The Speed of Filling Jobs Is Declining

In the September Beige Book, the St. Louis Fed noted that employers were experiencing “ongoing difficulties finding qualified workers.” This has been a common theme across the past several books. Part of the charm of the Beige Book is that it’s mere anecdote, but nevertheless it’s difficult to resist trying to quantify it.

Vacancy posting data give us one way to understand how difficult it is for employers to hire. Using data from The Conference Board Help Wanted OnLine (HWOL), we looked at the filling rate of job vacancies.1

However, before we get into our findings, it’s important to note a few limitations with our dataset, which result in some important inconsistencies with the vacancy filling rate—or vacancy yield as it is often called—estimated in a paper by Steven Davis, R. Jason Faberman and John Haltiwanger:2

- The HWOL, unfortunately, does not distinguish between postings that are withdrawn or expire without being filled and those that are filled. Thus, our vacancy filling rate is more accurately described as a vacancy exit rate. Still, it is our best approximation to the filling rate.

- The HWOL measures duration at monthly intervals, which we know is far too long because other datasets show that a huge fraction of vacancies are filled in the first days after posting.

- Its sample collects only online postings, which may not be representative and their fraction may change over time.

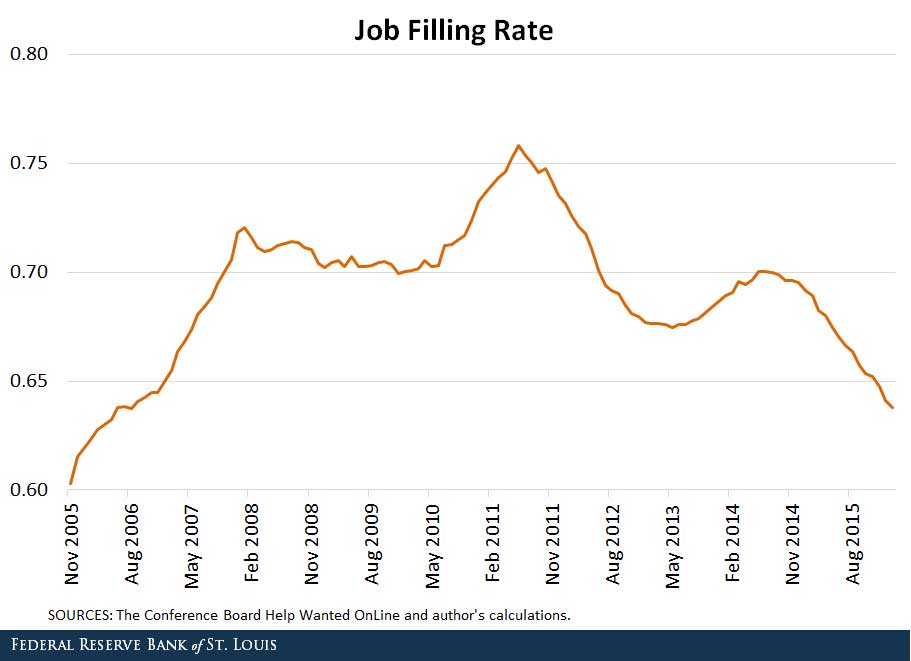

In the figure above, the higher the number, the faster job vacancies are filled. We see that vacancies posted in the midst of the Great Recession filled faster and the rate even kept rising. However, the filling rate has steadily declined in the past year or so.

This is basically as we would expect: When there are relatively few vacancies for each job searcher, the vacancies can find a worker easily. As the labor market recovers, more vacancies chase fewer searchers, and they stay open longer. Thus, the filling rate declines.

With the HWOL, we can look at how the estimated filling rate differed across occupations. Clearly, there should be persistent differences because the search process for a construction worker is quite different from that for a new research scientist.

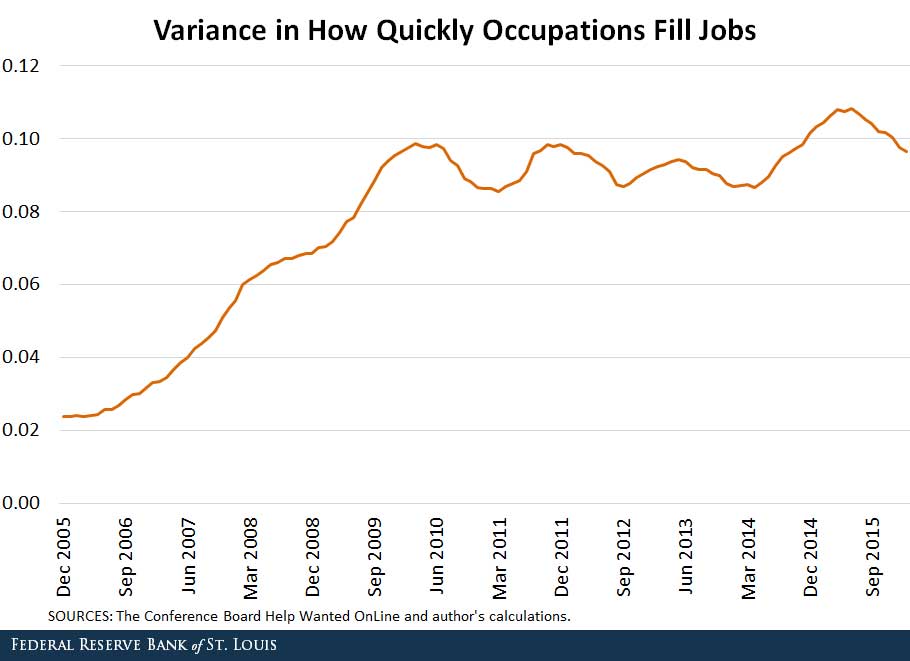

Oddly though, despite the cyclical change in average vacancy yield, the dispersion in the log of yield does not seem to have changed recently. In the figure below, we plot the variance in how quickly jobs are filled across occupations.

What this shows is that, even though the filling rate has declined on average, the dispersion remains around its recessionary high. As examples, only about one-third of health care practitioner vacancies are filled in a month, while construction vacancies fill almost with certainty.

When the Fed’s survey respondents report their difficulty finding workers, they are giving a great picture of the economy, at least some part of it.

Notes and References

1 Our equation was ft = -log((Pt+1 – Pst)/Pt). It’s the same equation we would use for job finding rates, only using the number of unemployed workers instead of postings. In the numerator, we look at postings tomorrow minus new inflows, those younger than one period. We take a 12-month moving average, which removes measurement noise and seasonality.

2 Davis, Steven J.; Faberman, R. Jason; and Haltiwanger, John C. “The Establishment-Level Behavior of Vacancies and Hiring.” Quarterly Journal of Economics, 2013, Vol. 128, Issue 2, pp. 581-622. Unfortunately, the Bureau of Labor Statistics Job Openings and Labor Turnover Survey data that they used are not available without special access from the Bureau of Labor Statistics.

Additional Resources

- On the Economy: Matching Jobs with the Right Skill Levels

- On the Economy: Labor Compensation and Productivity Gap Keeps Growing

- On the Economy: Jobs Found through Referrals Pay More

Citation

David G Wiczer, ldquoThe Speed of Filling Jobs Is Declining,rdquo St. Louis Fed On the Economy, Oct. 10, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions