Retirements Surge for Older Workers during COVID-19

The COVID-19 pandemic has affected the labor market in many ways. In March and April 2020, millions of jobs disappeared, and while employment made up much of the lost ground, levels are still below those of early 2020.

Though the unemployment rate currently is roughly 0.7 percentage points above the pre-pandemic lows, this measure understates the pandemic’s impact on the labor market. There are still 3.9 million fewer jobs since February 2020, and a big part of the “missing jobs” is explained by an increase of people not in the labor force, that is, those that are neither employed nor looking for a job.

While there are many reasons a person may not be interested in working, here we focus on how retirement changed during the pandemic. For this, we used data from the Current Population Survey (CPS), which is the official source of information for labor market participation decisions in the U.S.

Rate of Retirement

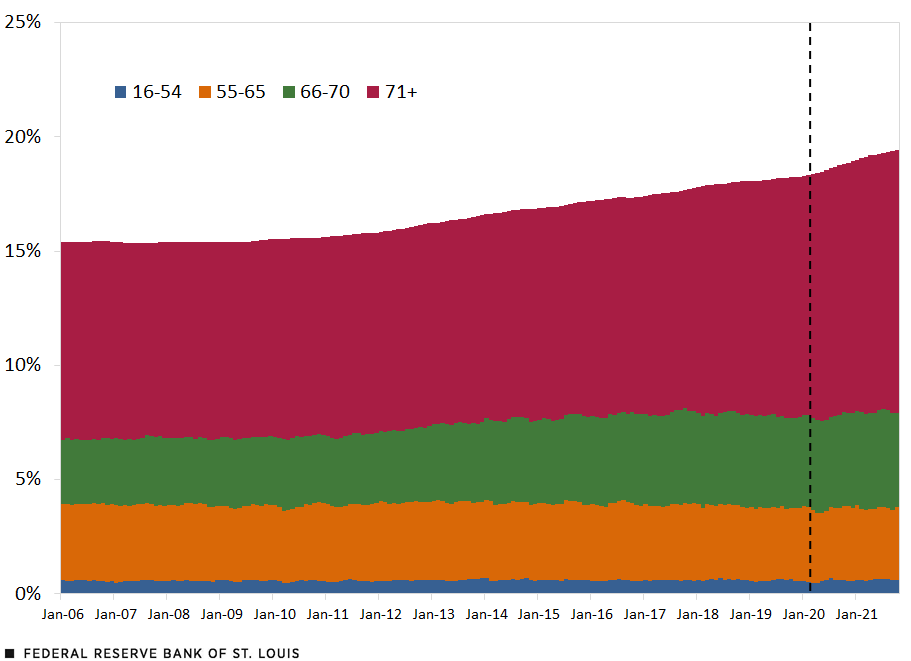

The chart below shows the evolution, since 2006, of the share of civilian population age 16 and older that is retired. To adjust for some seasonality and short-frequency volatility in the data, we show 12-month moving averages.

Retirement decisions differ greatly by age. It is rare for young individuals to be retired, while the opposite is true for older people. Because of this, the chart shows the evolution of retirement for four different age groups:

- People ages 16-54: those far from typical retirement age

- People ages 55- 65: those close to retirement

- People ages 66-70: those that just entered typical retirement age

- People age 71 and older: those deep into retirement age

Stacking all these groups together shows the evolution of the overall share of population that is retired.

Percentage of Population (16+) That Is Retired

SOURCES: Current Population Survey, Census Bureau and authors’ calculations.

NOTES: The vertical dashed line marks the start of the pandemic. Data are 12-monthly moving averages and end in October 2021.

Looking at the figure, the proportion of retired people has been rising since 2006, increasing from about 15% in January 2006 to nearly 20% in October 2021. However, this increase was driven by the retirees from the two oldest age groups. The shares of people retired in the two youngest groups remained relatively constant from 2006 to 2021.

The vertical dashed line in the figure indicates March 2020, which marks the beginning of the disruptions in U.S. labor markets due to the COVID-19 pandemic. The figure shows that the increase in the share of retired people accelerated during the pandemic, but once again, this is mainly due to retirement decisions of the oldest age groups.

Demographic Breakdown

To see this more clearly, the following table shows the proportion of those retired in each of these four age groups. The table’s columns show the average share during three different time periods: pre-pandemic (January 2018-February 2020), the first 16 months of the pandemic and the most recent months since July 2021.

The proportion of people retired has not changed much for those 65 and younger, but it has increased notably relative to the pre-pandemic period for the two oldest age groups: The share of people retired rose by nearly two percentage points among those ages 66-70 and one percentage point among those age 71 and older.

| January 2018- February 2020 |

March 2020- June 2021 |

July 2021- October 2021 |

|

| Share of People Ages 16-54 Who Were Retired | 1.1% | 1.2% | 1.2% |

|---|---|---|---|

| Share of People Ages 55-65 Who Were Retired | 19.1% | 19.4% | 19.6% |

| Share of People Ages 66-70 Who Were Retired | 61.5% | 62.5% | 63.3% |

| Share of People Age 71 and Older Who Were Retired | 82.3% | 83.4% | 83.3% |

| SOURCES: Current Population Survey, Census Bureau and authors’ calculations. | |||

While people’s retirement plans changed due to the pandemic—for example, their business closed, their retirement savings increased due to gains in the stock market, or they did not feel safe returning to work — the main question is whether these changes are permanent or will quickly revert to pre-pandemic levels. These people, while technically retired, could return to the labor market under the right conditions.

Retired for Good?

To investigate this further, the table below shows the average proportion of people 55 and older who were not in the labor force and who were not looking for a job but wanted one. It examines three different periods: 2019, the year before the pandemic; 2020, the year when the effects of the pandemic were stronger; and 2021, the year when the effects of the pandemic on the labor market eased.

| 2019 | 2020 | 2021 | |

| Percentage of People Age 55 and Older Who Weren't in the Labor Force | 59.0% | 60.0% | 60.7% |

|---|---|---|---|

| Breakdown by Employment Desire | |||

| Doesn't Want a Job | 57.5% | 58.2% | 59.0% |

| Wants a Job | 1.5% | 1.9% | 1.7% |

| SOURCES: Current Population Survey, Census Bureau and authors’ calculations. | |||

| NOTE: Annual data are averages for months; 2021 is average for first 10 months of the year. | |||

The main message from the table is that older people who are not in the labor force have little interest in participating in the labor market. Thus, while retirement of older workers has increased due to the pandemic, this change seems more permanent, and thus it is unlikely the country will see a significant influx of older people into the ranks of the employed. If there is lost ground to be made in terms of drawing more people into the labor force, the attention should be put in the younger segments of the population.

Citation

Maximiliano A. Dvorkin and Maggie Isaacson, ldquoRetirements Surge for Older Workers during COVID-19,rdquo St. Louis Fed On the Economy, Dec. 20, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions