Recession Signals: Home Sales Trend Lower in All Four Regions

KEY TAKEAWAYS

- Single-family home sales are a reliable indicator of housing market strength.

- New- and existing-home sales rates have declined in all four census regions.

- Based on previous cycles, the recent downturn in U.S. home sales is consistent with a broader economic slowdown in the near term.

As 2018 ended, several historically reliable housing indicators pointed to a possible recession in late 2019 or early 2020. Movements in mortgage rates, existing single-family home sales, inflation-adjusted house prices and residential investment’s contribution to economic growth all resembled patterns that preceded the last three recessions (starting in 1990, 2001 and 2007) by about a year.See Emmons, William R. "Recession Signals: Four Housing Indicators to Watch in 2019." Housing Market Perspectives, December 2018. Through early 2019, these housing-related forecast indicators remained consistent with the possibility of a late 2019 or early 2020 recession.See Emmons, William R. "Key Housing Indicators Weaken Further in 2019." St. Louis Fed On the Economy Blog, June 24, 2019.

Disaggregated Home-Sales Data Reveal Scope of Housing Downturn

Economists often study sectors and regions of the economy to gauge whether an incipient economic slowdown is broad-based and, therefore, likely to worsen. Two of the four housing indicators noted above—mortgage rates and sectoral contributions to economic growth—are national indicators, and as such provide no information about the regional nature of the housing slowdown. House prices are available at the regional and local level, but their behavior varies greatly across housing markets and business cycles. Thus, none of these indicators reveals whether the housing downturn evident in national data has reached all parts of the country.

Conversely, single-family home sales are an ideal measure of regional housing conditions. Existing-home sales are published by the National Association of Realtors; new-home sales are published by the Census Bureau. Both series are available monthly for each of the four census regions: the Northeast, Midwest, South and West. They have proved to be an early and reliable signal of housing downturns and, by extension, of possible economic downturns.

Home Sales in All Regions Have Slowed Significantly

Data on single-family home sales through May 2019 confirm that housing markets in all regions of the country are weakening. While May’s results were mixed—showing a 7.8% drop in sales of newly built homes but a 2.5% uptick in sales of previously owned units—monthly data can be volatile and subject to revisions. A longer view of the data reveals a significant slowing. The severity of the housing downturn appears comparable across regions—in all cases, it’s much less severe than the experience leading to the Great Recession but similar to the periods before the 1990-91 and 2001 recessions.

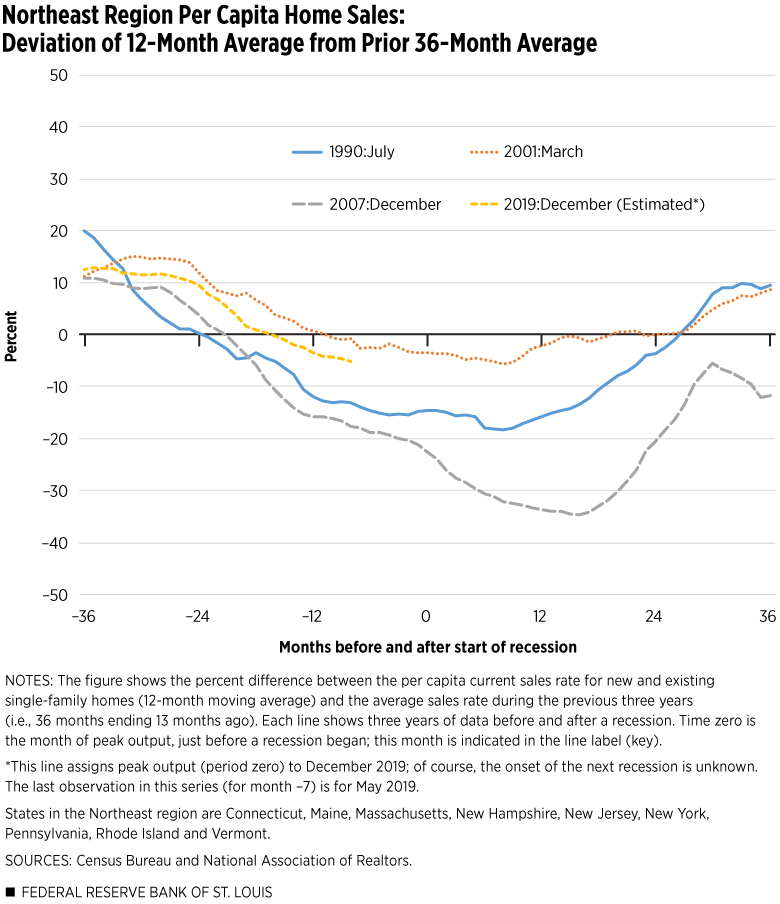

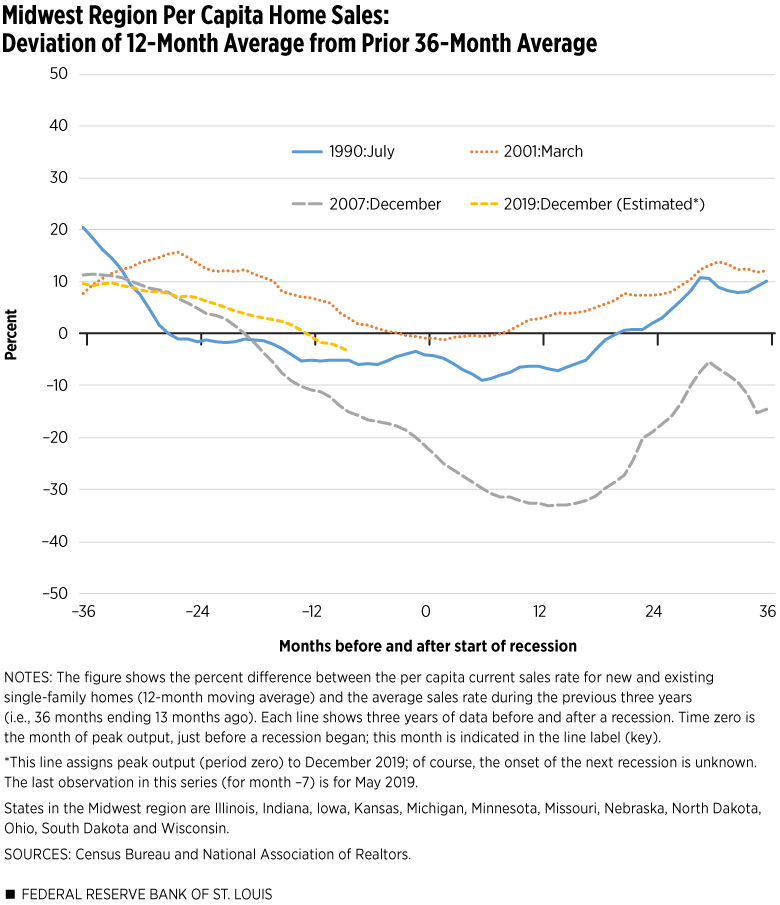

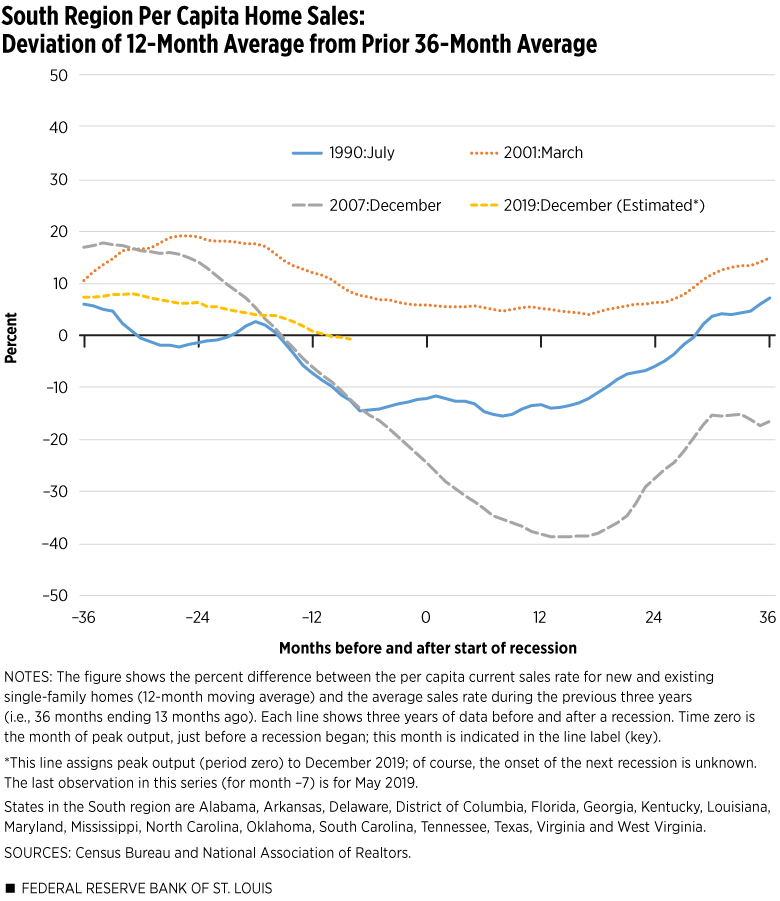

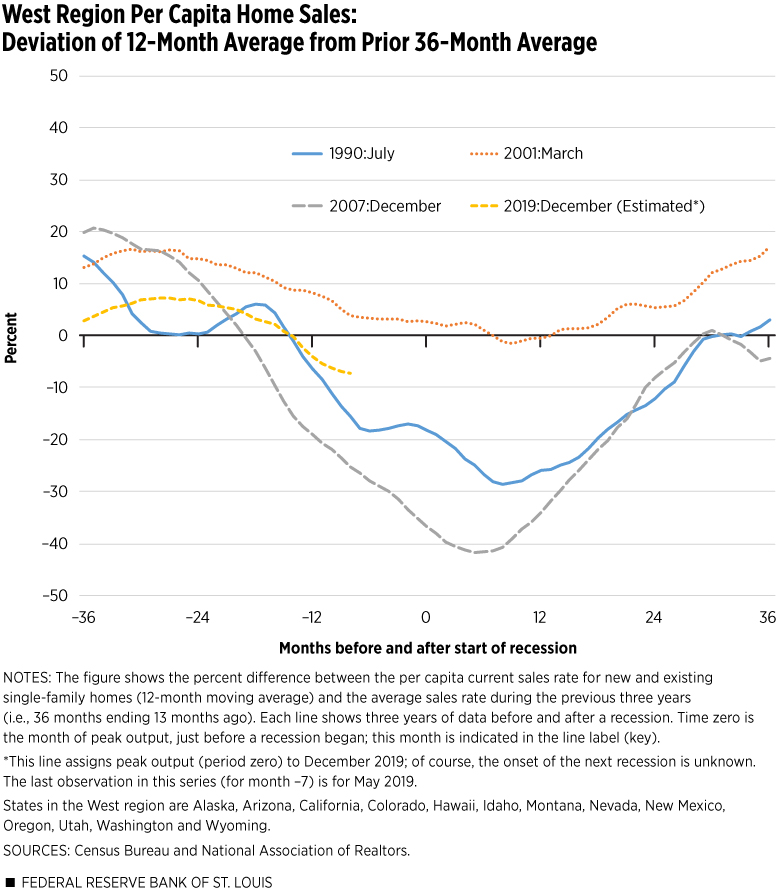

The figures below compare average per capita home sales (for both new and existing single-family homes) for the 12 months ending May 2019 with the average during the previous three years. Each recession episode is centered on the month in which the economy reached its peak output; observations before that month are marked by negative numbers, and those after the peak are marked positive. The most recent data are centered on December 2019, which is intended to serve as a plausible month for peak growth. (Of course, the onset of the next recession is unknown.)

Northeast Region

Assuming that December 2019 is the next business-cycle peak, the first time that current home sales in the Northeast would have fallen below their previous three-year moving average was in month –16, which was August 2018. (See Figure 1.) Prior to the three previous recessions, this indicator for the Northeast region turned negative in months –23, –10 and –21, respectively. Thus, the current pattern falls within the historical range.

Midwest Region

Figure 2 shows cyclical patterns in the Midwest region that are very similar to those in the Northeast. The same indicator of home-sales momentum turned negative in month –12, which was December 2018. This result lies within the historical range for the region: The indicator first entered negative territory in month –26 before the 1990-91 recession, in month –19 prior to the Great Recession and as late as month –2 before the 2001 recession.

South Region

As seen in Figure 3, housing cycles have varied more in the South than in the Northeast and Midwest. The home-sales indicator failed to turn negative prior to the 2001 recession, and it first reached negative territory in month –30 before the 1990-91 recession. The swing from boom to bust around the Great Recession was particularly large in the South, with home sales falling from 18% above the three-year average (in month –34, which was February 2005) to 39% below its trailing average (in month 15, which was March 2009). In the current episode, the home-sales indicator fell slightly below zero in February 2019.

West Region

The West region has some of the most volatile housing markets in the U.S., both in terms of home sales and prices. The home-sales momentum indicator shown in Figure 4 turned negative in month –14, which was October 2018. Around the Great Recession, home-sales momentum reached a peak of 21% above the trailing three-year average in January 2005 (month –35), then plunged to a 42% deficit in May 2008 (month 5).

Is the Nationwide Decline in Home-Sales Momentum Signaling a Broader Economic Downturn?

As of May 2019, the home-sales momentum indicators in the figures above stood at –5%, –4%, –1% and –8%, respectively, for the Northeast, Midwest, South and West regions. Compared with readings before the 1990-91 and 2007-09 recessions, these levels are not particularly worrisome. However, they are all weaker than those seen in the year before the 2001 recession.

Considering signals from other housing indicators and from indicators outside housing with good forecasting track records (such as the Treasury yield curve), the regional housing data noted here merit close attention.

Endnotes

- See Emmons, William R. "Recession Signals: Four Housing Indicators to Watch in 2019." Housing Market Perspectives, December 2018.

- See Emmons, William R. "Key Housing Indicators Weaken Further in 2019." St. Louis Fed On the Economy Blog, June 24, 2019.

This article originally appeared in our Housing Market Perspectives publication.

Citation

William R. Emmons, ldquoRecession Signals: Home Sales Trend Lower in All Four Regions,rdquo St. Louis Fed On the Economy, June 28, 2019.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions