Small Businesses More Satisfied with Small Bank Lending

According to the survey,1 79 percent of employer firms that applied for a loan or line of credit were approved for at least some financing. About 50 percent of firms were approved for the full amount of financing.

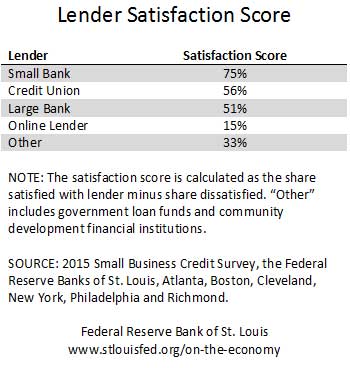

The survey also asked firms if they were satisfied with their lenders. The table below shows the satisfaction scores for the various types of lenders.

Regarding individual issues, online lenders actually scored better than small and large banks on wait times and application processes:

- Only 22 percent of successful applicants said the long wait for a credit decision was a reason they were dissatisfied with online lenders, while 43 percent and 45 percent said that about small and large banks, respectively.

- Only 21 percent gave “difficult application process” as a reason for dissatisfaction with online lenders, versus 52 percent and 51 percent for small and large banks, respectively.

However, 51 percent said repayment terms with online lenders were unfavorable (versus 15 percent and 16 percent for small and large banks, respectively). And 70 percent said high interest rates were a reason they were dissatisfied with online lenders. Only 15 percent and 18 percent gave the same reason for being dissatisfied with small and large banks, respectively.

Notes and References

1 The 2015 Small Business Credit Survey: Report on Employer Firms presents findings on the business conditions, financing needs and access to capital based on the responses of nearly 3,500 small businesses from 26 states. The project is a joint effort of seven Federal Reserve banks: St. Louis, Atlanta, Boston, Cleveland, New York, Philadelphia and Richmond.

Additional Resources

Citation

ldquoSmall Businesses More Satisfied with Small Bank Lending,rdquo St. Louis Fed On the Economy, March 14, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions