Real GDP Growth Projected at 3.7% Annual Rate in Q4

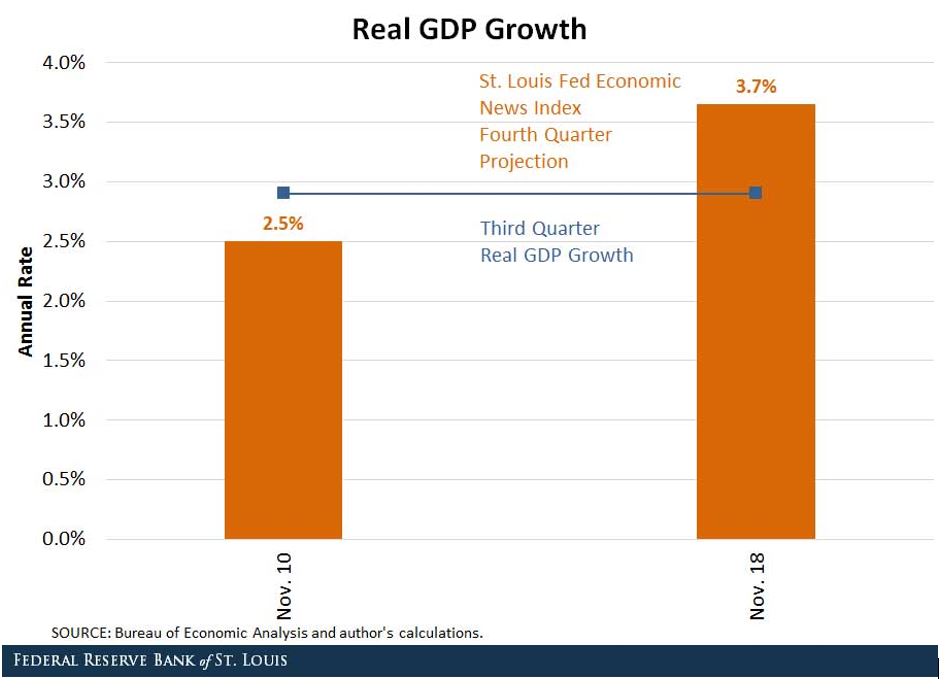

The St. Louis Fed’s Economic News Index (ENI) predicts that real gross domestic product (GDP) will increase at a 3.7 percent annual rate in the fourth quarter, up strongly from the previous week’s estimate of 2.5 percent. (Unlike other nowcasts, the ENI uses some data that do not flow directly into GDP, such as initial claims, housing starts, nonfarm payroll employment and consumer confidence.)

The projected growth rate for the fourth quarter is about 0.75 percentage points more than that registered in the third quarter. If the projection holds, it would signal that the economy had developed some healthy momentum over the second half of 2016 after increasing at only a 1.2 percent rate over the first half of the year. (See figure below.)

If real GDP advances at a 3.7 percent rate in the fourth quarter, then the U.S. economy will have grown by 2.2 percent this year, modestly stronger than the 1.9 percent gain seen in 2015 (measured on a fourth-quarter-to-fourth-quarter basis).

Real GDP increased at a 2.9 percent annual rate in the third quarter, according to the advance estimate published by the Bureau of Economic Analysis (BEA) on Oct. 28. The BEA’s advance estimate was very close to the ENI’s 3.1 percent forecast, which was calculated Oct. 27.

As noted in a previous On the Economy blog post, the St. Louis Fed’s ENI uses economic content from key monthly economic data releases to forecast the growth of real GDP during that quarter.1 This simple-to-read index is updated every Friday. Starting in early January, it will be posted regularly on the St. Louis Fed’s FRED (Federal Reserve Economic Data) database.

Notes and References

1 See Kliesen, Kevin; and McCracken, Michael. “Tracking the U.S. Economy with Nowcasts.” The Regional Economist, April 2016, Vol. 24, Issue 2. The ENI will not produce forecasts for the major components of GDP, such as real nonresidential fixed investment.

Additional Resources

- The Regional Economist: Tracking the U.S. Economy with Nowcasts

- On the Economy: What Will Inflation Be over the Next Year?

- U.S. Financial Data

Citation

Kevin L. Kliesen, ldquoReal GDP Growth Projected at 3.7% Annual Rate in Q4,rdquo St. Louis Fed On the Economy, Nov. 21, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions