Faster Payments, More Disruptions

In a recent Regional Economist article, Economist and Research Officer Alexander Monge-Naranjo outlined how digital payment technologies have begun transforming the payments and banking system. Innovation in payment technologies has increased the efficiency and number of mechanisms to transfer funds and has brought about the introduction and adoption of digital currencies. How will these continued innovations in the payments space disrupt the banking system?

Faster Payments Are Here to Stay

Consumers have become accustomed to making transactions digitally, either online or through an application on their smart device. Today, consumers have the ability to walk into their favorite coffee shop or check out at the grocery store with just a tap of their mobile device. The transaction takes place almost instantaneously.For more on the impact of faster transactions, see Duffie, Darrell. “Digital Currencies and Fast Payment Systems: Disruption Is Coming (PDF).” Draft presented to the Asian Monetary Policy Forum in Singapore, May 2019.

“The world has moved from the standard two to three business days required to clear a check to a global standard of fast payments with near real-time availability of the funds for payees on a 24/7 basis,” Monge-Naranjo wrote.

The author noted that applications such as Venmo, Apple Pay or Google Pay have been widely adopted. Now financial institutions and some central banks are responding as well. The adoption of new payment technologies varies worldwide, reaching some countries at different stages of development. For example, Swedish private mobile payment system Swish and the Korean Electronic Banking System are well rooted in these developed countries. The Mexican SPEI and the Costa Rican SINPE are both managed seamlessly by the respective central banks of these two developing countries.

Currencies Are Evolving

Along with the development of new payment technologies, Monge-Naranjo also noted the emergence of new forms of digital currencies.

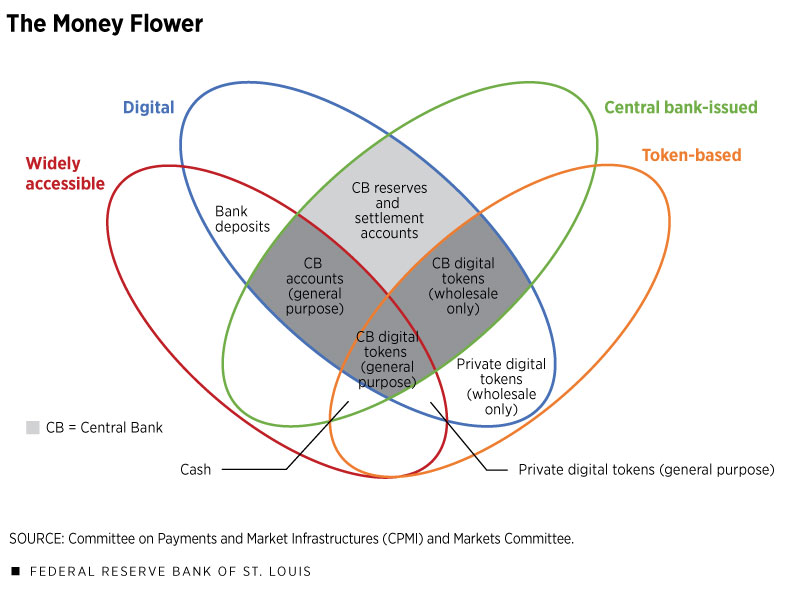

To analyze the emergence of these new currencies, economists Morten Bech and Rodney Garratt have proposed the so-called “money flower,” which classifies currencies by type:Bech, Morten; and Garratt, Rodney. “Central Bank Cryptocurrencies.” BIS Quarterly Review, September 2017, pp. 55-70.

- widely accessible

- digital

- central bank-issued

- token-based

The figure below is a reproduction of a version of Bech and Garratt’s money flower. Committee on Payments and Market Infrastructures (CPMI); and Markets Committee. “Central Bank Digital Currencies.” CPMI Papers No. 174, Bank for International Settlements, March 2018.

“Bech and Garratt’s money flower helps map the possible forms of money that will be used in the near future,” Monge-Naranjo wrote.

Disruptions for Banking

The improved efficiency from new payment technologies will likely bring some disruption to the existing banking markets, but the level of the disruption will depend on how banks respond to the change, Monge-Naranjo noted.

“Banks that are unable or unwilling to upset their business models may be doomed to downsize and even be left behind completely,” he wrote.

In North America, the major sources of disruption will be in the segments of consumers’ credit cards and domestic transactions, the author noted. He observed that much of credit card usage is for convenience of payment and not credit and that U.S. banks rely more heavily on transaction and payment fees than foreign banks.

For the rest of the world, the major disruptions will be on the commercial segments, specifically on revenue from account-related liquidity and domestic transactions, he wrote.

Still, Monge-Naranjo noted that the overall disruption may be dampened by two forces. New payment technologies and digital currencies have been around for a while, and the financial industry has historically been among the fastest industries in adopting new technologies. Meanwhile, given low inflation and low interest rates globally, the costs of liquidity are low; hence, the pressure to switch from existing media of payments is also low.

Notes and References:

1 For more on the impact of faster transactions, see Duffie, Darrell. “Digital Currencies and Fast Payment Systems: Disruption Is Coming (PDF).” Draft presented to the Asian Monetary Policy Forum in Singapore, May 2019.

2 Bech, Morten; and Garratt, Rodney. “Central Bank Cryptocurrencies.” BIS Quarterly Review, September 2017, pp. 55-70.

3 Committee on Payments and Market Infrastructures (CPMI); and Markets Committee. “Central Bank Digital Currencies.” CPMI Papers No. 174, Bank for International Settlements, March 2018.

Additional Resources

- Regional Economist: New Payments Technologies Seen Bringing Efficiency and Disruption

- On the Economy: Fintech: How Digital Wallets Work

- On the Economy: Beyond Bitcoin: A Look at Distributed Ledger Technology

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions