Declining Labor Share and U.S. Industries

In recent decades, the share of payments to labor have been trending down in several countries. We recently explored the idea that the global decline in labor share is related to the declining price of capital goods. In this post, we focus on the change in employee compensation over the past few decades, looking at select U.S. industries.

Value Added by Industries

The value added of an industry is its contribution to overall gross domestic product (GDP) and is computed as the difference between an industry’s gross output and the cost of its intermediate inputs.

The components of value added consist of:

- Compensation of employees

- Taxes on production and imports less subsidies

- Gross operating surplus

Thus, the compensation of employees (or the total income earned by employees) gives us information on labor income as a share of total value added by an industry.Note that the labor share is the sum of employees’ compensation and proprietors’ labor compensation as a fraction of total value added. In this post, we focus only on the first component.

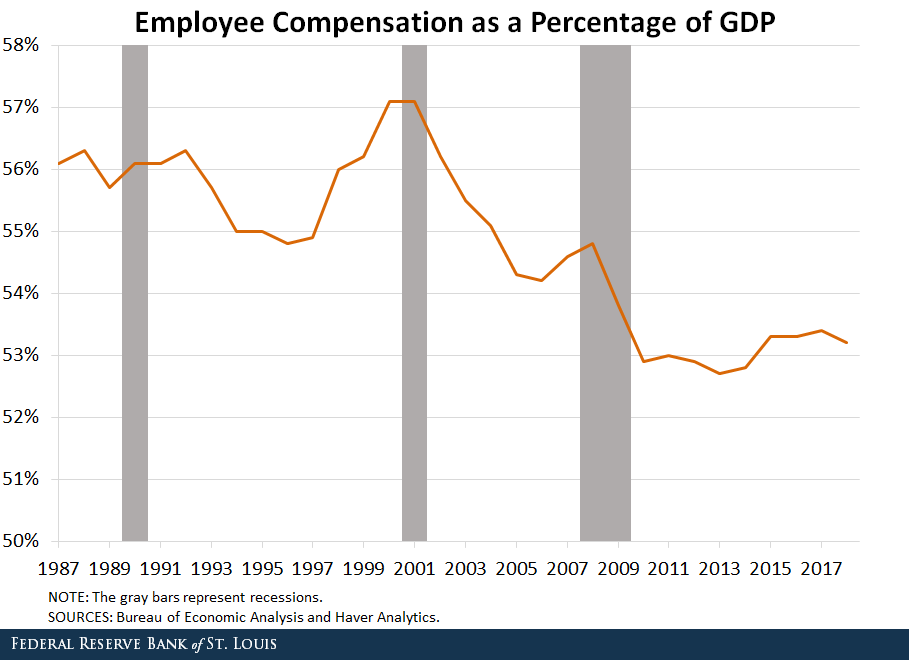

The figure below shows aggregate trends in the compensation of employees as a percentage of GDP.

We observe that there has been a marked downward trend since the early 2000s. In 2018, the share of payments to workers was about 53%, relative to 57% in 2000.

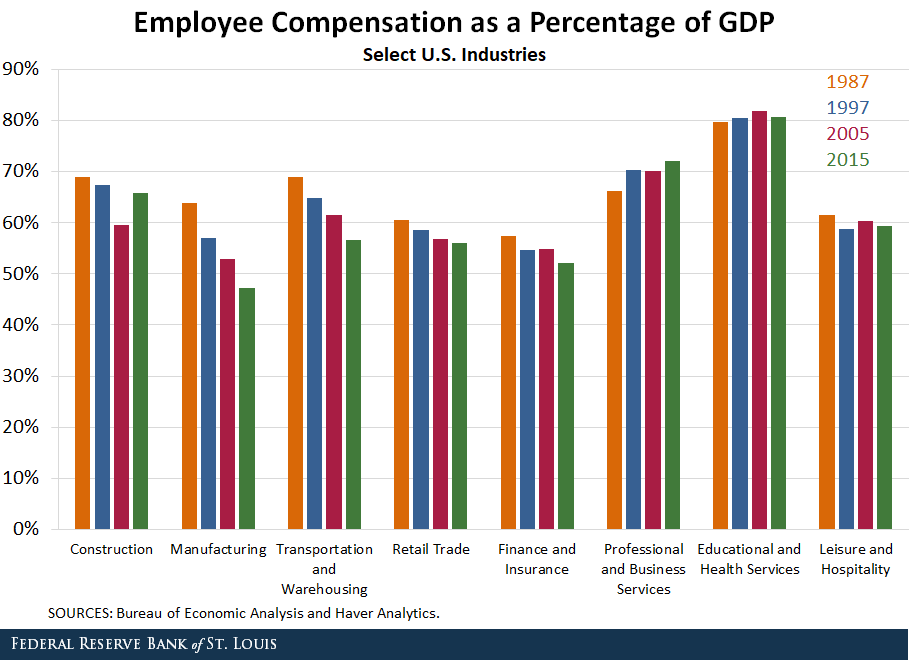

Which industries are driving this downward trend? In an attempt to answer this question, we present a decomposition of this series by industry in the figure below. It depicts the share of employees’ compensation in eight major industries, and each bar represents a specific year in the last four decades, starting with 1987 (the first year for which these data are available).

It is clear from the graph that industries like manufacturing, transportation and warehousing, and retail trade have experienced secular declines in this share. The only industry that generally trended upward was professional and business services. Industries like construction seem to have experienced declines in recent years relative to 1987, although the share in 2015 was higher than that in 2005.

The decrease in the share of compensation to employees within most industries could be attributed to the decline in the price of capital goods. Since different industries use capital with different intensities, the effect of this decline on the share of income to workers will vary. It would also be more pronounced in sectors that use capital more intensively and that can more easily substitute capital for labor.

In addition, other factors may be behind these trends, including factors such as:

- Declining bargaining power of workers

- Increased imports of labor-intensive goods that displace domestic production

- Offshoring of labor-intensive tasks

- Increased adoption of labor-augmenting technology

In future work, it would be interesting to delve into these factors to better understand the reasons for this trend.

Notes and References

1 Note that the labor share is the sum of employees’ compensation and proprietors’ labor compensation as a fraction of total value added. In this post, we focus only on the first component.

Additional Resources

- On the Economy: The Rise of Robots in the Workplace

- On the Economy: How Do Women-Led Firms Differ from Those Led by Men?

- On the Economy: The U.S. Auto Labor Market since NAFTA

Citation

Maximiliano A. Dvorkin and Asha Bharadwaj, ldquoDeclining Labor Share and U.S. Industries,rdquo St. Louis Fed On the Economy, Dec. 19, 2019.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions