Vacation Plans and the COVID-19 Pandemic

The COVID-19 pandemic has brought unprecedented economic disruptions to the global economy, but the effects on consumer income and spending haven’t been quite as straightforward as they may seem, especially in terms of tourism and travel.

Expanded unemployment insurance benefits and three rounds of stimulus payments equaling over $800 billion through May 2021 helped prop up household incomes.This is visible in the rise in real disposable personal income to levels above previous trend lines. And with large portions of the U.S. economy shut down or operating under capacity, the personal savings rate reached record highs.The personal saving rate reached an all-time high of 33.8% in April 2020.

As economic activity has picked up and conditions have begun to improve, consumers have shown more willingness to spend. Some of this is visible in the personal saving rate, which was down to 9.4% in June—the lowest since the beginning of the pandemic, though still well above February 2020’s 8.3%. Surveys of consumer sentiment also show a marked uptick.Personal consumption expenditures minus food and energy returned to pre-pandemic levels in March 2021, and the University of Michigan’s Index of Consumer Sentiment hit a pandemic high of 88.3 in April before falling to a preliminary result of 80.8 in July.

Tourism Spending Saw a Sudden and Massive Dropoff

While consumer spending decreased overall, not all sectors were impacted the same. Some sectors saw significant increases in consumer activity—e-commerce retail, for example, saw total sales rise 43.8% from the second quarter of 2019 to the second quarter of 2020.

Tourism, on the other hand, faced a serious negative shock as travel restrictions disrupted the sector. The United Nations’ World Tourism Organization reported that international tourist arrivals declined by 84% between March and December 2020, causing a drop of $2.4 trillion in global GDP. In the U.S., traveler accommodation revenue fell 64.8% from the first quarter of 2020 to the second quarter of 2020.

Estimates for the return of tourism spending in the second half of 2021 vary widely, since several different factors will impact the speed and strength of the recovery. With COVID-19 vaccine rates varying widely among countries, international travel remains disrupted among regions, and shifting pandemic policies remain a wild card threatening the industry. In addition, the recent rise in cases driven by the delta variant poses another obstacle to recovery—this summer saw the number of new confirmed COVID-19 cases rise from 4 per 100,000 at the beginning of July to 40 per 100,000 by mid-August.

Because the U.S. is an advanced economy and one of the leaders in vaccine uptake rates, it’s worth examining the country’s outlook for vacation spending to better understand where the travel industry stands. With the summer vacation season drawing to a close, weaker-than-anticipated growth could indicate that consumers are still wary of traveling. If consumers are confident, however, high levels of personal income and pent-up savings could bring the industry a recovery as steep as its initial drop-off.

Vacation Expectations Slow to Rebound, Auto Travel More Likely than Plane

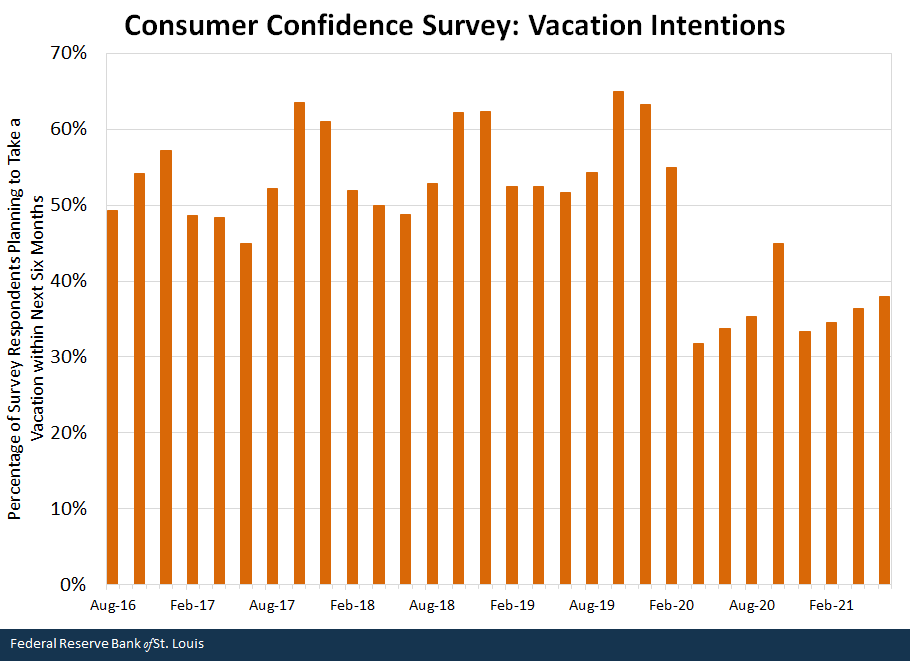

Though full vacation data for the summer months aren’t available yet, asking people whether they plan to take a vacation within the next six months provides valuable insight. This is exactly what the Conference Board does in its consumer confidence survey. In April 2019, 52.4% of respondents answered yes to this question; a year later, this had fallen to 31.8%, the lowest level since October 1968.

NOTE: Survey questions about vacation plans are asked every other month.

SOURCE: Conference Board.

Looking at survey results over the course of the pandemic, a few things stand out. First, vacation expectations were relatively quick to return during the fall but fell during the winter. In October 2020, 44.9% of respondents said they intended to vacation within the next six months—down 31% year over year, but a sharp jump from August 2020. At that time, 35.3% of respondents answered yes, down 35% year over year. By December, however, attitudes had shifted: Only 33.4% of respondents said they intended to vacation, down 47% year over year.

Slow Recovery in Vacation Expectations

The U.S. saw positive COVID-19 tests and hospitalizations reach national peaks last winter, which suggests a strong link between consumer travel attitudes and the state of the pandemic. It is interesting to note, however, that as vaccines have rolled out, expectations have not recovered as quickly as cases have fallen. As of June 2021, 37.9% of consumers surveyed said they intended to take a vacation, up 12% from the previous year but down 27% from June 2019.

Examining results by travel type also helps clarify how the recovery is segmented by different modes of travel. Vehicle travel expectations have rebounded above pre-pandemic levels; after falling to 15.9% of respondents intending auto vacations in April 2020, October 2020 saw 35.9% of respondents planning auto trips, the highest rate in over a decade.

As of June 2021, this intention to travel by car had fallen to 25.9%, which was up 22% year over year and 7% over June 2019. In contrast, plane travel expectations were slower to fall but remained below pre-pandemic levels. Intended vacations by plane reached a low of 12.4% in August 2020 (down 59% year over year) and remained at 21.4% in June 2021, down 25% from June 2019.

Substitution effects are likely at play between auto and plane-based vacationing, so the size of the drop-off in expected plane travel may not measure overall willingness to travel as much as it does the appeal or availability of flights compared with drives. An additional look at travel data from this summer, once it’s made available, will provide a better idea of what effect new virus variants and shifting mandates had on travel and give us a better idea of what to expect heading into the winter holiday travel season.

Notes and References

- This is visible in the rise in real disposable personal income to levels above previous trend lines.

- The personal saving rate reached an all-time high of 33.8% in April 2020.

- Personal consumption expenditures minus food and energy returned to pre-pandemic levels in March 2021, and the University of Michigan’s Index of Consumer Sentiment hit a pandemic high of 88.3 in April before falling to a preliminary result of 80.8 in July.

Additional Resources

- Page One Economics: Consumer Spending and the COVID-19 Pandemic

- On the Economy: How Well Do Americans Balance Income and Spending?

Citation

Nathan Jefferson, ldquoVacation Plans and the COVID-19 Pandemic,rdquo St. Louis Fed On the Economy, Aug. 23, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions