How Eighth District Firms Have Responded to Higher Inflation

In the first post of this two-part blog series, I outlined the extent to which rising inflation surprised many businesses in the Eighth Federal Reserve District.Headquartered in St. Louis, the Eighth Federal Reserve District includes all of Arkansas, southern Illinois, southern Indiana, western Kentucky, eastern Missouri, northern Mississippi and western Tennessee. In today’s blog post, I’ll examine these firms’ responses to this inflationary environment and the regional price outlook in coming months.

Greater Ability to Raise Prices

In the St. Louis Fed’s quarterly survey conducted in February,The St. Louis Fed conducts this pricing survey as part of its report to the Beige Book. For more information on this survey, see Endnote 2 in the previous blog post. firms were asked to provide a point estimate in the growth rate of the prices they charged customers, as well as in the growth rate in employee compensation. These results are summarized in the table below, along with comparable economic data from the Bureau of Labor Statistics (BLS). On average, District firms reported that prices charged to customers increased 7.8% in 2021, which is generally consistent with changes in consumer prices (7.5%), producer prices (12.5%) and The CFO Survey prices (6.3%).The CFO Survey is conducted through a partnership between Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta. Survey results are not weighted by firm size or sector; the initial sample is intended to reflect the industry mix of the Eighth District economy.

| 2021 | 2022 | |

|---|---|---|

| Survey: Prices Charged | 7.8% | 5.8% |

| The CFO Survey: Prices | 6.3% | 4.2% |

| BLS: Consumer Prices | 7.5% | 4.4% (f) |

| BLS: Producer Prices | 12.5% | 5.9% (f) |

| Survey: Employee Compensation | 5.6% | 5.4% |

| The CFO Survey: Wages | 7.9% | 7.2% |

| BLS: Compensation per Hour | 5.1% | 5.0% (f) |

| SOURCES: Bureau of Labor Statistics, The CFO Survey and Federal Reserve Bank of St. Louis. | ||

| NOTES: Consumer Prices is measured by the consumer price index for all urban consumers; Producer Prices is measured by the producer price index for final demand; and Compensation per Hour is measured by the employment cost index for total compensation, for private industry workers. Values for the three BLS entries are growth rates for the 12 months ended January 2022. The CFO Survey referenced was conducted in the fourth quarter of 2021; values are growth rates from the fourth quarter of 2020 to the fourth quarter of 2021.

(f) Forecasts are growth rates from fourth quarter of 2021 to the fourth quarter of 2022 and come from IHS Markit (as of Mar. 7). |

||

Industry-level data from the survey indicate that price growth was fastest in construction (19.0%), retail (9.6%), and transportation and logistics (9.1%). Growth was slowest in other professional services (4.9%).

The table also indicates relatively strong growth in employee compensation (wages plus benefits) at 5.6%, with firms in the tourism and hospitality sector reporting the fastest growth at 9.7%, followed by the transportation and logistics sector at 8.3%. Wage growth was slowest in other professional services at 4.8%. The reported growth rate was slightly stronger than the BLS estimate of growth in compensation per hour, and weaker than The CFO Survey-reported wage growth (which excludes benefits).

Inflation Outlook: Moderating but Not Enough, and Upside Risks Remain

The inflation outlook suggests a slight moderation in inflationary pressures. As indicated in the table, firms expect price growth to moderate from 7.8% in 2021 to 5.8% in 2022. This deceleration is welcome but indicates inflation rates above those of professional forecasts. All of these projections may be viewed as higher rates of inflation than what one would consider price stability, typically measured at about 2% growth in prices paid by households.

Survey results also indicate that considerable upside risks remain. Firms report continued strong compensation growth of 5.4%, which aligns closely with professional forecasts. This may be inflationary if firms pass on higher wage costs to customers, but these pressures could be offset if worker productivity growth remains strong, allowing firms to maintain profitability.

Passing Costs to Customers

There is, however, some evidence in the survey that the rapid rise in both labor and nonlabor costs will be passed on to customers. When we asked which factors will influence their prices charged over the next three to six months, there was a notable increase in the share of firms indicating that these costs would place strong upward pressure on prices. On net (the share of respondents reporting “higher” less the share reporting “lower”), about 70% and 65% of firms indicated upward pressure from labor costs and nonlabor costs in February 2022, respectively, up from prior-year shares that had remained around 40% since 2019.

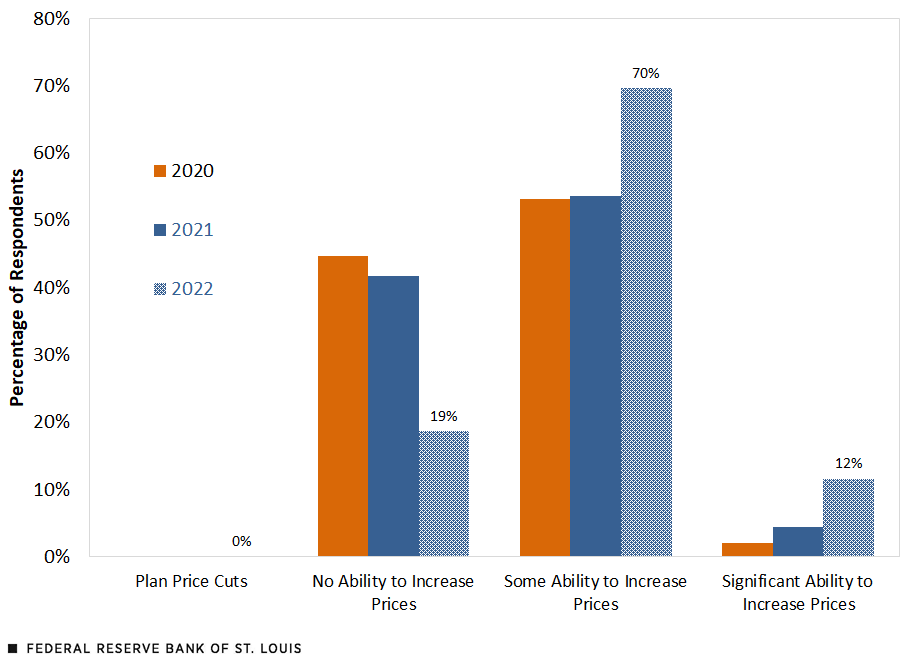

There was also a slight uptick in the share of firms expecting to raise prices to maintain profit margins. Moreover, the share of firms expecting worker productivity gains to put downward pressure on prices remained unchanged from previous surveys. In addition to these cost pressures, firms are indicating a greater ability to increase prices. As shown in the figure below, 82% of firms indicate that they have at least some ability to increase prices over the next three to six months—a notable increase from prior-year averages at around 50% of firms.

Which of the Following Best Describes Your Ability to Increase Prices Charged to Customers over the Next Three to Six Months?

SOURCE: Federal Reserve Bank of St. Louis.

NOTE: Surveys were conducted during the first two weeks of February of the respective year; therefore, the 2020 survey is considered pre-pandemic.

Notes and References

- Headquartered in St. Louis, the Eighth Federal Reserve District includes all of Arkansas, southern Illinois, southern Indiana, western Kentucky, eastern Missouri, northern Mississippi and western Tennessee.

- The St. Louis Fed conducts this pricing survey as part of its report to the Beige Book. For more information on this survey, see Endnote 2 in the previous blog post.

- The CFO Survey is conducted through a partnership between Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta. Survey results are not weighted by firm size or sector; the initial sample is intended to reflect the industry mix of the Eighth District economy.

Citation

Charles S. Gascon, ldquoHow Eighth District Firms Have Responded to Higher Inflation,rdquo St. Louis Fed On the Economy, April 5, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions