal used in catalytic converters, electronics and jewelry.

2 Percentage changes in the commodity price index were constructed from percentage changes (returns) in the prices of oil, gold, wheat and palladium. The return to each commodity was weighted by the inverse of the return’s standard deviation.

3 A stock’s decline may exceed 100% because the annualized returns are 250 times the mean continuously compounded return, in which 250 is the approximate number of business days in a year. Some stocks with a negative beta may show a gain despite higher commodity prices because of other news and events that affected their share price during the quarter.

Citation

Christopher J. Neely and Samuel Jordan-Wood, ldquoRussia’s Invasion of Ukraine and Its Impact on Stock Prices,rdquo St. Louis Fed On the Economy, June 30, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions