Foreign Demand for Currency and the Fed’s Balance Sheet

By Fernando Martin, Research Officer and Economist

The Federal Open Market Committee (FOMC) has recently stated that “it intends to continue to implement monetary policy in a regime [with] an ample supply of reserves.”See Balance Sheet Normalization Principles and Plans. In other words, the Fed is expected to maintain a large balance sheet instead of shrinking it back to precrisis levels.

To put matters into perspective, the Federal Reserve’s total liabilities have more than quadrupled since the onset of the financial crisis, amounting to about $4.1 trillion in the fourth quarter of 2018. Currently, around three quarters of these liabilities are split equally into bank reserves and currency in circulation outside banks. The statement quoted above states the Fed’s intention in terms of reserves. What about currency?

Currency in Circulation

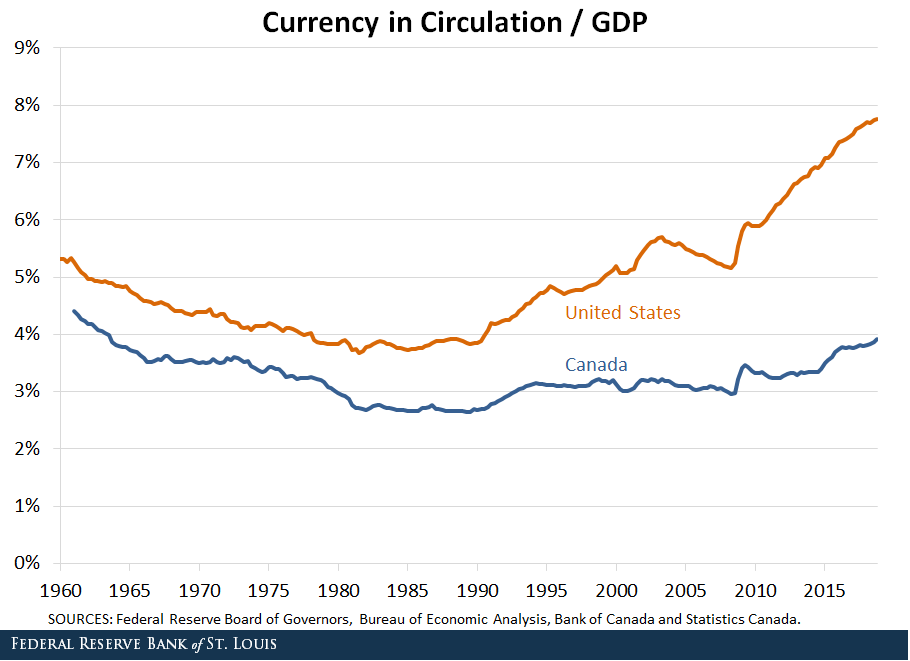

When discussing recent developments in monetary policy, the fact that currency in circulation has grown significantly since the financial crisis is often overlooked. Currency in circulation was $762 billion or 5.2% of gross domestic product (GDP) in the fourth quarter of 2007. In the fourth quarter of 2018, it had climbed to $1.6 trillion or 7.8% of GDP.Source: Board of Governors of the Federal Reserve System, H.6 Release, “Money Stock and Debt Measures.” Using other tables published by the Board gives slightly different numbers. As the figure below shows, this increase is arguably part of a process that started in the 1990s and got briefly interrupted in the mid-2000s.

Currency in the U.S. and Canada

It is informative to compare the U.S. experience with Canada. As we can see from the above figure, currency in circulation in terms of GDP evolved similarly in the two countries until the 1990s, with the U.S. having a higher ratio. The higher ratio in the U.S. can be explained by the fact that an important share of U.S. currency is held abroad, whereas almost all Canadian currency is believed to circulate domestically.

Starting in the 1990s, the currency-to-GDP ratio started climbing for the U.S. while it remained relatively stable in Canada. This difference has been attributed to a significant increase in U.S. currency held abroad. Using the methodology proposed by economist Ruth Judson, the estimated share of currency held abroad went from around 20% prior to 1990 to 50% to 60% in present time.Judson, Ruth. “Crisis and Calm: Demand for U.S. Currency at Home and Abroad from the Fall of the Berlin Wall to 2011,” Board of Governors of the Federal Reserve System, International Finance Discussion Papers 1058, November 2012.

The Circulation of $100 Bills

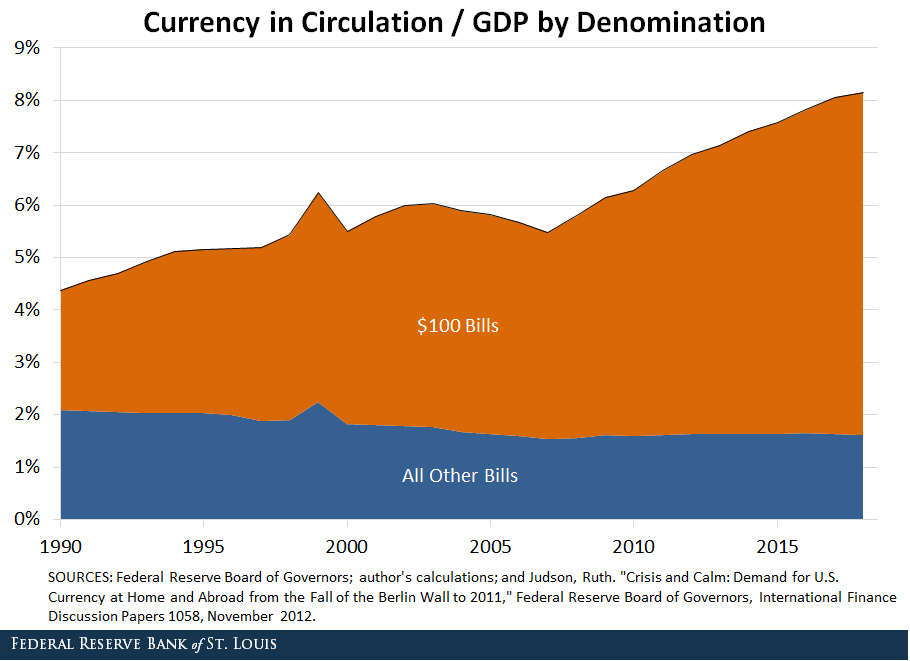

On closer inspection, the recent increase in U.S. currency in circulation can be solely attributed to a rise in $100 bills. As the figure below reveals, the value of all notes excepting the $100 bill has been declining slightly in terms of GDP since 1990.I used data from the aforementioned paper from Judson for the period 1990-1997 and data from the Federal Reserve Board for 1998 onwards. Due to differences in methodologies, the numbers for currency in circulation are slightly different from those used in the first figure. In contrast, the value of all $100 bills has been increasing steadily. Given that the estimated proportion of $100 bills held abroad is much larger than for other denominations, these facts lend support to the hypothesis that the increase in currency in circulation is driven by foreign demand for U.S. dollars.For 2011, Judson estimated that as much as 70% of $100 bills were held outside the U.S.

Foreign Demand for Currency and the Fed's Liabilities

It seems then that a significant portion of the increase in the Fed’s liabilities since the financial crisis is not due to U.S. monetary policy per se, but rather an increase in foreign demand for U.S. assets, physical dollar bills in particular. This phenomenon may be due, among other factors, to flight to safety, as many currencies around the world have not managed to preserve their value. Banegas, Ayelen; Judson, Ruth; Sims, Charles; and Stebunovs, Viktors. “International Dollar Flows,” Board of Governors of the Federal Reserve System, International Finance Discussion Papers 1144, September 2015.

If we were to attribute all of the increase in the value of $100 bills to foreign demand, then this rise in the foreign demand for U.S. currency would explain about a quarter of the increase in the Fed’s liabilities since the financial crisis. Regardless of what monetary policy stance the FOMC adopts, it is unlikely that this increase will be reversed unless there is a reversal in foreign demand for U.S. dollars.

Foreign Demand for Other U.S. Assets

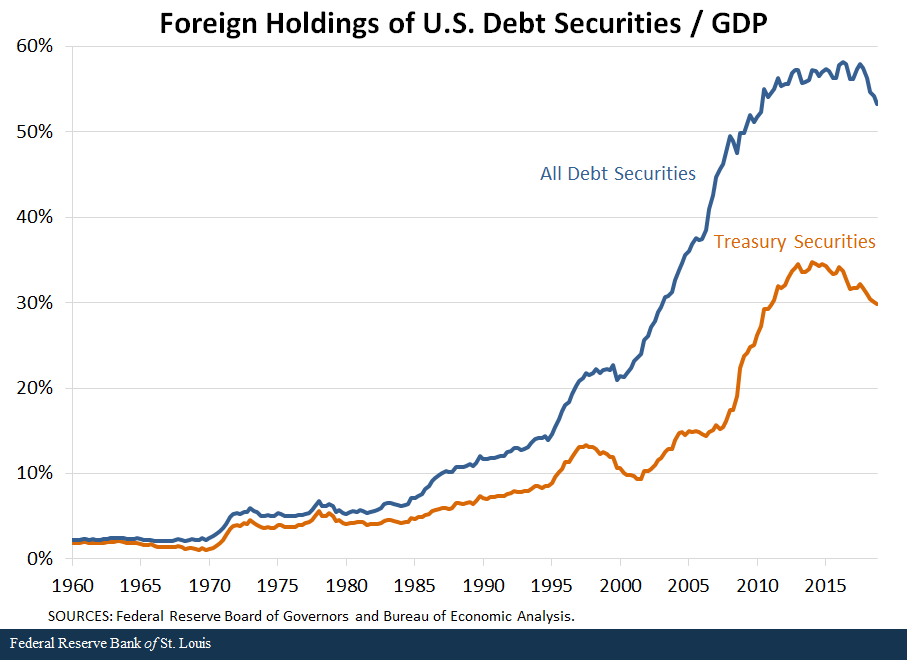

The increase in foreign demand for dollar-denominated assets goes beyond currency. As the figure below shows, there has been a significant rise in debt securities held abroad since the mid-1980s.

Notes and References

1 See Balance Sheet Normalization Principles and Plans.

2 Source: Board of Governors of the Federal Reserve System, H.6 Release, “Money Stock and Debt Measures.” Using other tables published by the Board gives slightly different numbers.

3 Judson, Ruth. “Crisis and Calm: Demand for U.S. Currency at Home and Abroad from the Fall of the Berlin Wall to 2011,” Board of Governors of the Federal Reserve System, International Finance Discussion Papers 1058, November 2012.

4 I used data from the aforementioned paper from Judson for the period 1990-1997 and data from the Federal Reserve Board for 1998 onwards. Due to differences in methodologies, the numbers for currency in circulation are slightly different from those used in the first figure.

5 For 2011, Judson estimated that as much as 70% of $100 bills were held outside the U.S.

6 Banegas, Ayelen; Judson, Ruth; Sims, Charles; and Stebunovs, Viktors. “International Dollar Flows,” Board of Governors of the Federal Reserve System, International Finance Discussion Papers 1144, September 2015.

Additional Resources

- On the Economy: Fed Payments to Treasury and Rising Interest Rates

- On the Economy: Banks’ Demand for Reserves in the Face of Liquidity Regulations

- On the Economy: Safe Assets in the U.S. Economy

Citation

Fernando M. Martin, ldquoForeign Demand for Currency and the Fed’s Balance Sheet,rdquo St. Louis Fed On the Economy, May 7, 2019.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions