Black-Owned Banks and the Communities They Serve

KEY TAKEAWAYS

- Black-owned banks are uniquely positioned to assist the economic recovery in majority-Black communities where they operate.

- The COVID-19 pandemic had a disproportionate impact on Black-owned businesses and areas, while PPP loans were slow to arrive.

- The number of Black-owned banks has been declining, but recent calls for racial and economic justice have attracted greater support.

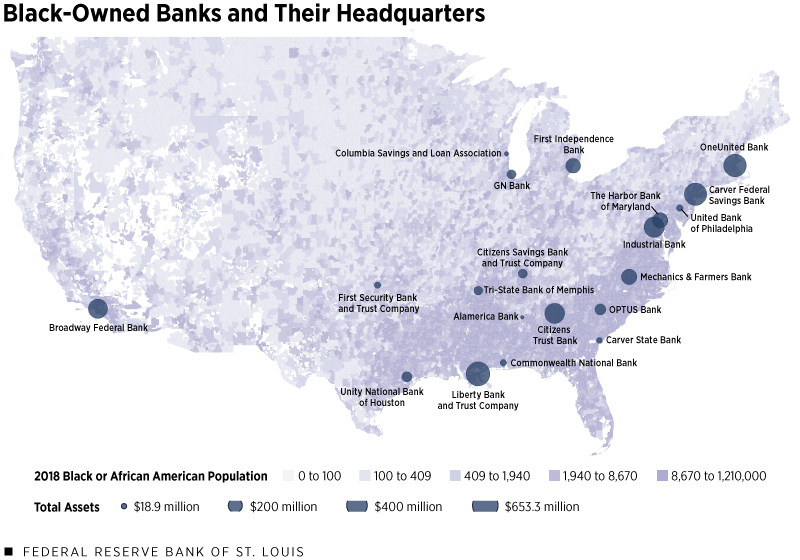

Throughout their history, Black-owned banks have consistently maintained their focus on serving Black-owned small firms, local community organizations, nonprofits and Black families. Today, Black-owned banks and their branches serve majority-Black areas (see the figure below), which have been hit especially hard by the COVID-19 pandemic and its economic aftermath.

Like other community banks, Black-owned banks possess deep insight and knowledge of the communities they serve. Many Black-owned banks serve low- to moderate-income communities, which have distinct needs and real challenges when accessing banking services.

Moreover, Black-owned banks enable individual entrepreneurs and Black-owned small businesses. And although the number of Black-owned banks is fairly small compared to the overall number of commercial banks in the U.S., these banks have substantial impacts on their communities and households, through both mortgage and small-business loans.See the paper "Minority-Owned Banks and Their Primary Local Market Areas" by Maude Toussaint-Comeau and Robin Newberger. Significant changes in banking structure marked the past decade, but Black-owned banks and other minority-owned depository institutions (MDIs) continue to play a special role in underserved markets.

Black Communities and Banking Mistrust

The Black community’s widely regarded distrust of the banking industry can be traced to the Freedman’s Savings Bank, a private corporation established by Congress in 1865 to accept deposits from freed slaves and Black soldiers. The bank was grossly mismanaged by a corrupt group of trustees and collapsed less than a decade later.For a history of Black-owned banks, see “The Color of Money: Black Banks and the Racial Wealth Gap” by Mehrsa Baradaran and “Let Us Put Our Money Together: The Founding of America's First Black Banks” by Tim Todd. More than 60,000 Black Americans from 17 states lost an equivalent of $65 million in today’s dollars.

Later, African Americans were subjected to redlining and other discriminatory lending practices, and became targets of predatory lenders’ subprime mortgages that contributed to the 2008 financial crisis. Black-owned banks seek to improve structural inequities.

Black-Owned Businesses Underserved by the Banking Industry

Prior to the pandemic, Black businesses lacked established banking relationships and were experiencing funding gaps, according to the Federal Reserve’s 2019 Small Business Credit Survey.

In 2019, less than a quarter of Black-owned firms had a current borrowing relationship with a bank. This is not because of some preference on the part of Black entrepreneurs. White- and Black-owned firms apply for loans at about the same rate, but Black businesses are denied at significantly higher rates. More than one-third (38%) of Black business owners reported being discouraged and not applying for loans because they perceived the likelihood of loan approval to be small. Among white-owned firms, only 13% reported being discouraged.

The racial gap persists, even when considering just a sample of healthy and stable firms. Black-owned small businesses rely instead on personal savings and financial support from friends and family members.

The Impact of the Pandemic on Black-Owned Businesses

Areas with higher concentrations of Black-owned businesses recorded higher incidences of COVID-19 infections. The same areas saw higher rates of forced business closures.

The combined impact of these forces helps explain why the pandemic has inflicted such a disproportionate economic impact on Black communities.The study “Double Jeopardy: COVID-19’s Concentrated Health and Wealth Effects in Black Communities (PDF)” by the Federal Reserve Bank of New York looks at the effects of COVID-19 on Black communities and Black-owned businesses. Black business ownership has dropped sharply since the start of the pandemic: From February to April 2020, the number of active Black-owned businesses dropped by 41%. This decline was twice that of white-owned firms.

Paycheck Protection Program Loans Slow to Arrive

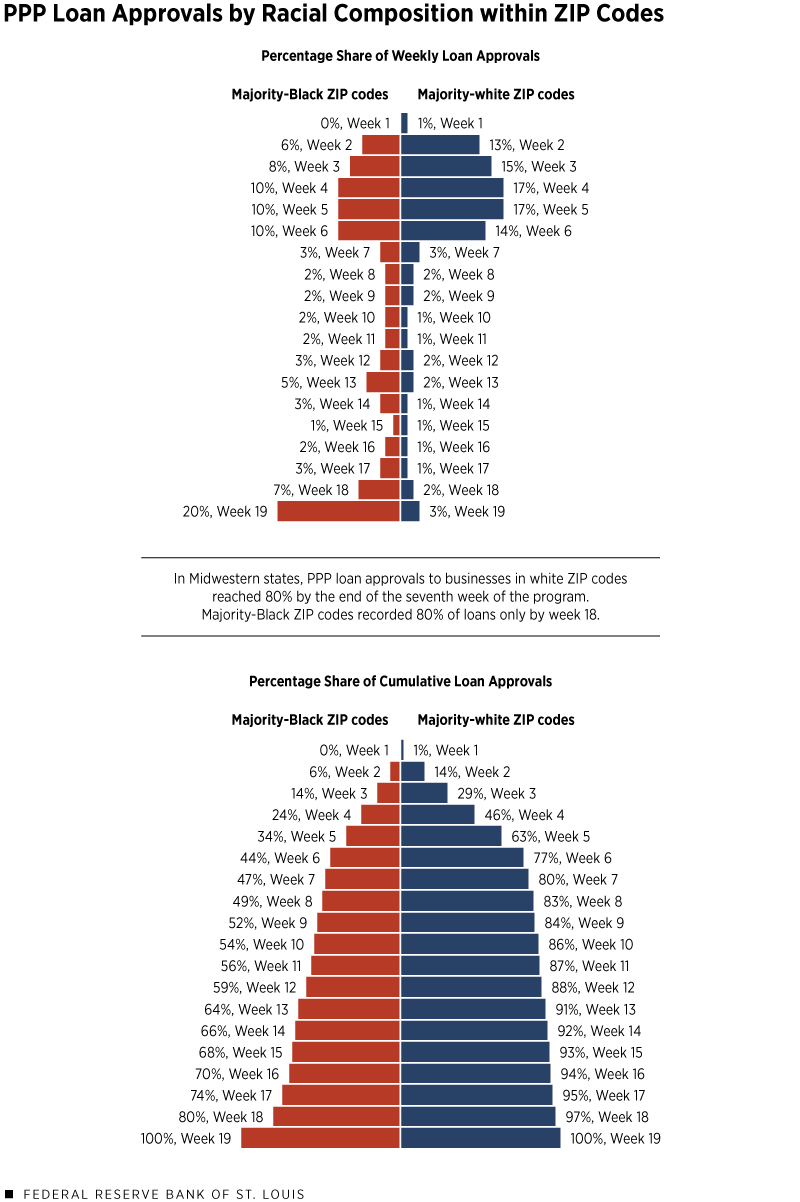

The federal government’s signature economic relief initiative—the Paycheck Protection Program (PPP)—has been slow to reach businesses in Black communities. The figure below examines the trends in PPP loan approvals. It shows loan approvals for PPP loans for up to $150,000 within ZIP codes in select Midwestern cities.The Federal Reserve’s Eighth District covers all of Arkansas, southern Illinois, southern Indiana, western Kentucky, eastern Missouri, northern Mississippi and western Tennessee.

SOURCE: Small Business Administration and author's calculations.

NOTE: Paycheck Protection Program loan data through Aug. 8 (less than $150,000 to businesses in the states of the Eighth District).

In these areas, PPP loans reached majority-white ZIP code areas faster than majority-Black areas. In white areas, 80% of all PPP loans approved from the start of the program on April 3 to the beginning of August were approved by the end of week 7 of the program. For businesses in majority-Black ZIP codes, this mark was reached only by week 18.

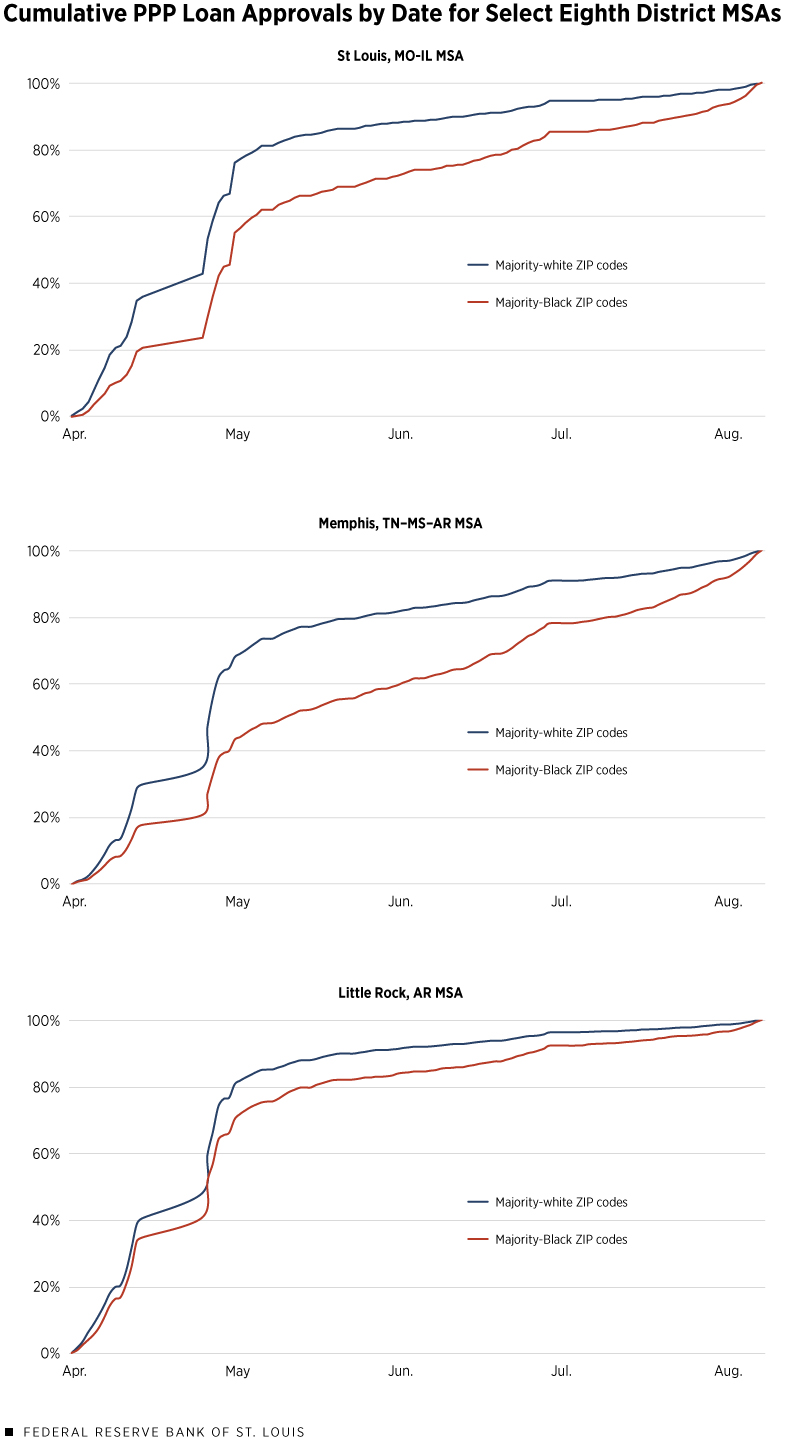

The third figure below shows the same data for select metropolitan statistical areas (MSAs) within the Eighth District: St. Louis; Memphis, Tenn.; and Little Rock, Ark. It demonstrates that businesses in majority-Black ZIP codes were receiving loans at a significantly slower rate in each of these areas.

The Small Business Administration (SBA) PPP loan approval data demonstrate that Black-owned businesses were at a disadvantage during the crucial early stages of the pandemic.

SOURCE: Small Business Administration and author's calculations.

NOTE: Paycheck Protection Program loan data through Aug. 8 (loans less than $150,000 to businesses in the states of the Eighth District).

The Potential for Change

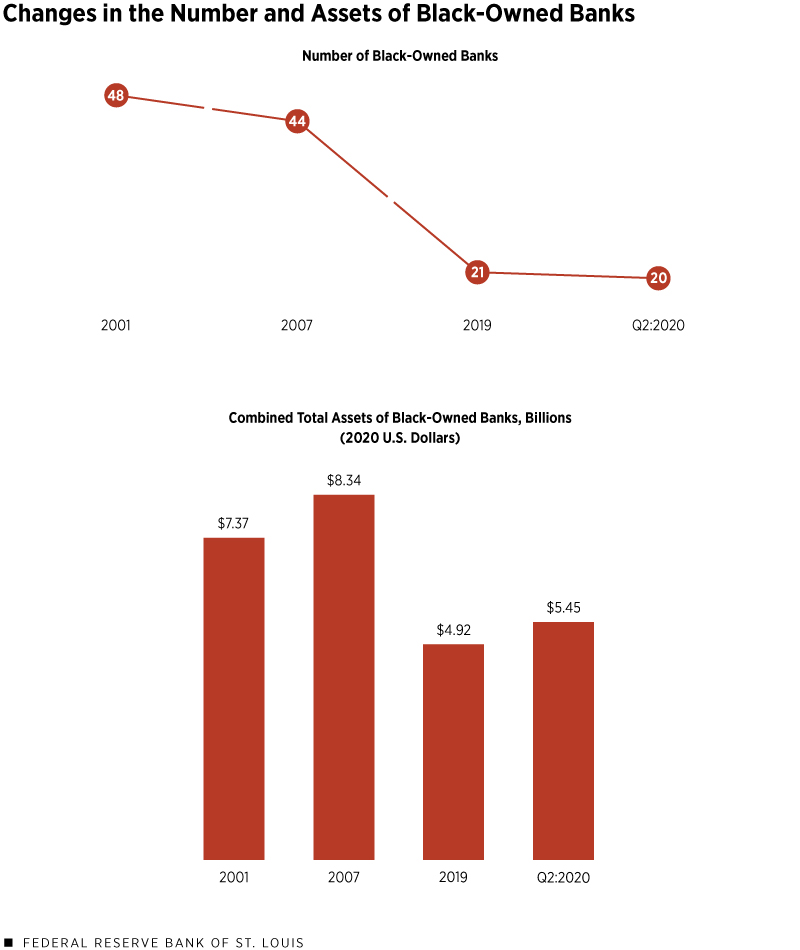

The period following the Great Recession was particularly challenging for Black-owned banks. The years after 2008 were marked by a wave of mergers, acquisitions and failures within the banking sector.

In some cases in which MDIs have closed, they have been replaced by non-MDIs. The fourth figure below illustrates the changes in this sector over the past two decades. The number of Black-owned banks dropped from 48 in 2001 to 44 in 2007, then another drop of 50% followed in the years after the financial crisis. By the end of the second quarter of 2020, there were only 20 Black-owned banks. At the end of the second quarter, the combined total assets of all Black-owned banks reached $5.45 billion.

For comparison, the total number of commercial banks in the U.S. exceeds 5,000, and the largest bank in the country—JPMorgan Chase & Co.—has assets totaling $2.8 trillion.

SOURCE: Small Business Administration and author's calculations.

NOTE: FDIC-insured minority depository institutions (MDIs), Black or African American MDIs or Black-owned banks with minority boards serving the Black community. 2020 data is as of Q2:2020.

There is, however, a key distinction between the current socioeconomic climate and the climate of the years that followed the Great Recession. The police killings of George Floyd and Breonna Taylor have reinvigorated demands for racial economic equity, including calls to #BankBlack.

The #BankBlack movement is already having an impact, with some banks reporting an enormous uptick in deposits. The rise in deposits is attributed to a wave of new individual customers and nonprofit and community organizations that now choose Black-owned banks and credit unions.

Equally encouraging are the reports of an increase in corporate support:

- Netflix announced it would put 2% of its cash deposits—$100 million—into Black-owned banks.

- Fintech firm Square intends to invest 3% of its cash and marketable securities—also $100 million—in support of minority and underserved communities, with much of the money earmarked for deposits in Black-owned banks.

- Another Fintech giant, PayPal, said it would invest over $500 million in majority-Black communities and Black-owned companies and banks.

A sudden increase in deposits could present a problem for small banks that do not have the means to lend out such a massive influx. One solution could come from a number of the country’s largest banks that have announced equity investments into Black financial institutions. Among other things, such investments can help Black banks upgrade their technological infrastructure.

Nationwide, the banks expect that the pandemic will increase the shares of nonperforming real estate and small-business loans, so increasing funding sources and capital will become critical, especially for MDIs.

Scholars and policymakers agree that encouraging greater access to mainstream financial services is critical to closing the racial wealth gap. Black-owned banks have demonstrated an unwavering commitment to their communities and could play a vital role in equitable economic recovery.

Notes and References

- See the paper "Minority-Owned Banks and Their Primary Local Market Areas" by Maude Toussaint-Comeau and Robin Newberger.

- For a history of Black-owned banks, see “The Color of Money: Black Banks and the Racial Wealth Gap” by Mehrsa Baradaran and “Let Us Put Our Money Together: The Founding of America's First Black Banks” by Tim Todd.

- The study “Double Jeopardy: COVID-19’s Concentrated Health and Wealth Effects in Black Communities (PDF)” by the Federal Reserve Bank of New York looks at the effects of COVID-19 on Black communities and Black-owned businesses.

- The Federal Reserve’s Eighth District covers all of Arkansas, southern Illinois, southern Indiana, western Kentucky, eastern Missouri, northern Mississippi and western Tennessee.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us