How Has the 2017 Federal Tax Overhaul Impacted Venture Capital?

Many economists agreed the 2017 federal tax overhaul would create higher economic growth, but some have argued that the boost to U.S. economic growth would be temporary.

However, using data on innovation and venture capital-funded activities, St. Louis Fed Assistant Vice President and Economist Juan Sanchez argued in a recent Economic Synopses essay that the impact of tax cuts on growth can be more permanent, given that the tax cuts remain in place.

Sanchez concluded that the evidence suggests that both innovation and venture capital investment increased significantly after the tax cuts.The analysis draws on his recent working paper—"Financing Ventures: Some Macroeconomics," with Jeremy Greenwood and Pengfei Han—which analyzed the effect of tax rate changes in a model in which venture capital-financed innovation drives economic growth. Their paper aims to explain real-world funding for leading firms in sectors such as information and communication technology, biotechnology, and services, where venture capital funding is particularly important for startups. “The level of innovation and VC investment in 2018 and the first half of 2019 should support increased growth rates in the next years,” he wrote.

Venture Capital-Financed Innovation and Economic Growth

In the U.S., entrepreneurs funded with venture capital pay a 15% tax rate on their gains after an initial public offering or acquisition, Sanchez pointed out. He added that similar entrepreneurs in other countries—particularly those in Europe—would pay much higher tax rates.

Sanchez explained that the model from his recent working paper (with Jeremy Greenwood and Pengfei Han) predicts that increasing the U.S. tax rate from 15% to 35% would decrease growth by 0.11 percentage points for as long as the change persists. “This seemingly small growth change is very important, as it has a large cumulative effect on the level of output over time,” he said.

Higher R&D Spending

Sanchez noted that, in the model, economic growth responds to taxes because tax cuts encourage expenditures on innovation. And a similar effect from the changes made by the 2017 tax cuts can be expected “because owners of new ideas will be able to keep a larger share of the profits,” he wrote.

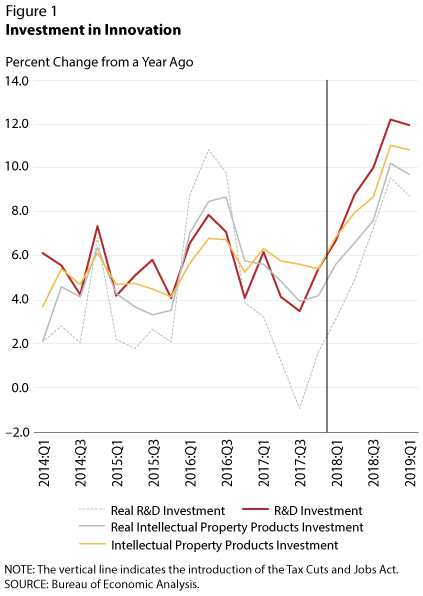

Innovation is measured by investments in intellectual property products and one of the main components (research and development), he explained. The figure below suggests that the tax cuts propelled some of the fastest growth in R&D spending since the recovery from the Great Recession, as Sanchez noted.

The growth rate in R&D investment has been 9.9% on average since the tax cuts, Sanchez pointed out. The dot-com boom (1995-2000) is the only other period with similar growth in R&D in recent decades, he explained, as the average growth rate from 1995 to 2017 was only 6.1%.

Higher Venture Capital Investment

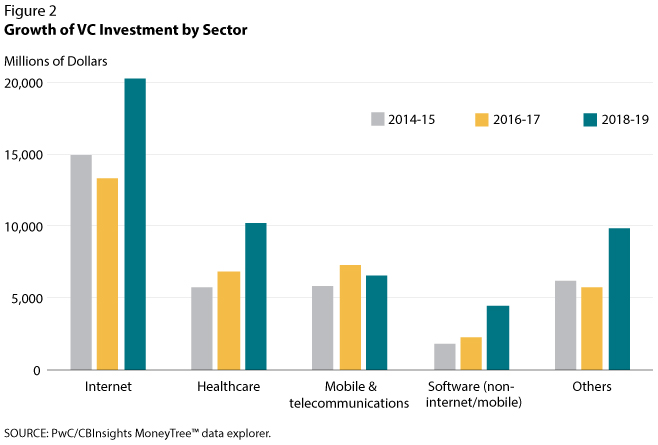

Another way to analyze the effect of the tax cuts on long-term economic growth is to look at data on venture capital investment from the PwC/CB Insights MoneyTree™ Report, Sanchez wrote.

The average yearly growth rate of venture capital investment was 11.2% between 2007 and 2017, he said. However, it grew by 51.2% between 2017 and 2018.

The figure below shows the level of venture capital investments for different sectors before and after the tax cuts. Sanchez noted that the difference in the dollar amounts is largest for sectors that receive venture capital investment:

- Internet

- Health care

- Software

“But there are also significant differences for other sectors that do not receive much VC investment, such as automotive and transportation,” he said.

Notes and References

1 The analysis draws on his recent working paper—"Financing Ventures: Some Macroeconomics," with Jeremy Greenwood and Pengfei Han—which analyzed the effect of tax rate changes in a model in which venture capital-financed innovation drives economic growth. Their paper aims to explain real-world funding for leading firms in sectors such as information and communication technology, biotechnology, and services, where venture capital funding is particularly important for startups.

Additional Resources

- On the Economy: Lessons from Kansas: Taxes and Corporate Organization

- Economic Synopses: On Corporate Income Taxes, Employment, and Wages

- On the Economy: Impact of Including R&D in GDP

Citation

ldquoHow Has the 2017 Federal Tax Overhaul Impacted Venture Capital?,rdquo St. Louis Fed On the Economy, Oct. 14, 2019.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions