Does Rising National Debt Portend Rising Inflation?

This is the second in a two-part series about the national debt. The previous post examined the national debt in terms of debt issuance, debt as currency and debt service. This post looks at monetizing the debt, inflation and pressures on the larger debt picture caused by COVID-19.

In a Regional Economist article, Senior Vice President and Economist David Andolfatto pondered the question, “Does the National Debt Matter?” He noted that a government, in principle, can roll over its debt indefinitely and that national debt can be viewed as a form of money in circulation.

Monetizing the Debt

In the article, Andolfatto explained that the composition of the national debt is determined in part by monetary policy. When the Federal Reserve buys Treasury securities, it’s essentially trading lower-yielding reserves for higher-yielding securities—a process also known as “monetizing the debt.” The composition of Fed liabilities between reserves and currency in circulation is determined by the demand for currency.

The recent rise in the Fed’s holdings of Treasury securities is largely revealing itself as interest-bearing reserves, the author observed.

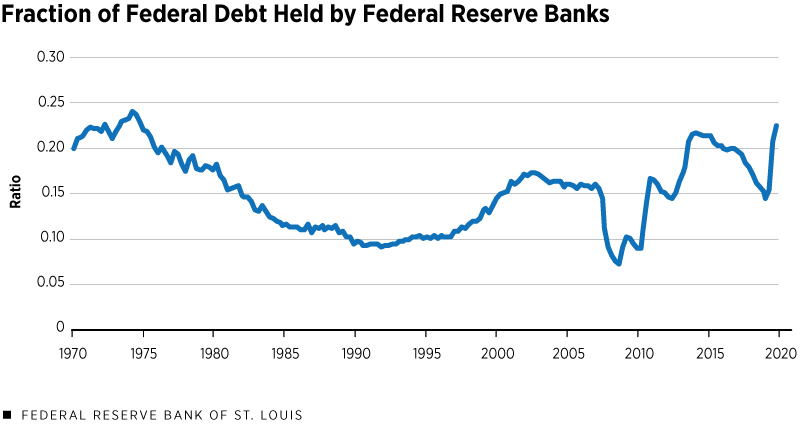

“The implication of this is that private banks are now holding large quantities of interest-bearing reserves that are, to a first approximation, not much different from interest-bearing Treasury securities,” the author wrote. “So, the ‘monetization’ of debt now is not the same as in the past (see the figure below), when Federal Reserve liabilities mainly took the form of zero-interest securities (currency).”

Andolfatto noted that exactly how large a deficit the government can run depends on the debt-to-GDP ratio, which the government doesn’t determine. The ratio is determined by market demand for debt, which, in turn, depends on the structure of interest rates either set or influenced by the Fed.

“There is presumably a limit to how much the market is willing or able to absorb in the way of Treasury securities, for a given price level (or inflation rate) and a given structure of interest rates,” Andolfatto wrote. “However, no one really knows how high the debt-to-GDP ratio can get. We can only know once we get there.”

A Word on Inflation

The purchasing power of nominal wealth is inversely related to the price level, Andolfatto pointed out. While a higher price level means the average person’s money buys fewer goods and services, inflation is the rate of change in the price level over time. It’s also helpful to distinguish between a change in price level that is temporary and a change in inflation, which is persistent.

A one-time increase in the supply of debt that doesn’t correspond to increased demand can likely mean a change in the price level or the interest rate, or both, the author explained. A continuing debt issuance not met by a corresponding growth in the demand for debt is likely to show up as a higher rate of inflation. How the interest rate on U.S. Treasury securities is affected depends mainly on Fed policy, Andolfatto wrote.

“As long as inflation remains below a tolerable level, there is little reason to be concerned about a growing national debt,” the author wrote. “Like a firm that finances itself with convertible debt, the prospect of involuntary default is never a concern.”

In reality, a firm that exercises its conversion option is likely to experience share dilution, while a government that monetizes debt is likely to experience a jump in the price level, he added.

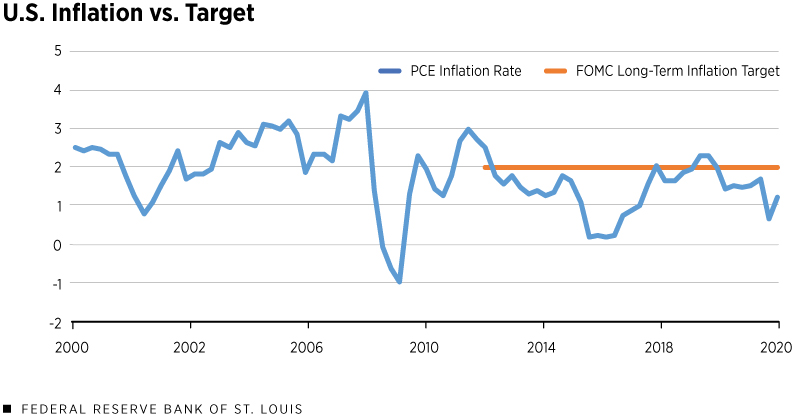

The Fed has had an official 2% inflation target since 2012 (see the figure below), but Fed officials have said they would be willing to let inflation exceed this target if it would help an improving labor market. But what might happen if inflation rises and remains above a tolerable level? The Fed might have to cut back on purchasing U.S. Treasury securities, which could put upward pressure on bond yields.

“Higher interest rates would reduce private sector wealth and increase the cost of borrowing, both of which would serve to reduce private sector spending, slowing economic growth,” Andolfatto wrote. “It would also serve to increase the government’s carry cost. This, in turn, could result in a set of government austerity measures, which could propel the economy into a deep recession.”

Slowing the pace of debt issuance beforehand might avoid such a situation, but there isn’t a way to know in advance how large the debt can get before inflation becomes worrisome. All we can say for now is that inflationary pressures appear contained, the author noted.

“It would be wise, however, for the government to have a plan in place to deal with this contingency should it arise,” he wrote. “The plan might allow for inflation to remain elevated for a period of time as tax-and-spend legislation is recalibrated.”

Enter COVID-19

The COVID-19-induced recession is different in some ways from others that happened because of monetary-fiscal contractions or asset price collapses. During those kinds of recessions, private sector spending tends to fall far more than what might be justified by any change in underlying fundamentals, Andolfatto wrote. Instead, the COVID-19 shock caused a contraction in some sectors of the economy that had to shut down to avoid spreading the virus.

Because of this, social insurance is necessary to keep up the incomes of people and businesses disproportionately affected by the pandemic. To the extent that total economic output declines and the income support is financed by a one-time increase in the national debt, the likely result is a one-time increase in the price level.

“In other words, Americans should prepare themselves for a temporary burst of inflation,” Andolfatto wrote. “To be clear, a higher price level is not inevitable, since much depends on how the demand for U.S. Treasury securities responds going forward.”

But if the inflation rate does spike suddenly, monetary or fiscal policy shouldn’t be tightened as long as the spike is temporary, the author cautioned.

Additional Resources

Citation

ldquoDoes Rising National Debt Portend Rising Inflation?,rdquo St. Louis Fed On the Economy, March 2, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions