The Financial Challenges of Startups

More than two-thirds of startup firms faced financial challenges in the past year, according to the 2016 Small Business Credit Survey: Report on Startup Firms.

The survey, which was a collaboration of all 12 Federal Reserve banks, provides an in-depth look at startups1 and their financing and credit experiences, covering the second half of 2015 through the second half of 2016.

Age Matters

The survey found that age influences whether a small business faces challenges. Around 70 percent of startups said they faced financial challenges in the previous 12 months. Specifically, 72 percent of startups that were 2 years old or younger and 69 percent of startups that were 3 to 5 years old said they faced challenges during that period.

In contrast, only 56 percent of small employer firms that are mature (more than 5 years old) reported financial challenges in the 12-month period.

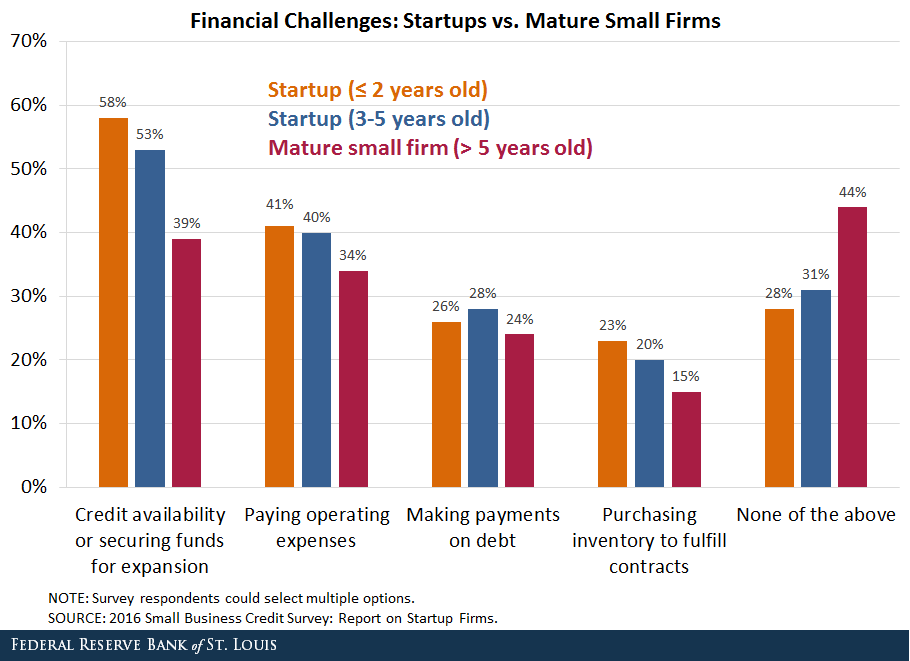

The figure below shows where startups faced financial challenges.

Difficulties in obtaining financing also are more common for startups than mature small businesses. As seen in the table, 58 percent of startups that are 2 years old or younger and 53 percent of startups that are 3 to 5 years old reported difficulties with credit availability or accessing funds for expansion. Though still a top concern for mature small businesses, only 39 percent of older smaller firms cited this problem.

Among the actions taken to deal with financial challenges:

- 81 percent of startups reported using personal funds.

- 45 percent took out additional debt.

- 43 percent made a late payment.

- 42 percent said they cut staff hours and/or downsized operations.

Financing Difficulties

The survey also found that 52 percent of all startups had applied for financing. However, 28 percent of startups that applied were not approved for any financing, while an additional 41 percent received some but not all the financing that they had sought.

The 48 percent of startups that didn’t apply for financing reported different reasons for not seeking funding:

- More than a third (36 percent) said they had sufficient financing.

- Another 27 percent said they were averse to debt.

- 27 percent were discouraged, saying they didn’t apply because they believed their application would be rejected.

Notes and References

1 Startup firms are defined as small businesses that were 5 years old or younger in 2016 and had full- or part-time employees.

Additional Resources

- Small Business Credit Survey: Report on Startup Firms

- On the Economy: The Financial Challenges of Small Businesses

- On the Economy: How Did Small Businesses Do in 2016?

Citation

ldquoThe Financial Challenges of Startups,rdquo St. Louis Fed On the Economy, Oct. 26, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions