Could Increasing Taxes Be Expansionary?

By Laura Jackson, Assistant Professor of Economics, Bentley University; Christopher Otrok, Sam B. Cook Professor of Economics, University of Missouri-Columbia, and Research Fellow, St. Louis Fed; and Michael T. Owyang, Assistant Vice President and Economist, St. Louis Fed.

Economists who study taxes typically focus on evaluating the effect of increasing the average tax rate, implicitly assuming that the change in tax burden is uniformly distributed. In a recent working paper, we considered the effect of changes in tax rates across people with varying incomes.

In particular, we examined how macroeconomic outcomes would be affected by an increase in tax progressivity, in which more progressive taxes shift the tax burden from low-income earners to high-income earners. In our model, we identify jointly both a measure of progressivity and the level of taxes. An increase in progressivity is analogous to a change in the slope of the tax burden, while the level of taxes (i.e., roughly the weighted tax rate) is analogous to its intercept. Consistent with previous studies, we found that an increase in the overall level of taxes is contractionary; moreover, we found that an increase in tax progressivity can be expansionary.

A More Progressive Tax Structure

Our finding that an increase in progressivity is expansionary can be explained if consumers at the high end of the income distribution are savers, but low-income earners consume all of the increase in their disposable income. Thus, when tax progressivity increases, the net effect is that total consumption—and therefore gross domestic product (GDP)—increases.

In our framework, tax legislation typically consists of both shifts in progressivity and the tax level, in which the tax rate on any income bracket is the sum of the two components. How these two factors change is determined by the specific legislation.

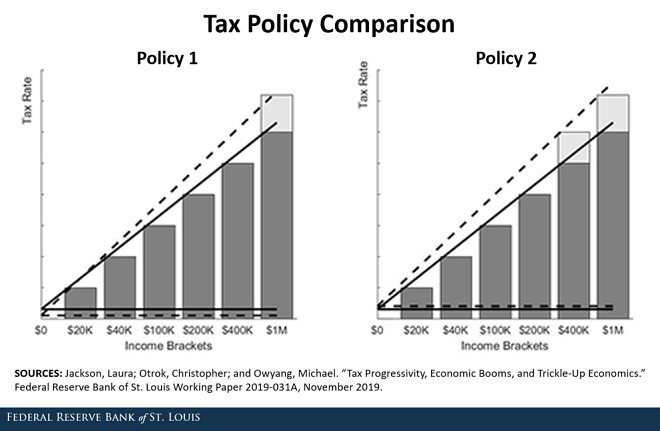

For example, consider two alternative tax policies, shown in the figure below:

- A policy that increases the income tax rate on those making $1 million or more by 10 percentage points, shown on the left side of the figure

- A policy that increases the income tax rates by 10 percentage points on both those making $1 million or more and those making between $400,000 and $1 million, shown on the right side of the figure

Total tax revenue increased under both policies. Therefore, analyses that consider only the level of taxes would predict that both policies would be contractionary.

Policy Change Effects on Tax Progressivity and Level

In the figures, the solid lines represent the original tax policies, and the dotted lines represent the more progressive tax policy. The upward sloping sets of lines represent the tax rate structure (where more progressive taxes are characterized by a counter-clockwise rotation) and the set of flat lines near the horizontal axis represent the tax level.

Using our statistical model, we found that the first policy results, as expected, in an increase in progressivity to account for the rise in taxes for the top bracket. However, this policy also results in a decrease in the tax level (as seen by the flat dotted line falling below the flat solid line), because the increase in progressivity overshoots the tax rates for some of the brackets below the top bracket. For the model to fit these brackets, the level of taxes (the intercept of the sloped line in the figure) must fall. Because both increasing progressivity and decreasing the tax level are expansionary, this policy is unambiguously expansionary.

Meanwhile, policy 2 results in an increase in progressivity and an increase in the tax level. In this case, because some of the taxes are levied on the middle part of the income distribution, the increase in progressivity does not overshoot the middle brackets and the level of taxes rises. For this broader tax increase, the contractionary effect of raising the level of taxes dominates the expansionary effect of raising the progressivity of taxes.

Why are these results important? As we noted, the previous standard for evaluating the effect of taxes would predict that essentially any tax policy that increases tax rates is contractionary. Our analysis suggests that ignoring the heterogeneous effects of taxes may lead to incorrect conclusions about the effect of tax policies if these policies are not applied uniformly.

Additional Resources

- Working Paper: "Tax Progressivity, Economic Booms, and Trickle-Up Economics", Laura E. Jackson, Christopher Otrok, and Michael T. Owyang. Federal Reserve Bank of St. Louis Working Paper 2019-034A, November 2019

- On the Economy: How Has the 2017 Federal Tax Overhaul Impacted Venture Capital?

Citation

Laura Jackson, Christopher Otrok and Michael T. Owyang, ldquoCould Increasing Taxes Be Expansionary?,rdquo St. Louis Fed On the Economy, Nov. 26, 2019.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions