How Could Higher Tariffs Affect American Manufacturers?

The U.S. has recently been implementing significant changes in its trade policy. Among these changes, the U.S. is raising tariffs on a number of goods imported from China, which accounted for around $50 billion in 2017.

On Tuesday, the U.S. announced an additional round of tariff hikes on imports from China.For details, see the Office of the United States Trade Representative’s statement on Section 301 action. In this article, I restricted attention to imports from China affected by the tariff hike announced on June 15.For details, see the Office of the United States Trade Representative’s release “USTR Issues Tariffs on Chinese Products in Response to Unfair Trade Practices.”

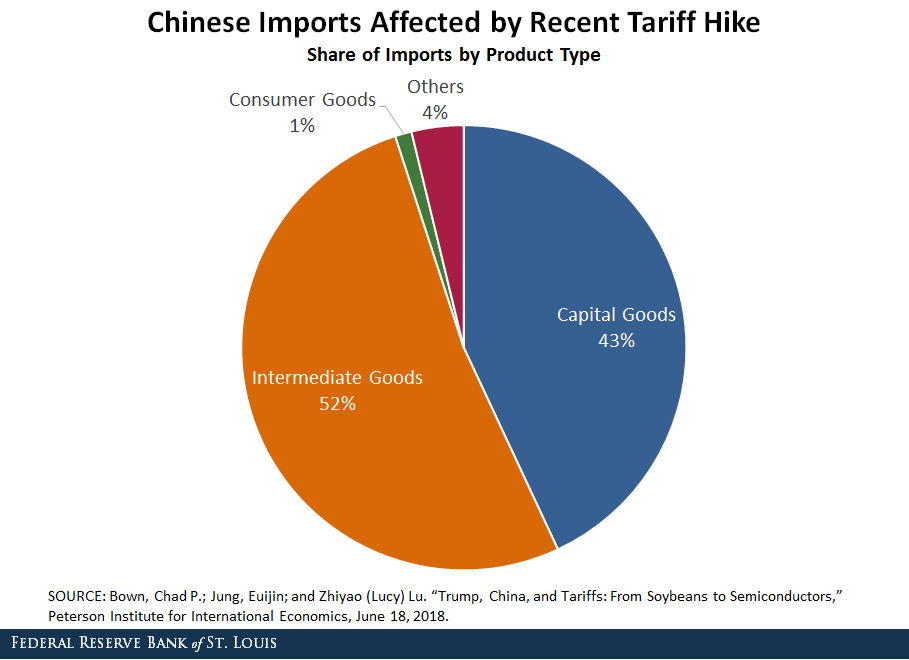

In a recent study, Chad Bown, Euijin Jung and Zhiyao Lu of the Peterson Institute for International Economics classified the type of goods affected by this tariff hike according to their use into:

- Consumption goods

- Capital equipment

- Intermediate inputs

- OthersBown, Chad P.; Jung, Euijin; and Lu, Zhiyao (Lucy). “Trump, China, and Tariffs: From Soybeans to Semiconductors,” Peterson Institute for International Economics, June 18, 2018.

The figure below shows that imports of production inputs (capital equipment and intermediate inputs) account for the vast majority of the total imports value among the goods affected by the tariff hike.

While higher tariffs could benefit domestic firms by improving their competitiveness vis-à-vis the rest of the world, raising tariffs on production inputs may end up hurting them by raising their costs of production.

In the rest of this article, I examine the extent to which raising tariffs on intermediate inputs may impact the U.S. manufacturing sector. To do so, I examined:

- The degree to which U.S. manufacturers rely on intermediate inputs to produce goods

- The share of intermediate inputs that are imported from the rest of the world

I used data from the Organization for Economic Cooperation and Development for 2011 (the latest year available) to compute these indicators across 16 industries within the U.S. manufacturing sector.Industries are categorized according to the ISIC rev. 3 industry classification.

Aggregate Impact on U.S. Manufacturing

I documented that intermediate inputs appear to play a key role in the average U.S. manufacturing industry. First, I found that U.S. manufacturing industries use intermediate inputs very intensively, with expenditures on intermediates accounting for 64 percent of the total value of production on average.

Moreover, I found that a significant fraction of intermediate inputs is sourced internationally: On average, 22 percent of the total expenditure on intermediates is purchased from abroad.

This evidence suggests that raising tariffs on intermediate inputs may have a significant negative impact on U.S. manufacturers. By raising the price of intermediates, the recent tariff hike may force U.S. manufacturers to raise prices, thus hurting consumers and leading to cuts in production. Moreover, some firms might not be able to compete in this alternative environment and might have to shut down.

Which Industries May be More at Risk?

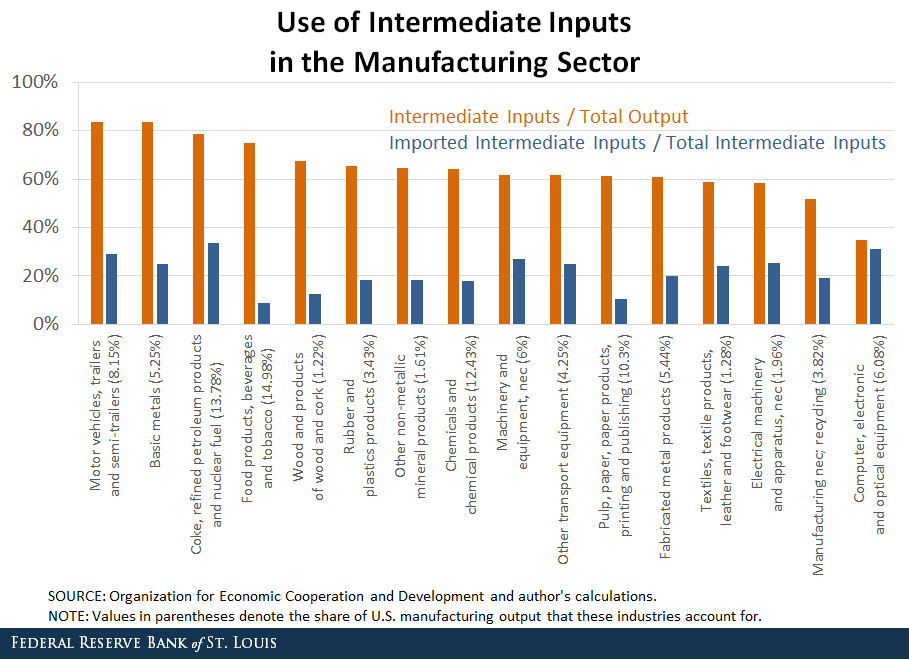

While the aggregate evidence shows that intermediate inputs are very important for U.S. manufactured goods, there is considerable heterogeneity across different industries.

To illustrate, the figure below reports the share of intermediates in total output as well as the share of imported intermediates for each of the 16 industries within the U.S. manufacturing sector.

The orange bars report the share of intermediates in total output for each industry, while the share of U.S. manufacturing output that these industries account for is reported in the x-axis alongside the industry name.

I found that intermediate inputs account for more than 50 percent of the value of total output in all industries except the computer, electronic and optical equipment industry.

Moreover, this share was particularly high in some of the largest industries. For instance, it was 84 percent in the motor vehicles, trailers and semi-trailers industry (8.2 percent of total U.S. manufacturing output) and 75 percent in the food products, beverages and tobacco industry (15.0 percent of total U.S. manufacturing output).

The blue bars report the share of imported intermediates in total intermediates for each industry. I found that there is considerable dispersion in the source from which different industries purchases their intermediate inputs.

On one end, the motor vehicles, trailers and semi-trailers and the computer, electronic and optical equipment industries purchase around 30 percent of their intermediates from abroad. On the other end, the food products, beverages and tobacco and the pulp, paper, paper products, printing and publishing industries only source around 10 percent of their intermediates internationally.

Impact on Manufacturing

This evidence suggests that there might be considerable dispersion in the potential impact of the recent tariff hike across industries. Nevertheless, one thing is clear: All industries within the U.S. manufacturing sector make intensive use of intermediate inputs and source at least 10 percent of these internationally. Insofar these imported intermediates are hard to substitute with domestic counterparts, then they are likely to have a significant impact on the functioning of U.S. manufacturers.

Further research needs to be conducted to quantify the extent to which these effects might impact employment and economic activity.

Notes and References

1 For details, see the Office of the United States Trade Representative’s statement on Section 301 action.

2 For details, see the Office of the United States Trade Representative’s release “USTR Issues Tariffs on Chinese Products in Response to Unfair Trade Practices.”

3 Bown, Chad P.; Jung, Euijin; and Lu, Zhiyao (Lucy). “Trump, China, and Tariffs: From Soybeans to Semiconductors,” Peterson Institute for International Economics, June 18, 2018.

4 Industries are categorized according to the ISIC rev. 3 industry classification.

Additional Resources

- On the Economy: Tariff Increases and the Potential Economic Effects

- On the Economy: Why Are Business Cycles in Emerging Economies More Volatile?

- On the Economy: How Do Americans Feel about NAFTA?

Citation

Fernando Leibovici, ldquoHow Could Higher Tariffs Affect American Manufacturers?,rdquo St. Louis Fed On the Economy, July 12, 2018.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions