Technological Innovations and Global Trade of Services

This is the second post in a two-part series on the role of innovations in global trade.

The previous post discussed how a simple innovation—the use of shipping containers—may have contributed to the rapid expansion of international trade over the past 50 years. This post looks at the potential impact of another innovation—information and communication technologies (ICT).

In a recent Regional Economist article, Alexander Monge-Naranjo, an economist and research officer, and Qiuhan Sun, a research associate, noted that the U.S. services trade has recently exhibited a growing surplus. They argued that this growing surplus can be linked to technological innovations—in particular, the introduction and diffusion of ICT embedded in devices such as smartphones and tablets.

While the U.S. has had persistent and growing trade deficits over the past 40 years, the authors explored the idea that the diffusion of ICT might end up turning the U.S. trade deficit back into a trade surplus.

U.S. Potential in Exporting High-Skilled Professional Services

Monge-Naranjo and Sun noted that the U.S. is a world leader in most high-skilled professional service sectors, including health, finance and many sectors of research and development. They added that U.S. producers have been ahead of others in adopting ICT in their production networks.

The global diffusion of ICT is prone to make many of these services tradeable for servicing households and businesses, they explained. Households already have online access to shopping, banking and education, and the day-to-day activities of many businesses include tasks that can be automated or performed remotely.

“Thus, a natural prediction would be that the U.S. should become a net exporter of high-skilled, knowledge-intensive professional services because of its comparative advantage,” the authors wrote.

U.S. Trends in Services Trade

This prediction has started showing up in the data, the authors wrote, noting that the U.S. trade surplus in services has consistently grown following the 1970s. This surplus substantially reduced the overall trade deficit of the U.S., they noted.

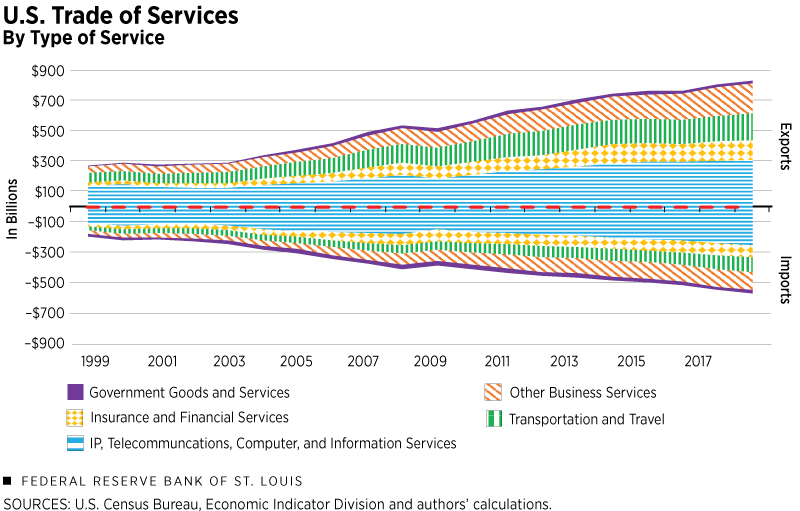

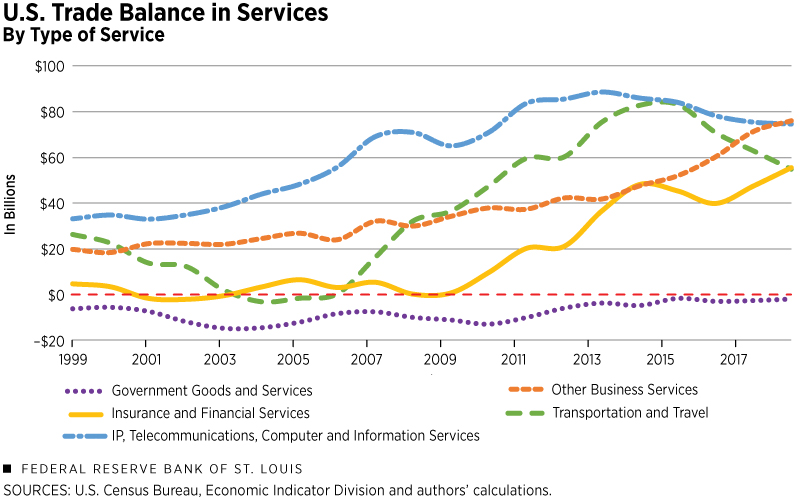

Monge-Naranjo and Sun looked at the trade balances across five groups of services from 1999-2018. The first figure below shows exports at the top and imports at the bottom, and the second figure shows the trade balances (exports minus imports) for the five groups.

All groups of services except for those associated with the government sector show persistent surpluses, they noted.

“Evidently, these high growth rates manifest the U.S.’s comparative advantage in high-skilled professional sectors,” the authors wrote. “They also suggest ample possibilities for growth in a world economy in which these services become more tradeable by the adoption, diffusion and improvement of ICT and portable devices.”

They went on to say that employment and production in the U.S. and world economies are expected to continue trending toward high-skilled, knowledge-intensive sectors.

Whether such trends would eventually lead to positive trade balances in the U.S. would depend on two key issues, the authors wrote: 1) whether the U.S. can keep its leadership in those sectors, and 2) whether the U.S. can access foreign markets for high-skilled tradeable sectors.

Additional Resources

- Regional Economist: Will Tech Improvements for Trading Services Switch the U.S. into a Net Exporter?

- Regional Economist: How Industrialization Shaped America’s Trade Balance

- Timely Topics: Educated Workers and America’s Competitiveness

Citation

ldquoTechnological Innovations and Global Trade of Services,rdquo St. Louis Fed On the Economy, Dec. 29, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions