How Well Do Nonemployer Firms Fare?

About two of every five nonemployer businesses operated at a loss, according to the recently released 2015 Small Business Credit Survey: Report on Nonemployer Firms.

This report, jointly produced by the Federal Reserve banks of St. Louis, Atlanta, Boston, Cleveland, New York, Philadelphia and Richmond, examined trends in businesses with no employees other than the owners. As the report noted, these businesses make up nearly 80 percent of all U.S. firms.

“Yet, little is known about the performance or the financing needs and decisions of these 23 million businesses. The few sources that provide insight on small business credit conditions do not distinguish the experiences of nonemployers from small employer firms, which may differ significantly.”

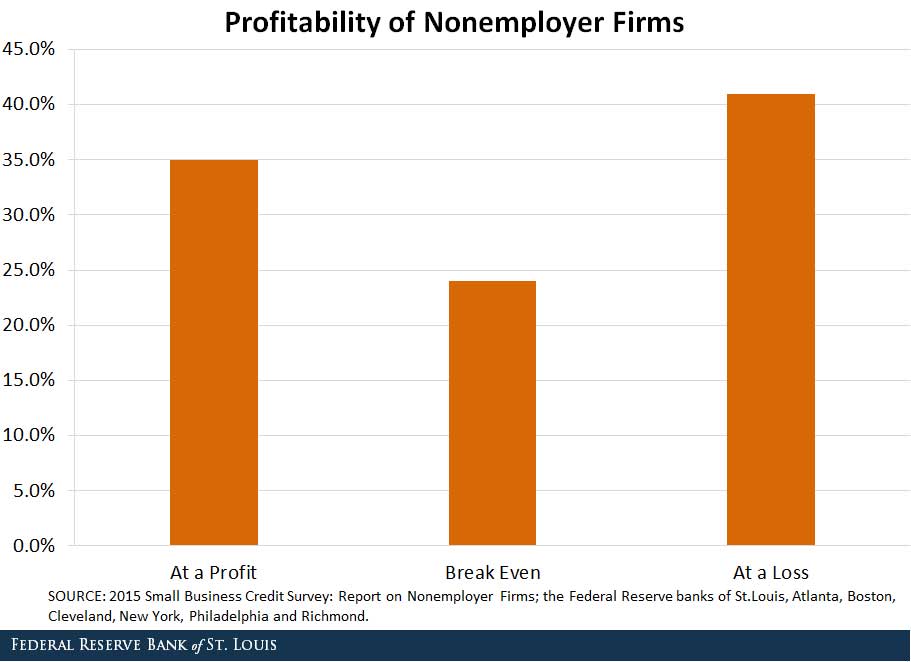

Profitability of Nonemployer Firms

The figure below shows the profitability of nonemployer firms as of the end of 2014.

As the figure shows, more than 40 percent of nonemployer businesses operated at a loss, while 35 percent showed a profit and the remainder broke even.

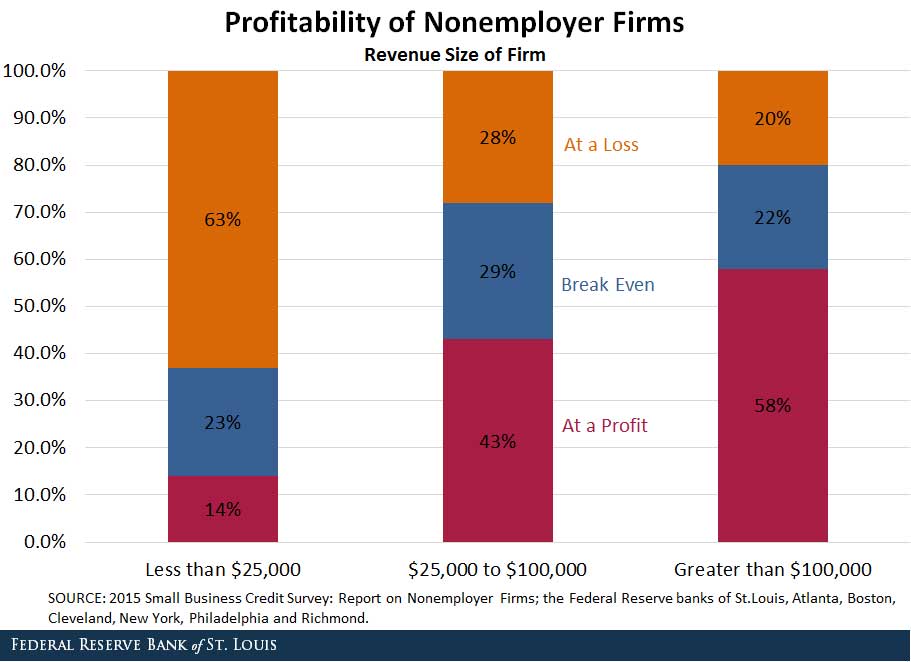

However, the size of the firm may play a role in profitability. The figure below shows the profitability of nonemployer firms by revenue size.

Firms that generated more revenue were also more likely to be profitable, rising from 14 percent of firms with less than $25,000 in revenue to 58 percent of firms with greater than $100,000 in revenue.

Firm age may also play a role in larger-revenue firms being more likely to generate a profit. The report noted that firms with less than $25,000 in annual revenue also tended to be young: “Three-quarters are less than six years old, and 39 percent are new firms (0-1 years).”

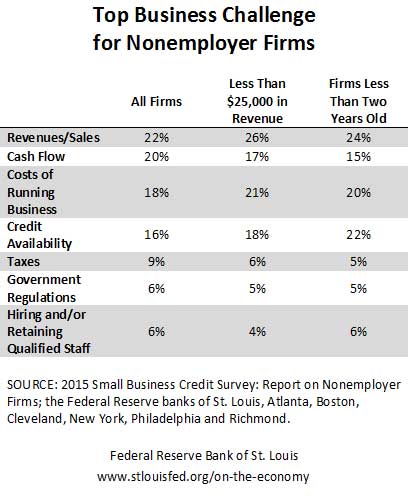

Top Business Challenges

Still, generating revenue was the top response given when asked about nonemployer firms’ top business challenge, as seen in the table below.

Younger and smaller-revenue firms more often responded with revenues and sales as the top business challenge than did nonemployer firms as a whole. These firms also cited the costs of running a business as the top challenge more often than nonemployer firms as a whole.

Additional Resources

Citation

ldquoHow Well Do Nonemployer Firms Fare?,rdquo St. Louis Fed On the Economy, Jan. 24, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions