Employment Losses in Contact-Intensive Industries

While the COVID-19 pandemic has had a large impact on the U.S. labor market, the effects have not been the same across industries. In a recent Economic Synopses essay, Senior Economist Ana Maria Santacreu, Economist Fernando Leibovici and Research Associate Matthew Famiglietti examined the extent to which contact-intensive industries have experienced greater job losses than those that are not contact-intensive.

“We find that differences in contact intensity and the essential nature of goods and services play significant roles in accounting for the heterogeneous employment losses experienced across U.S. industries,” the authors wrote.

In particular, they found that contact-intensive industries that are classified as nonessential were hardest hit by the pandemic.

Employment Loss by Industry Category

The authors looked at the change in employment from February to June for three industry groups:

- Non-contact-intensive industries

- Nonessential contact-intensive industries

- Essential contact-intensive industries

They noted that their classification of contact-intensive industries as essential is based on the industries’ importance to health care, utilities and the food supply chain. (For details on how they categorized industries as contact intensive, see “The Decline of Employment During COVID-19: The Role of Contact-Intensive Industries.”)

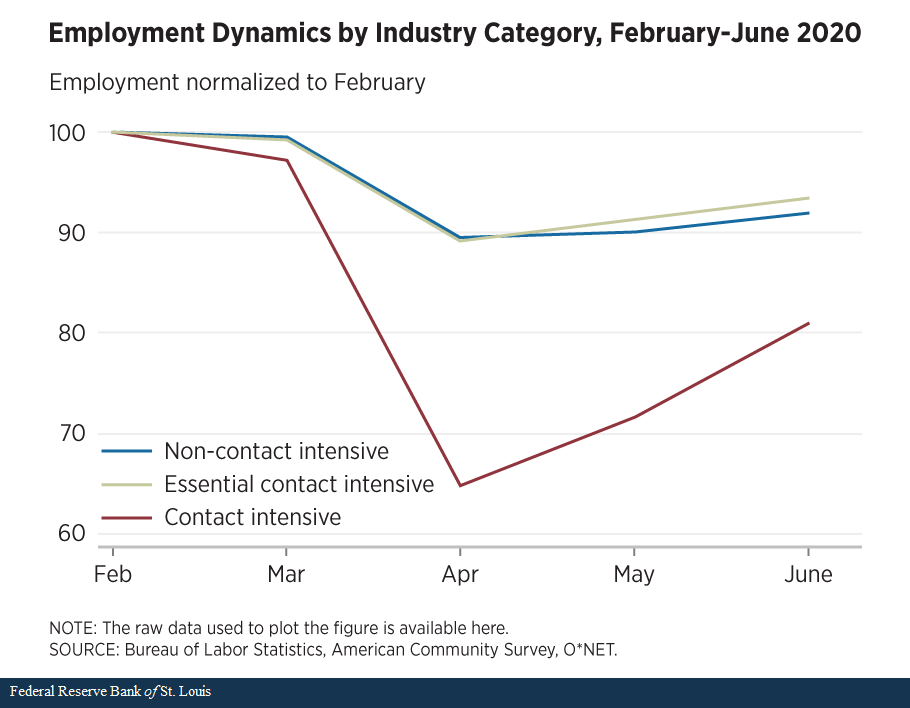

The authors found that nonessential contact-intensive industries were hit hardest in April, losing about 35% of their employment relative to February. Employment declined by about 10% for the other two groups, as shown in the figure below.

The authors added that employment has increased in all three groups since April, although not back to their pre-pandemic levels.

Employment Loss by Industry

The authors also looked at the relationship between the physical proximity index and employment changes between February and May for specific industries. They observed that there are some differences in employment losses across industries within each industry group, but the overall patterns largely hold.

“In particular, we observe that most non-contact-intensive industries and most essential contact-intensive industries experienced moderate employment losses, while most non-essential contact-intensive industries experienced much larger job losses,” they wrote.

They noted that essential contact-intensive industries that are related to health care (e.g., hospitals and nursing/residential care facilities) saw relatively little change in employment between February and May.

However, the authors pointed out that there is some more heterogeneity across nonessential contact-intensive industries as well as across non-contact-intensive industries. In the latter group, industries whose workers are largely able to work from home (e.g., banking and telecommunications) saw limited job losses, whereas industries whose workers are less able to work from home (e.g., metals manufacturing) had relatively larger declines in employment.

Additional Resources

- Economic Synopses: The Decline of Employment During COVID-19: The Role of Contact-Intensive Industries

- On the Economy: How the Impact of Social Distancing Ripples through the Economy

- Regional Economist: Which Jobs Have Been Hit Hardest by COVID-19?

Citation

ldquoEmployment Losses in Contact-Intensive Industries,rdquo St. Louis Fed On the Economy, Dec. 3, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions