Mortgage Rates Not Matching Declines in Treasury Yields

The 30-year mortgage rate typically tracks the 10-year Treasury yield. As the Treasury yield fell in recent months, however, the mortgage rate did not decline as sharply, which created a difference that has been historically large.

In a recent issue of Housing Market Perspectives, William R. Emmons, lead economist with the St. Louis Fed’s Center for Household Financial Stability, found the answer may lie in the primary or retail mortgage market.

That’s where individuals borrow from a financial institution when buying a home. By contrast, the secondary or wholesale market is where financial institutions sell mortgages to “securitizers” (Fannie Mae and others), which then sell mortgage-backed securities to investors, he noted.

The last time the difference, or spread, was this large was in 2008, during the depths of the Great Recession, and the time before that was in 1986, as seen in the figure below.

SOURCES: Freddie Mac, Federal Reserve Board and author’s calculations.

NOTES: The mortgage spread is the difference between the Freddie Mac Survey 30-year mortgage rate and the 10-year Treasury yield. Data are weekly averages.

DESCRIPTION: The figure shows the mortgage spread from January 1970 to May 28, 2020. The spread is roughly 1 to 2 percentage points for most of the period, with spikes during periods of extreme rate volatility.

In a broad sense, the large spread between mortgage rates and Treasury yields means monetary policy has had a weaker impact on the economy than the drop in Treasury yields alone would suggest, the author noted.

Evidence suggests that various factors in the primary market are likely causing mortgage rates to be unusually high compared with Treasury yields, according to Emmons. These may include decreased capacity in mortgage origination or servicing, more caution among lenders, and less lender competition than usual. Another issue could be financial weakness among leading nonbank mortgage originators, which aren’t passing on lower rates to household borrowers, as they might otherwise.

The secondary mortgage market can also influence the spread because of the time value of the investment and the interest rate risk associated with mortgage investments, he noted. This relationship between the price of mortgage-based securities and risk is very sensitive to variables such as recessions, financial crises and changes in government policy.

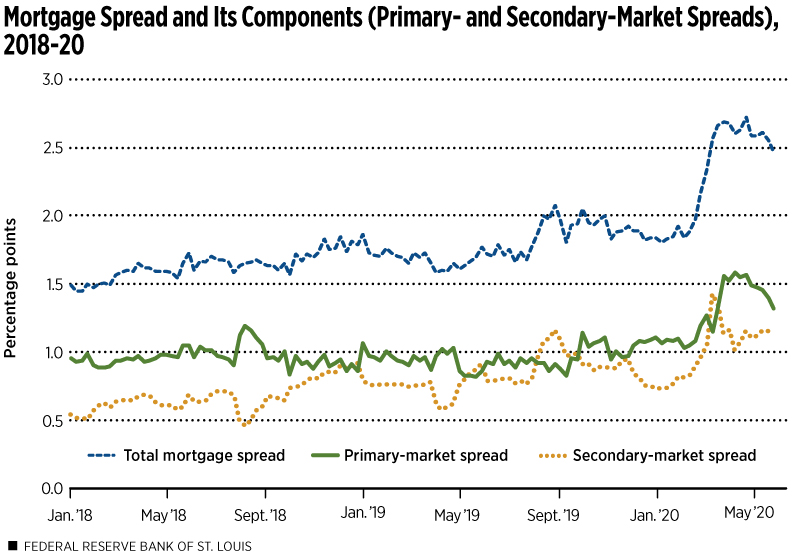

Emmons then looked at the two components of the overall mortgage spread: the primary-market spread and the secondary-market spread.

SOURCES: Freddie Mac, ICE BofA Merrill Lynch, Federal Reserve Board and author’s calculations.

NOTES: Total mortgage spread is the difference between the Freddie Mac Survey 30-year mortgage rate and the 10-year Treasury yield. Secondary-market spread is the difference between the Fannie Mae 30-year current coupon mortgage-backed security yield to maturity and the 10-year Treasury yield. Primary-market spread is the difference between the Freddie Mac Survey 30-year mortgage rate and the Fannie Mae 30-year current coupon mortgage-backed security yield to maturity. Data are weekly averages.

DESCRIPTION: The figure shows mortgage spreads from Jan. 4, 2018 to May 28, 2020. The total mortgage spread began to slowly rise from around 1.5 percentage points to just over 2 percentage points by August 2019, mostly because of the rising secondary-market spread; the total spread then slips to around 1.8 percentage points by the end of the year. In February 2020, the total spread again rises as both the primary- and secondary-market spreads increase, and it reaches a high of 2.72 percentage points by April 23, then declining 0.25 percentage points by the end of May as the primary-market spread declined by the same amount.

He found that the failure of the 30-year mortgage rate to decline in lockstep with the 10-year Treasury yield probably reflected the primary mortgage market’s sluggish adjustment to changed circumstances.

The author looked at both spreads from 2007-09. For most of 2007-08, the main contributor to the overall increase was a rising secondary-market spread. Starting in December 2008, however, short-term spikes in the primary-market spread helped push up the overall mortgage spread before declining in January 2009.

“If the current episode tracks the 2007-09 period in qualitative terms, we should expect primary-market spreads to decline in the near future,” Emmons wrote. “If long-term Treasury yields remain very low, ... this would put the mortgage rate below 3%, the lowest in more than 50 years.”

Additional Resources

- On the Economy: House Hunting in a Period of Social Distancing

Citation

ldquoMortgage Rates Not Matching Declines in Treasury Yields ,rdquo St. Louis Fed On the Economy, July 16, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions