The Fed Funds Rate and Low Long-Term Interest Rates

The federal funds rate target has risen four times in the past year and a half or so. How high might it go? A recent Economic Synopses essay examined what may happen, given the low long-term interest rate environment.

Federal Funds Rate Hikes So Far

Senior Economist YiLi Chien and Senior Research Associate Paul Morris noted that the Federal Open Market Committee (FOMC) has increased the target federal funds rate 25 basis points in December 2015, December 2016, March 2017 and June 2017. The latest projections of FOMC participants suggest one more rate hike may occur by the end of the year.

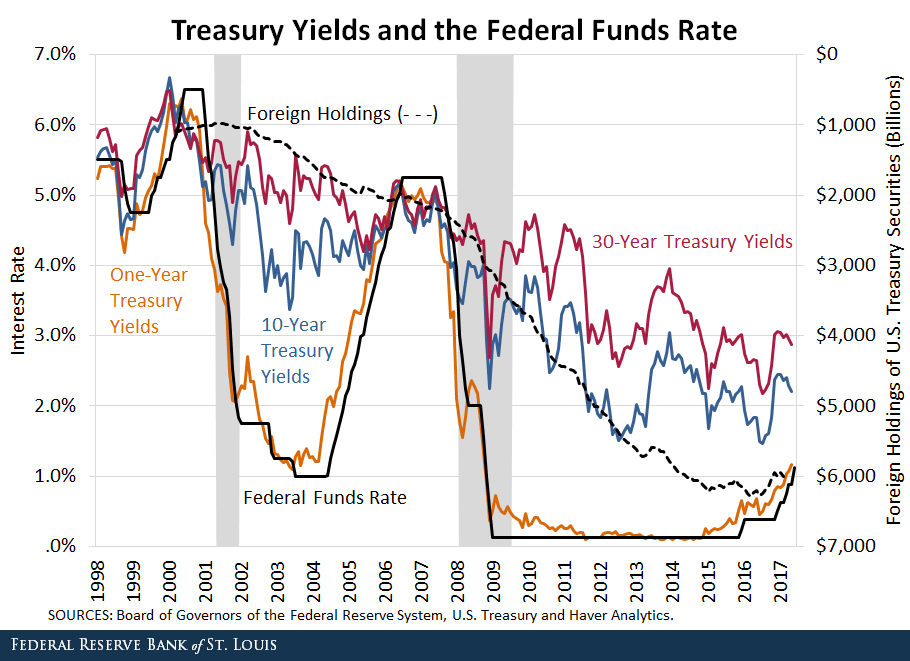

The black line in the figure below shows the federal funds rate target over the past several years.

Path of Treasury Yields

Also shown in the figure are yields on one-year, 10-year and 30-year Treasuries.

Long-Term Interest Rates

Chien and Morris started with the long-term interest rate measured by the 30-year Treasury yield, noting that it has declined consistently from 6 to 7 percent in the late 1990s to around 3 percent today. “This slow decline suggests that the low long-term yield is not a result of the close-to-zero federal funds rate that held from 2009 to 2015,” they wrote.

The dotted black line shows the increase in foreign holdings of Treasury securities, which have risen sixfold from 2000 to 2017. Chien and Morris noted that prices of Treasury securities go up and yields go down when foreign demand rises. “Thus, the decline in long-term interest rates likely has more to do with increasing foreign demand for Treasury securities than federal funds rate policy,” they noted.

Short-Term Interest Rates

Chien and Morris noted that the short-term interest rate measured by the one-year Treasury yield much more closely followed the federal funds rate than the long-term 10-year and 30-year rates. They wrote: “The federal funds rate strongly influences short-term yields, but this influence gets weaker as the maturity increases. Going forward, it is unlikely that the long-term rate will increase as much as the federal funds rate.”

Increasing the Federal Funds Rate

The authors explained that the low long-term yield could play a role in the FOMC’s decision-making. A series of hikes, coupled with continued low long-term rates, could push short-term interest rates ahead of long-term ones. “This phenomenon is referred to as the inverted yield curve and is believed to be a strong indicator of recessions,” they wrote.

As seen in the figure above, inverted yield curves preceded the last two recessions. In both cases, the FOMC dropped the federal funds rate target. “Hence, it is unreasonable to expect the federal funds rate to reach 5 or 6 percent during the current rate-hike cycle because of the low long-term yield,” Chien and Morris wrote.

The authors noted that current projections seem to be in line with this thinking. “The median projection of FOMC participants is 2.1 percent and 2.9 percent by the end of 2018 and 2019, respectively, which is close to the long-term yield,” they wrote.1

Notes and References

1 “Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents Under Their Individual Assessments of Projected Appropriate Monetary Policy.” FOMC, June 2017.

Additional Resources

- Economic Synopses: The Rising Federal Funds Rate in the Current Low Long-Term Interest Rate Environment

- On the Economy: Wealth Hits Another Peak. Time to Celebrate or Worry?

- On the Economy: The Market’s Expectations about FOMC Meetings

Citation

ldquoThe Fed Funds Rate and Low Long-Term Interest Rates,rdquo St. Louis Fed On the Economy, Aug. 8, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions