What Are the Fed’s Dollar Swap Lines and FIMA Repos, and Why Do They Matter?

In March, the Federal Reserve temporarily expanded its dollar swap lines and created the Foreign and International Monetary Authorities (FIMA) repo facility. In this post, we explain what these policies are and why they are important. In a follow-up post, we will show evidence that these policies have been largely effective.

What Are Swap Lines and FIMA Repos?

Dollar swap linesAlso known as “dollar liquidity swap lines” or “dollar liquidity swap operations.” allow foreign central banks to swap their own currency for an equivalent (market-based) amount of U.S. dollars from the Fed. After some pre-determined time, the bank returns the dollars it borrowed—plus some interest—and gets back the currency it gave the Fed.The bank can use the dollars it borrows however it would like. It just has to return the same amount to the Fed when the swap is over. Until then, the Fed simply holds onto the foreign currency. These swaps allow central banks to borrow U.S. dollars while insulating the Fed from downside risks.For instance, since the “exchange rate” is set to be the same on both dates, there is no risk that the Fed could lose money due to fluctuations in the market exchange rate over the borrowing term. On the unlikely case the borrowing bank could not pay back the full owed amount of the lending bank’s currency, the Fed would also have the borrowing bank’s currency as collateral.

FIMA reposShort for FIMA repurchase agreements. FIMA (Foreign and International Monetary Authorities) accounts are specific accounts held at the Fed by foreign central banks, governmental monetary entities and international entities. are similar to dollar swap lines: FIMA account holders borrow U.S. dollars for a set time and at a set rate. However, instead of exchanging foreign currency for dollars, they exchange U.S. Treasury securities they own.Highlighting the similarity of FIMA repos and swap lines, St. Louis Fed President James Bullard referred to the former policy as a “way to sidestep [the] issue” of which central banks the Fed should set up swap lines with.

Why Are Swap Lines and FIMA Repos Important?

In times of turmoil, demand for the U.S. dollar tends to rise because it is seen as a safe asset. This demand rapidly increases the value of dollars relative to foreign currencies while making it difficult for foreign and international markets—where the dollar is often used—to function, increasing financial risks across the world. This demand can also impact the flow of credit to U.S. households and businesses, since it becomes more difficult or expensive to acquire U.S. dollars.

By making it easier for central banks to access U.S. dollars, these swaps and FIMA repos increase the supply of dollars in foreign markets, calming exchange rate volatility and allowing markets and credit lines to operate smoothly.

What Has the Fed Done So Far?

Since the Great Recession, the Fed has had standing swap lines with five major central banks.The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank. In March, it lowered interest rates for these swaps and introduced swaps of longer maturity, making it cheaper and easier to borrow U.S. dollars. It then added swap lines with nine additional central banksThe Reserve Bank of Australia, the Banco Central do Brasil, the Danmarks Nationalbank (Denmark), the Bank of Korea, the Banco de Mexico, the Norges Bank (Norway), the Reserve Bank of New Zealand, the Monetary Authority of Singapore and the Sveriges Riksbank (Sweden). Temporary lines were also created with these central banks during the Great Recession. and created the FIMA repo facility,Reuters reported that there were more than 200 FIMA accounts at the Fed, most of them other central banks. further expanding its policy reach.

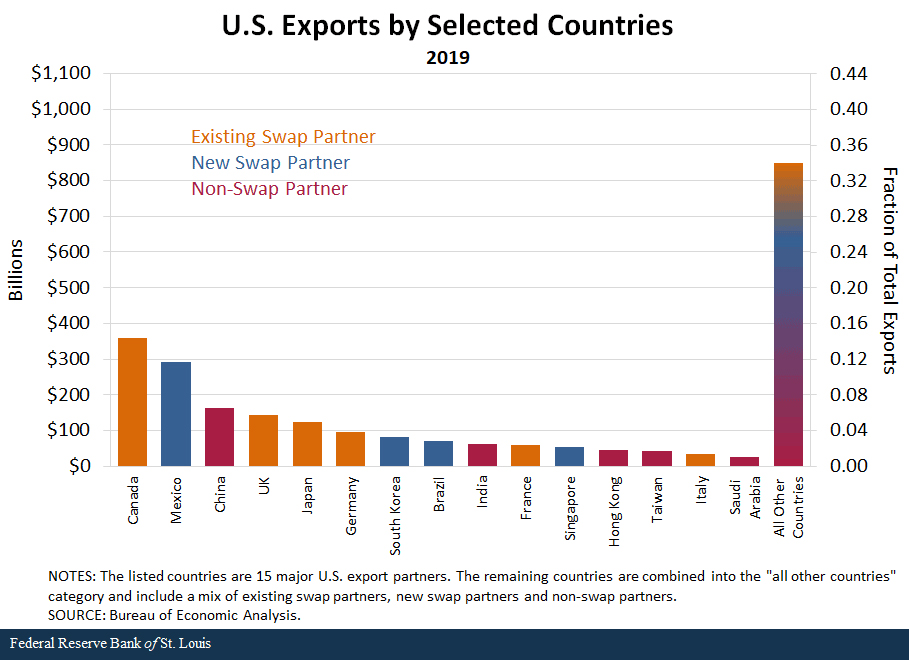

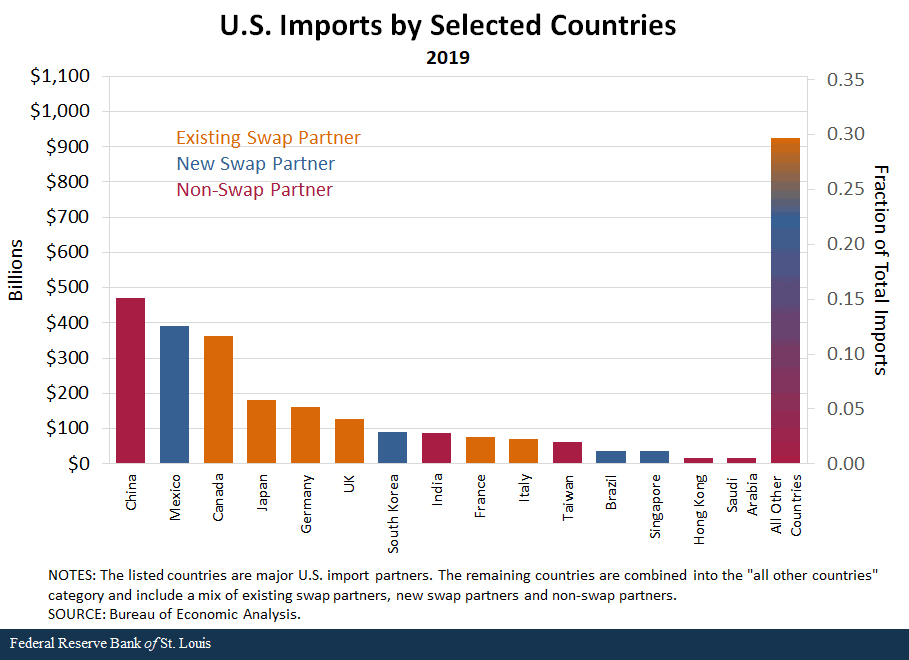

The figures above show 15 major U.S. import and 15 major U.S. export partners, which together account for two-thirds of U.S. trade. Notably, the Fed already had or established swap lines with most countries that trade frequently with the U.S. This clear focus on stabilizing economies most intertwined with the U.S. aligns well with its ultimate mandate to protect the U.S. economy, since economic problems in these countries are the most likely to affect the U.S. economy.Treasury data on U.S. foreign holdings reinforces this impression: Nearly two-thirds of international U.S. debt is held by countries with dollar swap lines. It is also worth noting that the five preexisting swap lines covered every G-7 country, where volatility could have serious implications for the worldwide economy regardless of their direct relationships to the U.S.

Notes and References

- Also known as “dollar liquidity swap lines” or “dollar liquidity swap operations.”

- The bank can use the dollars it borrows however it would like. It just has to return the same amount to the Fed when the swap is over. Until then, the Fed simply holds onto the foreign currency.

- For instance, since the “exchange rate” is set to be the same on both dates, there is no risk that the Fed could lose money due to fluctuations in the market exchange rate over the borrowing term. On the unlikely case the borrowing bank could not pay back the full owed amount of the lending bank’s currency, the Fed would also have the borrowing bank’s currency as collateral.

- Short for FIMA repurchase agreements. FIMA (Foreign and International Monetary Authorities) accounts are specific accounts held at the Fed by foreign central banks, governmental monetary entities and international entities.

- Highlighting the similarity of FIMA repos and swap lines, St. Louis Fed President James Bullard referred to the former policy as a “way to sidestep [the] issue” of which central banks the Fed should set up swap lines with.

- The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank.

- The Reserve Bank of Australia, the Banco Central do Brasil, the Danmarks Nationalbank (Denmark), the Bank of Korea, the Banco de Mexico, the Norges Bank (Norway), the Reserve Bank of New Zealand, the Monetary Authority of Singapore and the Sveriges Riksbank (Sweden). Temporary lines were also created with these central banks during the Great Recession.

- Reuters reported that there were more than 200 FIMA accounts at the Fed, most of them other central banks.

- Treasury data on U.S. foreign holdings reinforces this impression: Nearly two-thirds of international U.S. debt is held by countries with dollar swap lines. It is also worth noting that the five preexisting swap lines covered every G-7 country, where volatility could have serious implications for the worldwide economy regardless of their direct relationships to the U.S.

Additional Resources

- On the Economy: Hot Money Credits to Kick-Start a Stalled Economy?

- On the Economy: Viewing the U.S. Financial Structure from the Financial Crisis to the Pandemic

Citation

Sungki Hong and Devin Werner, ldquoWhat Are the Fed’s Dollar Swap Lines and FIMA Repos, and Why Do They Matter?,rdquo St. Louis Fed On the Economy, Oct. 8, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions