Commercial Loans Rise Sharply during COVID-19 Pandemic

KEY TAKEAWAYS

- U.S. commercial lending spiked in May 2020 because of small-business participation in the Paycheck Protection Program.

- Households reined in their spending and use of credit as the economy worsened, unlike what they did during the last recession.

- Many lenders changed credit policies to offset risk, including tightening lending standards.

The economic shocks that hit the global economy in the spring of 2020 sparked a renewed focus on the extent to which the nation’s banks can provide economic assistance to affected people and businesses. Amid the uncertainty, banks were left to juggle liquidity risk, customer expectations and regulatory guidelines.

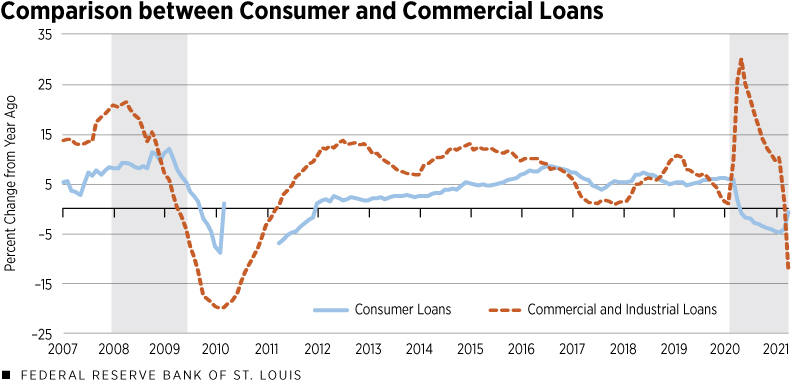

Data from this period show that commercial lending increased significantly during the first several months of the pandemic, while consumer loans declined moderately. Studying these shifts gives valuable insight into how sectors handled the crisis and how the economy responded, while providing important lessons for the future.

A growing body of Federal Reserve research is shedding light on financial trends during COVID-19. A couple of examples include a look at the impact of the pandemic on Black-owned businesses and an analysis of small-business lending. This article seeks to provide an overview of lending trends at the national and regional levels and to offer insights on the long-term outlook of the banking industry.

Bank Lending during the Peak of the Pandemic

As COVID-19 cases continued to surge and more restrictions were put in place during the spring of 2020, many business owners had to take out new loans to sustain their businesses. This caused commercial and industrial (C&I) loan growth to spike in May, growing by more than 29%, as shown in the first figure. Small-business participation in the Paycheck Protection Program (PPP) was a major contributor to this elevated growth.This program—enacted as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act—was designed to help businesses seeking to maintain their employment levels. As businesses continued to seek relief funds, many banks reported being overwhelmed by the volume of applications after the program’s launch in early April.

SOURCES: Board of Governors of the Federal Reserve System (Federal Reserve Economic Data).

NOTES: Consumer loan growth between April 2010 and March 2011 was removed because a change in methodology caused a spike in the series. See this article for more information. U.S. recessions are shaded; the most recent end date is undecided.

In contrast, in May 2020, consumer loans at all commercial banks dropped below their year-ago levels for the first time since December 2011. This 1% fall in consumer loans, and a year-over-year decline of 6% in credit card lending, signified changes in consumer spending behavior induced by the pandemic. Throughout most of the global financial crisis from 2007-09, consumer lending continued to increase as incomes declined and households borrowed to maintain their normal spending levels.

As households became less confident about the future of the economy in 2020, many began to save more and borrow less. This behavior, combined with the first round of federal aid checks,The first round of COVID-19 stimulus checks, also known as federal economic impact payments, was distributed to qualifying individuals as part of the CARES Act, mostly in April 2020. led deposits at all commercial banks to increase more than 15% year over year in April 2020, the fastest increase recorded in the past 45 years. The personal saving rate also surged to a record 34% in April 2020, up from 8% in February 2020.

While real estate lending experienced little to no change at the beginning of the pandemic, its growth began to slow in late 2020, as depicted in the second figure. Residential real estate (RRE) loans on the books at commercial banks experienced a decline, with growth turning negative in November 2020. Commercial real estate (CRE) loan volumes, although facing a less steep decline, grew by less than 2% in May.

Comparison between Types of Real Estate Loans

SOURCES: Board of Governors of the Federal Reserve System and FRED (Federal Reserve Economic Data).

NOTE: U.S. recessions are shaded; the most recent end date is undecided.

However, government-sponsored enterprise (GSE) loans originated by banks and nonbanks increased significantly, indicating a sustained demand for mortgages. In addition, many mortgage lenders reported a spike in refinancing applications during the beginning of the pandemic; the MBA Refinance IndexThe MBA Refinance Index, calculated by the Mortgage Bankers Association, helps predict mortgage activity and loan prepayments based on the number of mortgage refinance applications submitted. was up more than 130% year over year in May 2020. This boom in refinancing activity was likely a result of homeowners trying to lock in historically low mortgage rates.The 30-year fixed rate mortgage average dropped below 3% for the first time in July 2020.

Tighter Standards

Besides changes in demand, these lending trends might allude to some changes on the supply side as well. The pandemic caused many lenders to make significant changes to their credit policies to offset risk; these modifications included tightening lending standards and terms and increasing loan-loss reserves. Throughout 2020, banks reported continuously tightening standards on C&I and CRE loans, citing a “less favorable economic outlook” and “worsening of industry-specific problems” as primary reasons.

On the consumer side, banks also tightened standards on consumer and RRE loans during the first three quarters of 2020. Standards on consumer loans were eased during the fourth quarter, while those on RRE loans remained unchanged. Tighter lending standards and terms reduced the supply of credit, leading to decreases in loan volumes.

| Date | Commercial and Industrial Loans | Consumer Loans | Real Estate Loans | |||

|---|---|---|---|---|---|---|

| District | Nation | District | Nation | District | Nation | |

| 3/4/2020 | 2% | 2% | 6% | 7% | 2% | 4% |

| 6/3/2020 | 36% | 28% | 4% | –2% | 5% | 4% |

| 9/2/2020 | 37% | 18% | 1% | –3% | 3% | 3% |

| 12/2/2020 | 33% | 14% | –1% | –4% | 2% | 1% |

| 3/3/2021 | 29% | 13% | –1% | –5% | 1% | –0.1% |

| SOURCES: Federal Reserve reporting form 2644, Haver Analytics and authors’ calculations. | ||||||

| NOTE: Data represent the percentage change over the same period one year ago for the parts of states that are in the District. | ||||||

Banking conditions in the Federal Reserve’s Eighth DistrictThe Eighth District includes all of Arkansas, eastern Missouri, southern Illinois, southern Indiana, western Kentucky, western Tennessee and northern Mississippi. mirrored those of the nation, with some small variations. As shown in the table, C&I loans in the Eighth District faced larger increases compared with the national average, growing more than 30% year over year from early June to early December 2020.

On the other hand, banks in the Eighth District reported less severe declines in consumer loan growth relative to national trends. Growth in real estate loans, partially driven by strong demand for RRE loans, increased slightly in the District in June 2020 before trending downward.

Long-Term Outlook

The economic outlook has improved significantly since the beginning of the year. In the January 2021 Senior Loan Officer Opinion Survey, banks reported anticipating stronger demand for consumer loans and all categories of business loans over the next 12 months, but weaker or unchanged demand for RRE loans. Loan performanceLoan performance is measured by delinquencies and charge-offs. was expected to deteriorate somewhat for most categories of consumer and business loans. The lone exception was for C&I loans to large- and middle-market firms, for which banks expect credit quality to improve.

To offset the risk associated with deteriorating loan performance, banks that participated in January’s survey expected to tighten lending standards across most business loan categories. These expectations, however, differed by bank size; on net, large banks expected to ease lending standards, while small banks expected to tighten them. In contrast, banks expected lending standards to be eased on loans to households. Credit conditions have improved over the past few months and by the April survey, banks indicated that, on balance, they eased standards on most categories of business and consumer loans.

While demand for C&I loans to large- and middle-market firms decreased over the first quarter, banks observed stronger demand for some categories of consumer loans, particularly for residential mortgage and auto loans. In addition, banking contacts for the Federal Reserve Bank of St. Louis’ Beige Book highlighted high asset quality, ample liquidity and record earnings in the first quarter of 2021. They also anticipated mortgage business and PPP loan income to further enhance their earnings.

Overall, participating banks were able to help absorb the initial economic shock caused by the pandemic in 2020 and are now cautiously optimistic about 2021.

Endnotes

- This program—enacted as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act—was designed to help businesses seeking to maintain their employment levels.

- The first round of COVID-19 stimulus checks, also known as federal economic impact payments, was distributed to qualifying individuals as part of the CARES Act, mostly in April 2020.

- The MBA Refinance Index, calculated by the Mortgage Bankers Association, helps predict mortgage activity and loan prepayments based on the number of mortgage refinance applications submitted.

- The 30-year fixed rate mortgage average dropped below 3% for the first time in July 2020.

- The Eighth District includes all of Arkansas, eastern Missouri, southern Illinois, southern Indiana, western Kentucky, western Tennessee and northern Mississippi.

- Loan performance is measured by delinquencies and charge-offs.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us