New Payments Technologies Seen Bringing Efficiency and Disruption

KEY TAKEAWAYS

- Digital technologies have begun to transform the payments and banking systems, but the final impact of the change is far from determined.

- However, faster payments are here to stay, and the new payments technologies will disrupt legacy deposit and payments franchises.

- The level of disruption on incumbents will depend on the structure of their legacy business and on their response in adopting the new technologies.

Digital technologies have changed the way we buy clothing, book trips, and schedule our work and social gatherings. Once considered eccentric and even snobbish alternatives to the established way of doing business, websites and smartphone apps have come to dominate our daily activities and transactions.

Not surprisingly, these same technologies have also begun transforming the payments and banking systems. As when shopping for shoes or getting airplane tickets, consumers are set to benefit from greater convenience, higher speed and lower costs when searching for products and making and receiving payments.

Quite likely, the new payment methods will trigger greater competition for funds, and thus households will end up earning higher returns on their deposits. As for merchants, their benefits may arise from faster access to sales revenues and from lower interchange fees. Some of the existing banks—and some new entrants as well—may contribute to the adoption of technologies by offering more open and efficient access to the payments system.

The identity and even the nature of the new dominant mechanisms for the payments and banking systems are far from determined yet. Innovation can be divided broadly along two related dimensions: the adoption of faster, more efficient payment systems, and the introduction and adoption of digital currencies or cryptocurrencies.

For both, as briefly reviewed in this article, the possibilities are ample. (See, for example, the accompanying figure, explained below.) At this point, however, only two things are certain. The first is that faster payments are here to stay. The second is that along with more efficiency, the new payments technologies will also disrupt profitable legacy deposit and payments franchises. These disruptions have already been seen in the retail industry, where the adoption of online technologies has led to the observed widespread closures of brick-and-mortar stores.

Banks that are unable or unwilling to upset their business models may be doomed to downsize and even be left behind completely. Central banks around the globe are increasingly aware of the potential disruptions to incumbent commercial banks, and they are responding in different ways.

Evolving Means of Payments

The payments system has been evolving in two broad dimensions: (1) through changes in the set and efficiency of the mechanisms available to transfer funds and (2) through the emergence of crypto or digital currencies, which has led to a substantial innovation in the currencies available to make transactions.

With respect to the first, improved efficiency in the mechanisms for making and receiving payments has been introduced by private banking and nonbanking institutions, as well as central banks, resulting in upgrades and faster speed of bank account-based payment networks.

As discussed by multiple authors,For example, see Duffie. the world has moved from the standard two to three business days required to clear a check to a global standard of fast payments with near real-time availability of the funds for payees on a 24/7 basis.

For example, consider a parent who needs to pay for a child’s violin lessons. Paying through a traditional bank account, the parent would write a check to the violin instructor. For the money to be finally deposited into the instructor’s account, the bank of the parent’s account first has to be debited, and then the money has to be transferred to the violin teacher’s bank, which finally has to deposit the money into the teacher’s account. Such a transaction could take two or even three days, plus the time it takes the instructor to go to the bank. With digital technologies, the payment can be done almost instantaneously with just a couple of clicks using apps such as Venmo, PayPal, Apple Pay or Google Pay.

The adoption of those payment systems is widespread, reaching countries in very different stages of development. For example, Swedish private mobile payment system Swish and the Korean Electronic Banking System are well rooted in these developed countries. The Mexican SPEI and the Costa Rican SINPE are both managed seamlessly by the respective central banks of these two developing countries. All in all, those payment systems allow households and businesses that register and install the required apps to quickly transfer and receive payments, circumventing the need for commercial banks to clear their checks.

Relative to using checks or carrying cash, these new technologies offer advantages—such as time savings, logistics and accounting—that can be substantial for both the payers and the receivers. For banks and other intermediaries in the business of clearing payments, these advances can require a redirection of their activities and, quite possibly, a reduction in their employment.

Digital Currencies

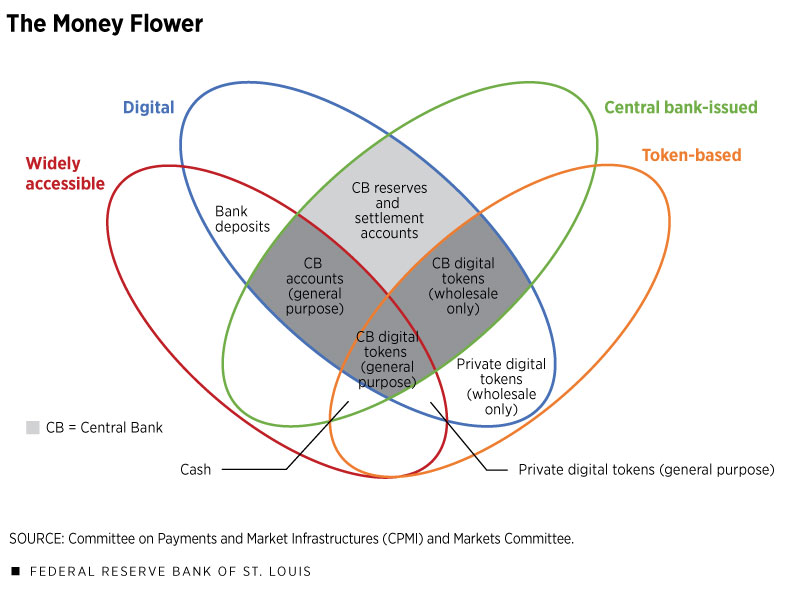

Similarly, the development, introduction and diffusion of multiple cryptocurrencies have received much attention from the private sector and central banks across the globe.See CPMI and Markets Committee. To analyze the emergence of these new forms of money, economists Morten Bech and Rodney Garratt have proposed a typology of money, the so-called “money flower,” classifying currencies by whether they are digital, whether they are central bank-issued, whether they are widely accessible and whether they are token-based.See Bech and Garratt

Figure 1

The accompanying figure reproduces a version of Bech and Garratt’s money flower, as modified by the Committee on Payments and Market Infrastructures (CPMI) and the Markets Committee; this is a simple Venn diagram that summarizes the different forms of money that can arise. While departing from traditional monetary theory in its focus on the circulation velocity and frequent-use-in-payments criteria for defining and understanding money,See the extensive discussion by Townsend. Bech and Garratt’s money flower helps map the possible forms of money that will be used in the near future.

On the one hand, we have very traditional categories, such as cash, which are token-based money that is widely accessible and nondigital. On the other hand, we have central bank reserves and settlement accounts, which are nontoken-based, digital, and available only to financial intermediaries.

A category of particular interest is that of private digital tokens. As shown by the figure, they can be either wholesale only or widely accessible. Also, depending on the form of their ledger technology, they can be “permissioned” (i.e., maintained by a trusted third party), such as Ripple and Corda, and others can be open or “permissionless,” such as Bitcoin and Ethereum. Which ones of these cryptocurrencies, if any, will eventually dominate the global payments system—or major components of it—is hard to predict at this point and the subject of interesting debate.David Andolfatto of the St. Louis Fed has written extensively on topics of cryptocurrencies, including their implications for policy. Interested readers in the topic should look into his thoughts about these issues.

Disruption in Payments and Banking Industries

The improved efficiency brought about by the new payments technologies will likely bring some disruption in existing banking markets. As with other markets, the level of disruption will depend on the response of incumbent banks to the new technologies as well as the structure of their legacy business.

Using data from a study by consulting firm McKinsey & Co., Darrell Duffie argues that the disruption for incumbent banks will be quite different between North America (U.S. and Canada) and the rest of the world.See Duffie. In North America, the major sources of disruption will be in the segments of consumers’ credit cards and domestic transactions. Much of the usage of credit cards is for convenience of payment and not for credit, and U.S. banks rely more heavily on the credit card interchange and payment fees than foreign banks do. For the rest of the world, the major disruptions will be on the commercial segments, specifically on the revenue from account-related liquidity and domestic transactions.

In any event, the overall disruption of the new technologies may be dampened by two forces. First, the finance industry has historically been among the fastest in adopting technological changes. Hence, it is expected that incumbent banks have long been preparing themselves. Second, with the low inflation and low interest rate environment observed in most countries lately, the costs of liquidity are also historically low. Hence, the pressure to substitute away from existing media of payments is also low.

Qiuhan Sun, a research associate at the Bank, provided research assistance.

Endnotes

- For example, see Duffie.

- See CPMI and Markets Committee.

- See Bech and Garratt.

- See the extensive discussion by Townsend.

- David Andolfatto of the St. Louis Fed has written extensively on topics of cryptocurrencies, including their implications for policy. Interested readers in the topic should look into his thoughts about these issues.

- See Duffie.

References

Bech, Morten; and Garratt, Rodney. “Central Bank Cryptocurrencies.” BIS Quarterly Review, September 2017, pp. 55-70.

Committee on Payments and Market Infrastructures (CPMI); and Markets Committee. “Central Bank Digital Currencies.” CPMI Papers No. 174, Bank for International Settlements, March 2018.

Duffie, Darrell. “Digital Currencies and Fast Payment Systems: Disruption Is Coming.” Draft presented to the Asian Monetary Policy Forum in Singapore, May 2019.

McKinsey & Co. “Global Payments 2017: Amid Rapid Change, an Upward Trajectory.” White paper, October 2017.

Townsend, Robert M. “Distributed Ledgers: Innovation and Regulation in Financial Infrastructure and Payment Systems.” Working paper, MIT, April 2019.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us