U.S. Soybeans Caught in Trade Tussle

Almost half of all soybeans grown in the U.S. were exported last year. China was far and away the largest global importer of soybeans, which make up products such as tofu and animal feed. Now, U.S. and regional farmers face uncertainty after China imposed a 25 percent tariff on U.S. soybean imports in July, as a recent Regional Economist article explored.

“While the result of the tariff is difficult to predict, economic models indicate a negative impact for both the U.S. and China, with significantly reduced U.S. soybean production,” the authors said.

Regional Economist Charles Gascon, former Senior Research Associate Jonas Crews and former Research Intern Camilla Adams looked at the impact of recent trade tensions on the soybean industry, an important crop for the U.S. and, in particular, the Eighth Federal Reserve District. The Eighth District includes all of Arkansas and parts of Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee.

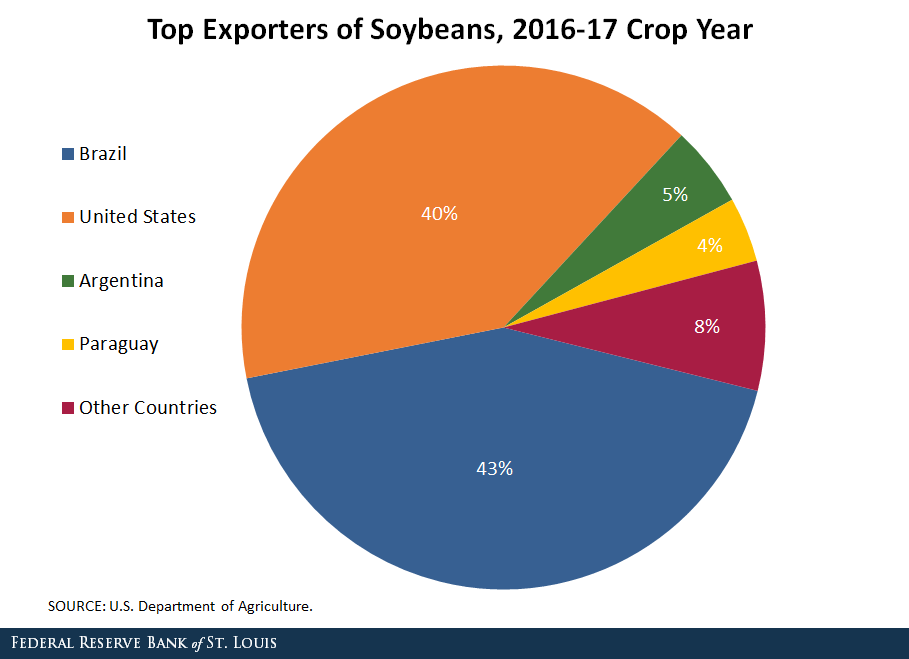

The U.S. was second only to Brazil in global soybean exports, with the two countries accounting for 83 percent of all soybean exports in the 2016-17 crop year, the authors noted. In the U.S., 46 percent of domestic soybean production was exported last year.

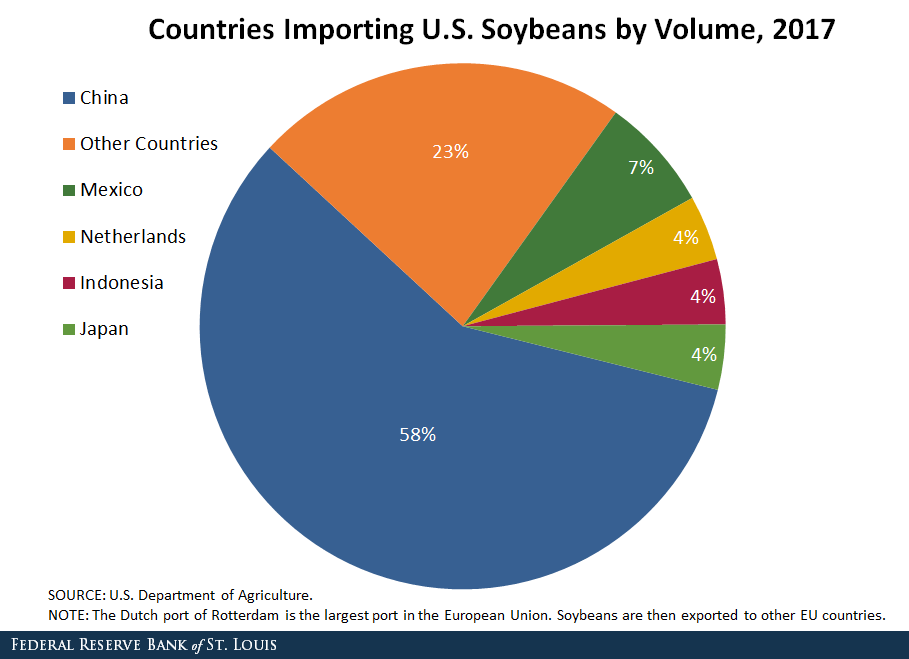

Meanwhile, the authors noted that China was the largest global importer, buying 65 percent of all global exports and 58 percent of U.S. soybean exports.

Soybean Production in the Eighth District

Soybeans were the most planted crop in the Eighth District, the authors pointed out. The District grew almost twice as many soybean acres as corn acres and 15 times as many as wheat in 2017. The area produced 19 percent of U.S. soybeans last year.

“Its pattern of production was consistent with that of the rest of the U.S.,” the authors said, pointing out that soybeans are grown mostly in the Mississippi River basin. In 2017, 26 of the 31 soybean-producing states had a portion of their territories fall within the watershed. The authors noted that those 26 states accounted for 99 percent of 2017 domestic production.

The top 10 soybean-producing counties in the Eighth District lie along the Mississippi River or are separated from it by one county, they said.

Impact of Tariffs on U.S. Soybean Industry

In recent months, strained U.S.-China trade relations have raised questions about continued production and pricing.

Even the prospect of tariffs in the spring affected soybean prices, the authors pointed out. U.S. future prices declined about $2 a bushel after the announcement of a potential tariff from China.

Early in 2018, reports indicated Chinese buyers were canceling orders for U.S. soybeans, in part due to fears that the tariff increase would be enacted before purchases entered China, the authors explained. They added those fears were fulfilled when China went ahead with the tariffs in July.

“Estimating the impact of an economic shock like a tariff is challenging because these shocks trigger a sequence of events that ripple through the economy,” the article said. One unknown is how Chinese consumers will respond to the tariff.

“On the one hand, the demand for soybeans may be relatively inelastic because the price of beans is relatively low; it is just one input into the cost of raising pigs,” it said. “On the other hand, there are substitutes for U.S. beans—primarily beans from other countries—that would increase the elasticity of demand.”

There are also mitigating factors. “First, proposed aid for farmers potentially offsets the drastic effects of lower prices, albeit not completely neutralizing the negative effects,” the authors wrote. “Additionally, Chinese consumers’ growing reliance on U.S. soybeans demonstrates an increasingly inelastic demand pattern for soybeans.”

Notes and References

1 The Eighth District includes all of Arkansas and parts of Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee.

Additional Resources

- Regional Economist: Soybeans, the Eighth District’s No. 1 Crop, Caught in Trade Tussle

- On the Economy: How Much Does the U.S. Trade with China, Canada and Mexico?

- On the Economy: The Evolution of US Agricultural Exports

Citation

ldquoU.S. Soybeans Caught in Trade Tussle,rdquo St. Louis Fed On the Economy, Oct. 25, 2018.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions