The Stock Market Is Up, but Mutual Fund Investors Are Fleeing

Each of the three major U.S. stock indexes—the Dow Jones industrial average, the S&P 500 index and the Nasdaq—have hit record highs multiple times in the past few months. This comes despite the uncertainty brought about by Brexit in June and the ongoing potential interest rate hike from the Federal Reserve.

Who is buying stock and pushing up prices? Investors can hold stock directly or through an equity fund. According to World Bank data, total U.S. stock market capitalization was around $25 trillion at the end of 2015, while the total value of U.S. equity funds was around $6 trillion, or 25 percent of total market capitalization. Hence, it is likely that the driver of the high stock value comes from other types of stock holdings.

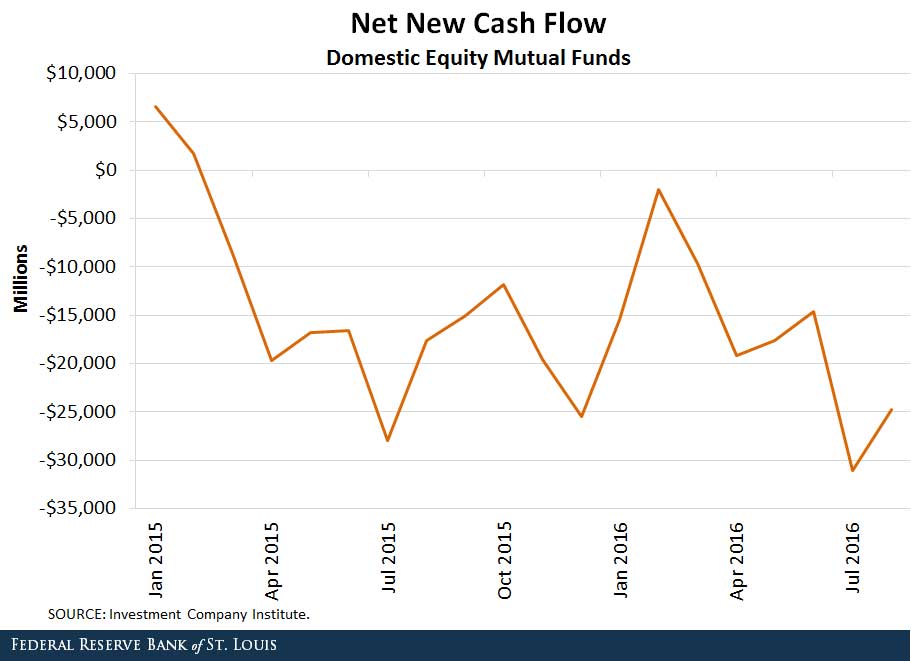

However, while stock prices have been going up, mutual fund investors have been fleeing their funds. As shown in the figure below, there were net cash outflows in U.S. domestic equity funds every month from March 2015 to August 2016.1

The outflows are sizable, averaging nearly $17.5 billion each month for a cumulative outflow of more than $310 billion over the past 18 months. The observed cash outflow indicates that average mutual fund investors have gradually cut back their equity positions since the beginning of last year.

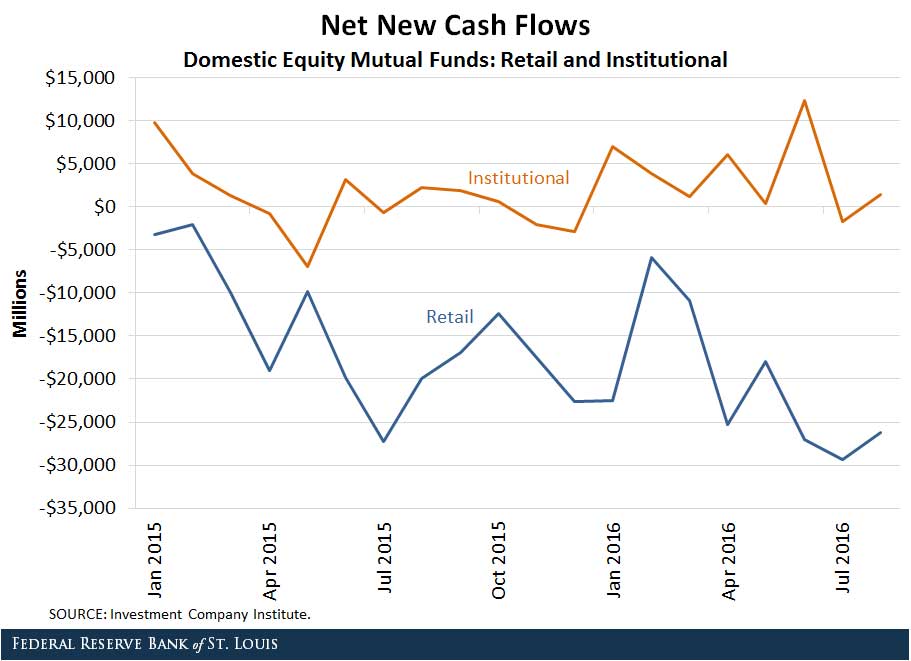

Mutual fund investors are composed of ordinary households and institutional investors, such as insurance companies. So, who is the driving force behind the sizable equity fund outflows seen in the data? There is no easy answer to this question, since there is no detailed decomposition of mutual fund holdings among them.

However, the data provided by the Investment Company Institute (ICI) includes net cash flows decomposed by method of sale. In general, there are two main categories: retail sales and institutional sales.2

The latter refers to those sales made primarily to institutional investors and institutional accounts. The investors who make up retail sales are less obvious, but we can reasonably assume they are more likely to be households investing in their brokerage or retirement accounts.

The figure below shows net cash flows of both retail and institutional sales of domestic equity funds from January 2015 to August 2016.

The net cash flows in the retail sales category are exclusively negative during the sample period. We see no clear trend for the institutional net cash flows. Clearly, the outflows seen in equity mutual funds overall are driven more by the retail sales than by those sales to institutional investors.

In sum, recent data suggest that there is a trend of trimming equity positions by mutual fund investors, even as money continues to flow into the stock market. Among mutual fund investors, the outflows are likely driven by ordinary households rather than institutional investors.

While it is difficult to pin down precisely why these outflows have been so persistent, it is clear that current conditions have made holding equity funds considerably less attractive relative to other assets.

Notes

1 The data are collected and provided by the Investment Company Institute (ICI) and include monthly cash flows to and from U.S. mutual funds, including equity, hybrid, bond and commodity funds.

2 For the definitions of ICI’s different sales categories here, see Mutual Fund Method of Sales Definitions.

Additional Resources

- On the Economy: The Speed of Filling Jobs Is Declining

- On the Economy: New SEC Rules Cause Shift in Money Market Fund Assets

- On the Economy: The Timing of Labeling a Bank “Too Big to Fail” Matters

Citation

YiLi Chien and Paul Morris, ldquoThe Stock Market Is Up, but Mutual Fund Investors Are Fleeing,rdquo St. Louis Fed On the Economy, Oct. 24, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions