How Well Do Americans Balance Income and Spending?

According to the 2016 Survey of Consumer Finances, around 55 percent of American households earned more than they spent, which indicates that they ran an income surplus. Around 30 percent of households broke even, while the rest (about 15 percent) ran an income deficit, where income is less than spending.

Permanent Income Hypothesis

A simple economic theory such as the permanent income hypothesis suggests that some households borrow to improve welfare.

Consider a typical household wage income stream over the course of its life. Its wage income starts relatively low while young, peaks at middle age and drops to zero after retirement. According to the consumption smoothing theory: The consumption smoothing theory suggests that individuals seek to have a stable path of consumption throughout their life.

- Young households should borrow to support a higher level of consumption.

- At middle age, they should clear out their debt and save for retirement.

- In retirement, they should spend down what they have saved.

As a result, it is natural to see that some households, especially young ones, would run an income deficit and borrow. However, this conventional thinking on the borrowing and saving pattern is not consistent with the data.

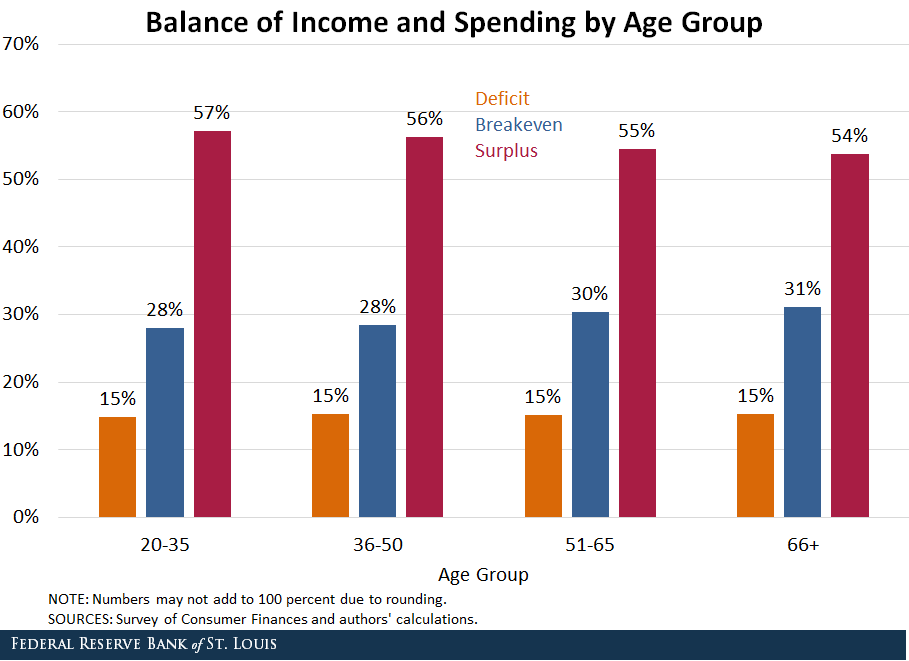

Household Income Surpluses by Age

We found that the percentage of households running an income surplus or deficit (income larger or less than spending, respectively) was almost constant across age groups. We see from the figure below that the youngest age group (age 20 to 35) had the highest percentage of households that run income surpluses.

In fact, the percentage of households running an income surplus gradually declined with age, while the percentage of households that broke even gradually increased with age. This is the opposite of what we would expect to happen. Obviously, the permanent income hypothesis without any modification (such as a borrowing constraint) does not describe the data well.

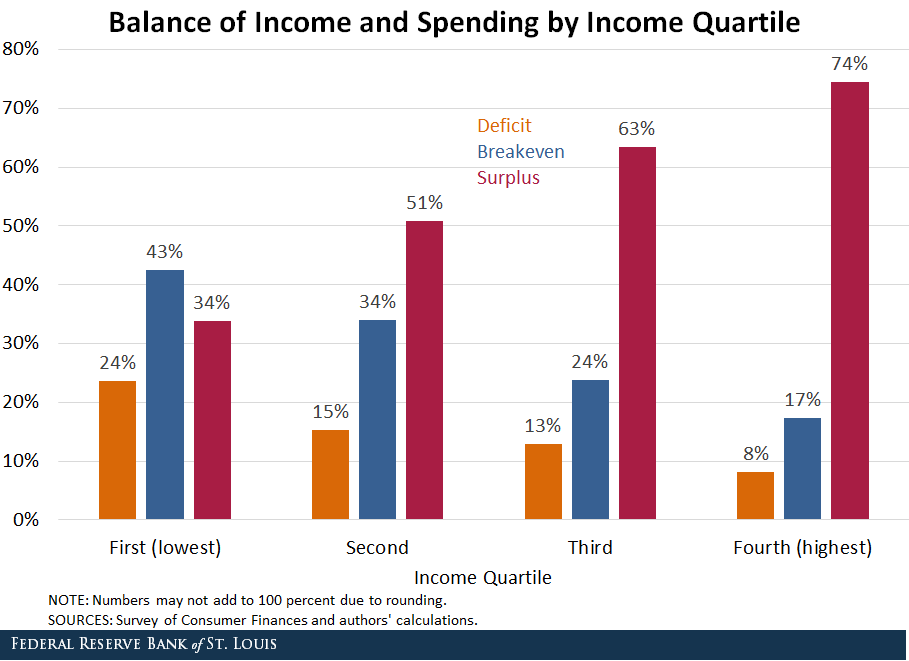

Household Income Surpluses by Income

What, then, explains the pattern of income surplus or deficit observed in the data? Intuitively, low-income households are less likely to save than high-income households. The figure below confirms this intuition.

We divided the households by their income quartile and found that the percentage of households running an income surplus increased in step with the level of household income while the percentage of households running income deficits decreased with the level of household income.

Among households in the highest income quartile (annual income greater than $98,000), 74 percent ran an income surplus and only 8 percent ran a deficit. In contrast, only 34 percent of households in the lowest income quartile (income less than $27,000) were able to save.

In short, 55 percent of American households saved, and another 30 percent of households broke even in their income and spending. The remaining 15 percent of households ran an income deficit and had to borrow. We also found that households that did not save were more likely to be low-income households and, hence, could not afford to save.

Notes and References

1 The consumption smoothing theory suggests that individuals seek to have a stable path of consumption throughout their life.

Citation

YiLi Chien and Qiuhan Sun, ldquoHow Well Do Americans Balance Income and Spending?,rdquo St. Louis Fed On the Economy, Nov. 6, 2018.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions