U.S. Lending Activity during the COVID-19 Pandemic

The COVID-19 pandemic triggered economic shocks in the spring of 2020. How did banks respond to this sudden economic shift?

In a Regional Economist article published in June, Regional Economist Charles Gascon, Associate Economist Nathan Jefferson and Research Associate Praew Grittayaphong examined lending trends in 2020 and offered an outlook on the banking sector in early 2021.

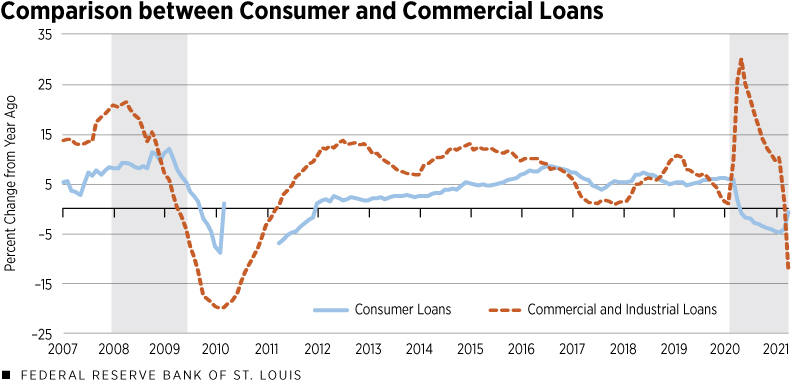

“Data from this period show that commercial lending increased significantly during the first several months of the pandemic, while consumer loans declined moderately,” they wrote. “Studying these shifts gives valuable insight into how sectors handled the crisis and how the economy responded, while providing important lessons for the future.”

Bank Lending during the Early Pandemic

During the spring of 2020, business owners took out new loans to keep their operations running as COVID-19 cases surged, the authors observed. Commercial and industrial (C&I) loan growth increased by more than 29% in May 2020. (See the figure below.) A key cause for this spike was small businesses tapping the Paycheck Protection Program, they noted.

SOURCES: Board of Governors of the Federal Reserve System and FRED (Federal Reserve Economic Data).

NOTES: Consumer loan growth between April 2010 and March 2011 was removed because a change in methodology caused a spike in the series; see this essay (PDF) for more information. U.S. recessions are shaded; the end date for the COVID-19 recession was undecided when the Regional Economist article was published.

While commercial loans increased significantly in May 2020, consumer loans fell below their year-ago levels for the first time since December 2011, the authors noted.

“This 1% fall in consumer loans, and a year-over-year decline of 6% in credit card lending, signified changes in consumer spending behavior induced by the pandemic,” they wrote. “Throughout most of the global financial crisis from 2007-09, consumer lending continued to increase as incomes declined and households borrowed to maintain their normal spending levels.”

In the early months of the pandemic, reduced confidence about the future spurred households to save more and borrow less. Combined with the first round of federal aid checks, this pushed up deposits at commercial bank and led to a record personal savings rate (34%) in April 2020, they explained.

Though real estate lending had little to no change at the start of the COVID-19 pandemic, growth started to slow in late 2020, the authors noted. (See the figure below.)

Comparison between Types of Real Estate Loans

SOURCES: Board of Governors of the Federal Reserve System and FRED (Federal Reserve Economic Data).

NOTE: U.S. recessions are shaded.

The pandemic also spurred banks to tighten lending standards and make other changes to their credit policies last year, for both businesses and consumers, authors pointed out.

Improved Outlook in Early 2021

Gascon, Jefferson and Grittayaphong noted that the economic outlook has improved since the start of 2021. Citing a January survey, they said banks were expecting, over the next 12 months, stronger demand for consumer loans and all types of business loans, but weaker or flat demand for residential real loans. Meanwhile, banks were also foreseeing deteriorating loan performance—which is measured by delinquencies and charge-offs—for most types of consumer and business loans.

“To offset the risk associated with deteriorating loan performance, banks that participated in January’s survey expected to tighten lending standards across most business loan categories,” the authors wrote.

By an April survey, however, bankers indicated that, overall, they loosened standards on most types of business and consumer loans.

Citation

ldquoU.S. Lending Activity during the COVID-19 Pandemic,rdquo St. Louis Fed On the Economy, Oct. 11, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions