How to Compare Banking Conditions in the U.S.

Many researchers have long categorized commercial banks by the Federal Reserve district in which the banks are physically located. The St. Louis Fed’s Federal Reserve Economic Database, commonly known as FRED, has traditionally used this method with its banking data.1 However, there may be times when it makes more sense to categorize a commercial bank according to the Fed district that supervises the institution’s bank holding company (BHC) that is the parent of the commercial bank.

Bank Supervision Structure

In a recent Regional Economist article, Senior Economist Andrew Meyer, with the St. Louis Fed’s Banking Supervision and Regulation Division, provided a brief background on how banking supervision is structured in the United States.

He noted that commercial banks are regulated by one of three federal regulators:

- The Fed, if the bank is chartered as a state bank and chooses to be a member of the Fed System

- The Federal Deposit Insurance Corp., if it is chartered as a state bank but chooses not to be a member of the Fed System

- The Office of the Comptroller of the Currency, if it charters as a national bank

Supervising Bank Holding Companies

Regardless of charter, most banks are organized as subsidiaries of BHCs, and all BHCs are supervised by the Fed, Meyer explained.

A BHC can be a simple structure, known as a “shell” holding company, which consists of only one bank subsidiary and no nonbank subsidiaries.

“In most cases, the headquarters of a BHC is in the same Fed district as its biggest subsidiary bank, also called the lead bank,” Meyer noted. “In fact, for most shell holding companies, the two headquarters are in the same building.”

On the other hand, there are many BHCs that are very large and complex.

“For example, a BHC may have its headquarters in New York City to give it better access to global financial markets and other major financial institutions, but it may also have a subsidiary in another state to take advantage of lower corporate taxes and a subsidiary in a third state to take advantage of relatively permissive usury laws,” Meyer explained.

Shifting Supervision Responsibilities

In these types of cases, it is rare but not unheard of for the Fed to shift responsibility for the supervision of a bank from the Federal Reserve district where the bank is physically located to the district where the top-level BHC resides.

“For example, a commercial bank may be headquartered in South Dakota, putting it physically in the Minneapolis Fed District, but its top holding company is in New York, putting it in the New York Fed District. In that case, the supervisors at the New York Fed would be responsible for monitoring the condition of the South Dakota subsidiary, even though it does not physically reside in the New York Fed District,” Meyer explained.

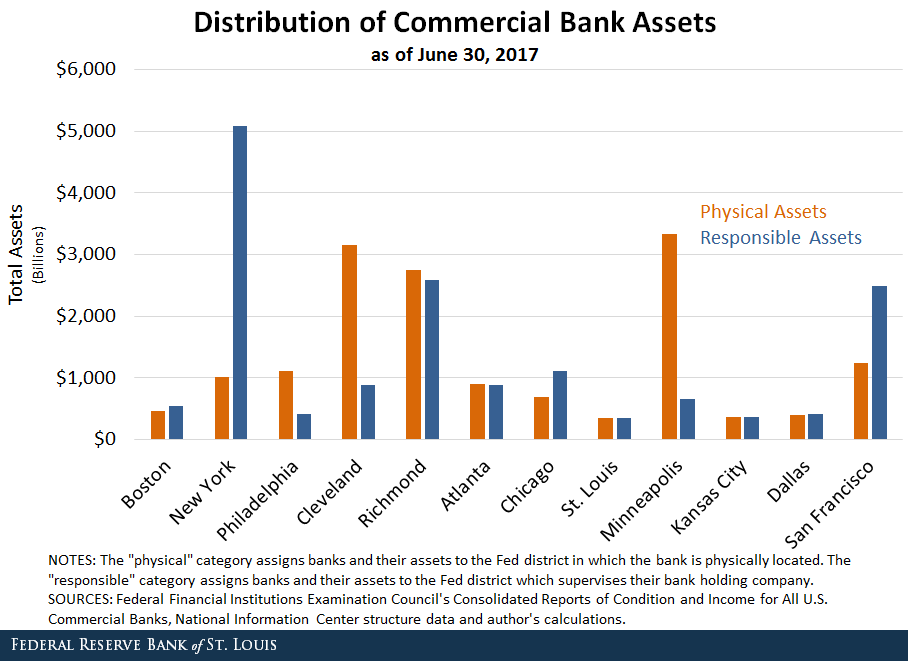

The table and chart below show the effect of these different methodologies on the distribution of commercial banks by district, and how the changes were more dramatic in terms of the total amount of assets supervised; FRED now provides banking data organized by responsible district.2

<

<

Meyer explained that New York experienced the largest increase due to assets of JPMorgan Chase Bank and Citibank shifting to it from the Cleveland and Minneapolis districts, respectively. The second largest increase—the San Francisco District—is largely due to Wells Fargo Bank, which shifts from the Minneapolis District.

“The above movements also explain why the biggest decreases in supervised assets appear in the Cleveland and Minneapolis Fed districts,” Meyer noted.

Which Method Is Best?

Meyer said that the standard definition of physical Fed district is perfectly appropriate for any research project that looks at how banking assets are distributed across U.S. geographic regions or the differences in bank performance across these regions.

On the other hand, “For research questions that explicitly examine decision-making at a bank holding company level, the responsible-district approach provides a more relevant perspective,” he concluded.

Notes and References

1 For the time series of the number of banks and the total assets by physical location, see https://fred.stlouisfed.org/release/tables?rid=55&eid=188985 and https://fred.stlouisfed.org/release/tables?rid=55&eid=188998, respectively.

2 For the time series of the number of banks and the total assets by responsible district, see https://fred.stlouisfed.org/release/tables?rid=55&eid=188972 and https://fred.stlouisfed.org/release/tables?rid=55&eid=188947, respectively.

Additional Resources

- Regional Economist: Another Way to Compare Banking Conditions in the U.S.

- On the Economy: Bank Supervision and the Central Bank: An Integrated Mission

- On the Economy: Why America's Dual Banking System Matters

Citation

ldquoHow to Compare Banking Conditions in the U.S.,rdquo St. Louis Fed On the Economy, Oct. 30, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions