The Informal Economy and Consumption Volatility

Many countries have a large informal economy1 that is poorly measured in the national accounts. In rich countries, the informal sector is between 8 percent and 23 percent of gross domestic product (GDP), while in poor countries it is between 20 percent and 60 percent of GDP.

At the same time, a puzzling business cycle fact emerges when measured volatility of consumption is greater than that of output. According to theory, consumption should be less volatile than output because consumers should spread their consumption over time.

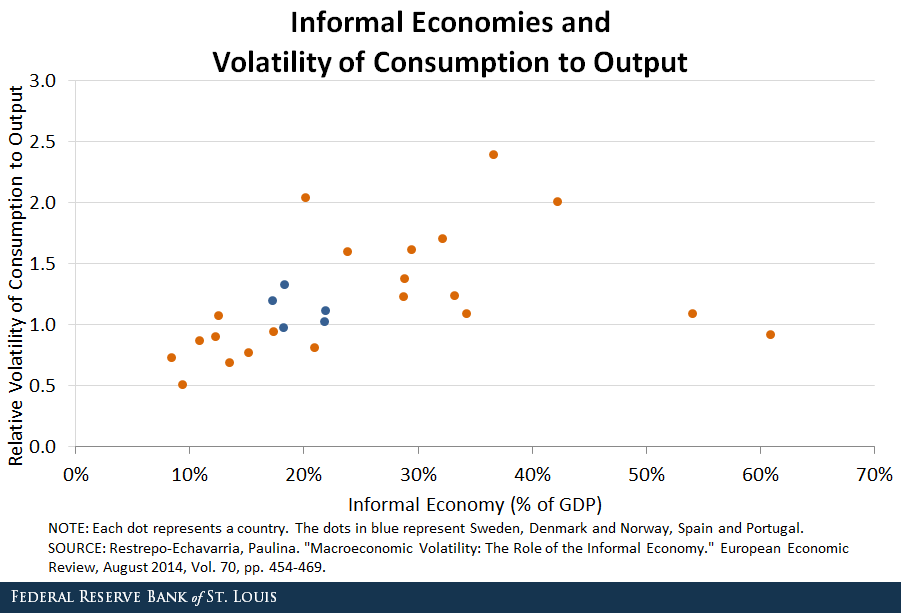

A recent study of mine (Paulina) shows the relationship between the size of the informal sector and the relative volatility of consumption to output.2 The figure below shows a scatter plot of the size of the informal economy and the relative volatility of consumption to output for a select group of countries.

The important thing to notice is that there is a high correlation (around 0.75) between the relative volatility of consumption to output and the size of the informal sector.

In general, countries that have a higher relative volatility of consumption to output have a large informal sector (which is difficult to measure). Interestingly, Norway, Sweden, Denmark, Spain and Portugal—which have above-average sized informal economies and are marked by blue dots in the figure—also have a higher volatility of consumption to output relative to other developed nations.

In the study, I (again, Paulina) show that relatively high consumption volatility is a natural consequence of having a large and poorly measured informal sector. This result derives from the fact that workers can move between the formal and the informal sector when there are economic factors (like access to credit) that affect the two sectors asymmetrically.

As a result, studies of business cycles in developing countries (and some developed countries) should recognize the importance of a worker’s decision to work in the formal versus the informal sector as this decision determines the size of the two sectors and, hence, how mismeasurement can affect measured cyclical fluctuations of the macroeconomy.

Notes and References

1 An informal economy is defined as market-based value-added creating activities that are not taxed or registered by the government.

2 See Restrepo-Echavarria, Paulina. “Macroeconomic Volatility: The Role of the Informal Economy.” European Economic Review, July 2014.

Additional Resources

- On the Economy: What Is the Informal Labor Market?

- On the Economy: Tigers, Tiger Cubs and Economic Growth

- On the Economy: How to Measure the Black Market

Citation

Paulina Restrepo-Echavarría and Brian Reinbold, ldquoThe Informal Economy and Consumption Volatility,rdquo St. Louis Fed On the Economy, Sept. 4, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions