Residual Seasonality: The Return of an Old First-Quarter Friend?

Predicting real gross domestic product (GDP) growth in the first quarter of the year has been a challenge over the past several years. Reported estimates published by the Bureau of Economic Analysis (BEA) have regularly come in lower than forecasters and policymakers had predicted.

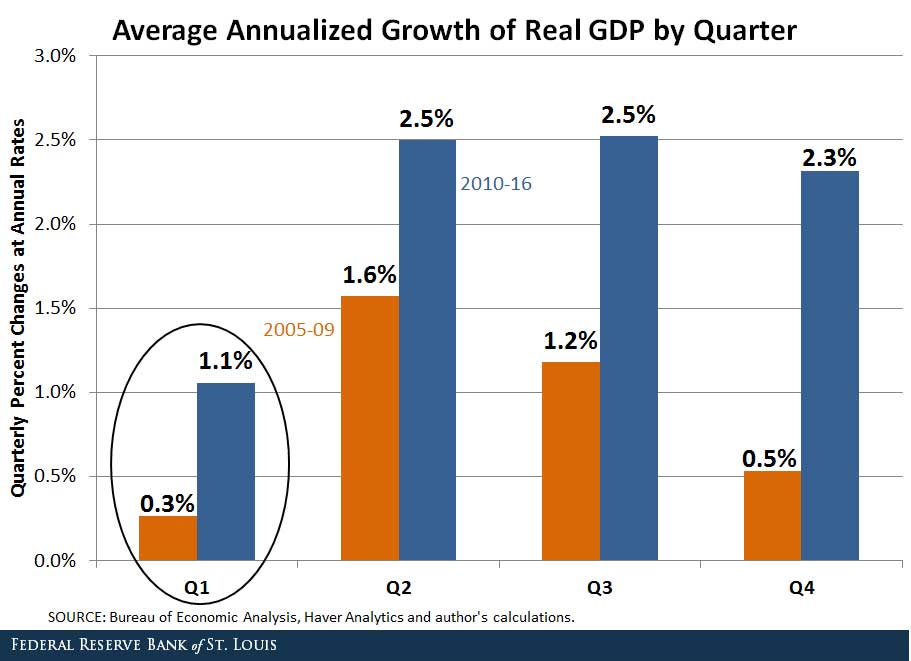

As seen in the figure below, real GDP growth has averaged 1.1 percent at an annual rate in the first quarter since 2010, while growth over the final three quarters of the year has averaged about 2.5 percent. A similar pattern existed over the previous five years as well.

Some believe this first-quarter softness reflects residual seasonality, which the BEA defines as: “lingering seasonality even though the data have already been adjusted to remove seasonal effects.”1

Continuing Pattern of Residual Seasonality?

This trend appears to be repeating itself this year. Key data designed to measure actual expenditures by consumers and firms—such as real personal consumption expenditures, light vehicle sales and construction spending—exhibited considerable weakness in January.

In contrast, data derived from surveys—such as surveys of business and consumer confidence—and financial market variables—such as stock prices and the St. Louis Fed Financial Stress Index—depict an economy that is exhibiting pretty strong growth during the first quarter of 2017.2 A similar conclusion follows from key indicators of labor market conditions, such as brisk job growth and extraordinarily low initial weekly claims for unemployment insurance benefits.

Effect on Projections

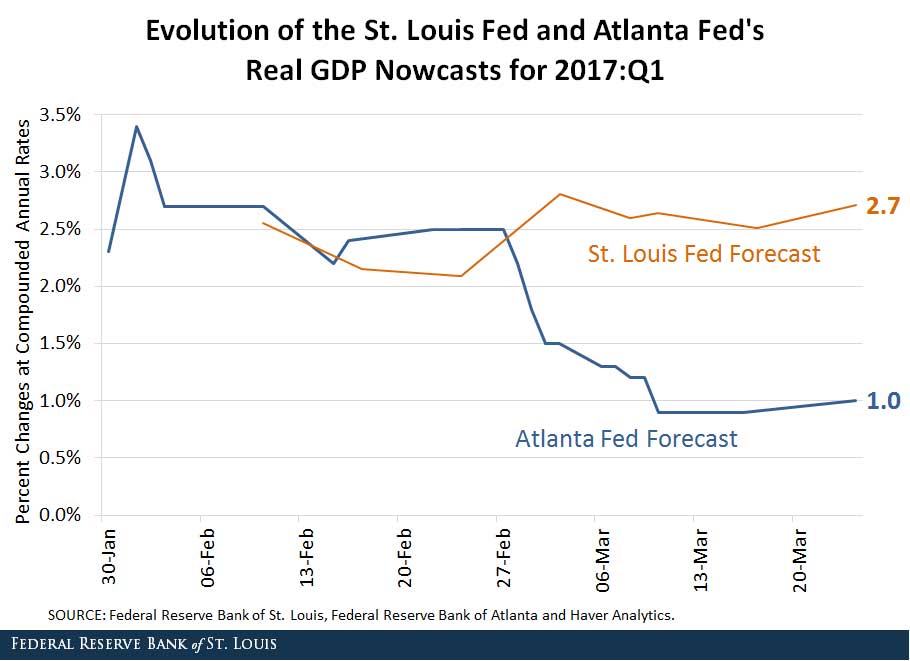

The data discrepancy is also showing up in several of the nowcasts, which are forecasts of first-quarter real GDP growth using the evolving data flows that measure economic activity over the January to March time frame. For example, the Atlanta Fed’s GDPNow forecast is predicting real GDP growth of 1.0 percent at an annual rate, but the St. Louis Fed Economic News Index is predicting that real GDP will increase at a 2.7 percent annual rate in the first quarter.

If the first-quarter estimate of real GDP growth turns out to be as weak as some nowcasts are predicting, then this may be yet another instance of residual seasonality. If so, then there appears to be a high likelihood of a sharp rebound in the remaining quarters of the year.

However, if instead the first quarter does not turn out to be a head fake, then forecasters and policymakers will have to reassess their expectations for the economy’s performance in 2017.

Notes and References

1 See “Residual Seasonality in GDP and GDI: Findings and Next Steps.” Bureau of Economic Analysis, June 1, 2016.

2 See Kliesen, Kevin. “Does Data Confusion Equal Forecast Confusion?” Economic Synopses, Federal Reserve Bank of St. Louis (forthcoming).

Additional Resources

Citation

Kevin L. Kliesen, ldquoResidual Seasonality: The Return of an Old First-Quarter Friend?,rdquo St. Louis Fed On the Economy, March 27, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions