Oil Prices Are Low. So Why Hasn’t Oil Production Fallen?

Crude oil prices have been quite low for quite some time now. Lower crude prices, however, have not discouraged all U.S. oil producers, who have continued to drill wells and extract steady amounts of oil and natural gas every day.

In this post, we will describe how lower costs and increased productivity have helped keep oil producers in business.

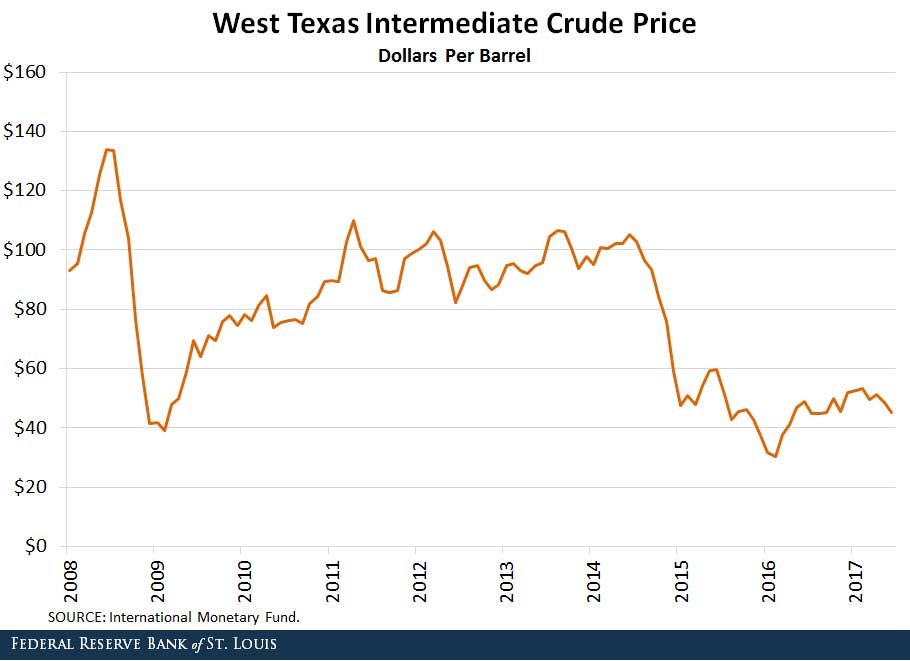

How Low Have Oil Prices Been?

The price of West Texas Intermediate (WTI) crude oil, used as a benchmark for light grade crude oil produced in the U.S., has fluctuated between $30 and $60 per barrel in the two and a half years since its steep decline from a peak of $105 per barrel in June 2014, as seen in the figure below.

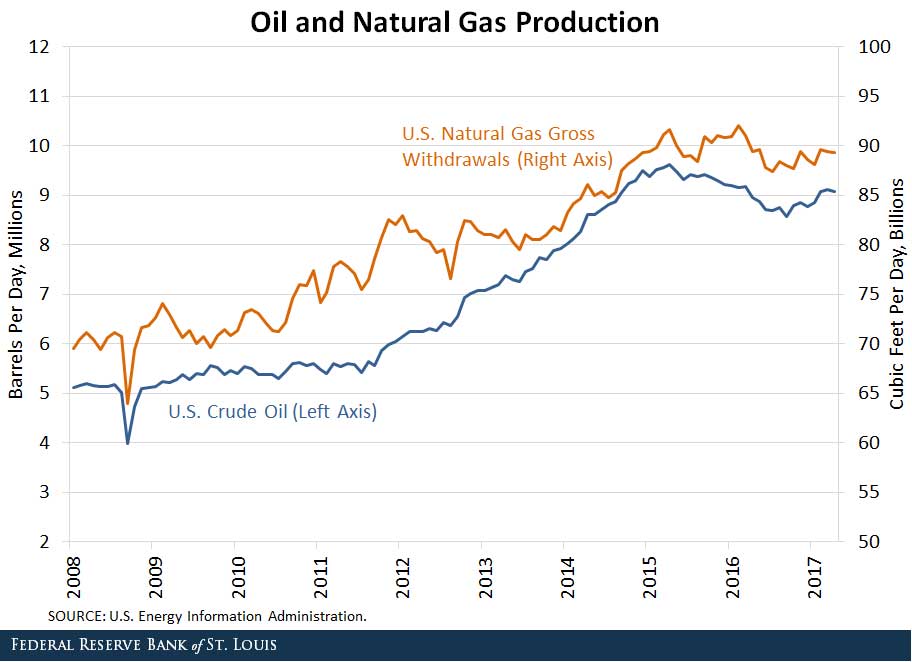

Increases in Oil and Gas Production

According to the most recent Dallas Fed Energy Survey, executives at exploration and production firms reported that second-quarter oil and gas production increased for the third quarter in a row, albeit at a slower pace than during the first quarter. Also, company outlooks remained positive for the fifth consecutive quarter.

Since 2015, U.S. crude oil production has fluctuated around 9 million barrels per day, with natural gas production around 90 billion cubic feet per day. As shown in the figure below, extraction of both oil and natural gas has increased steadily since 2008.

Why Are Oil Companies Still Producing So Much Oil?

Several factors have helped keep oil production companies in business. Key among them are that overall costs have declined in the industry, and the tools and technology used have improved and thus increased productivity.

Aside from cutting operating costs, companies reduced overall drilling activity by focusing on their most profitable projects. As overall drilling activity declined, there was a higher supply of workers and service providers, reducing costs along the supply chain.

Technology improvements that led to lower costs include innovations in well design, drilling and completion. More complex wells could be completed with the better technology, and these wells result in much higher productivity and efficiency despite being more expensive to drill, leading to lower costs of production per unit and larger oil recovery rates.

Finally, the adoption of best practices and improvements in well designs have reduced drilling and completion times, decreasing total well costs and increasing well performance.1

As oil production has become more efficient and productive, exploration and production firms have been able to stay profitable despite the low crude prices.

Notes and References

1 “Trends in U.S. Oil and Natural Gas Upstream Costs.” U.S. Energy Information Administration, March 23, 2016.

Additional Resources

- On the Economy: Is OPEC Losing Its Ability to Influence Oil Prices?

- On the Economy: Do Rises in Oil Prices Mean Rises in Food Prices?

- On the Economy: The Default Risk of Oil-Producing Countries

Citation

Paulina Restrepo-Echavarría and Maria A. Arias, ldquoOil Prices Are Low. So Why Hasn’t Oil Production Fallen?,rdquo St. Louis Fed On the Economy, Aug. 3, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions