Housing Has Become More Affordable over the Long Term

The prices of houses and apartment rents have risen faster than incomes and inflation lately. However, housing costs are actually more affordable today than they were 25 years ago, according to the latest issue of Housing Market Perspectives.

The author, William R. Emmons, is an assistant vice president with the St. Louis Fed and senior economic adviser with the St. Louis Fed’s Center for Household Financial Stability. He explained that average apartment rents and U.S. house prices have increased faster over the past five years (3.1 percent annually and 5.3 percent annually, respectively) than inflation (1.3 percent) and per capita personal income (3.0 percent).1

However, per capita personal income has grown 3.6 percent per year in the U.S. since 1991. House prices and apartment rents grew 3.1 percent and 2.9 percent per year, respectively, over the same time frame. (Inflation grew at an annual rate of 2.3 percent.)

Regional Differences in Housing Affordability

Because rents and house prices have increased faster in some regions than others lately, Emmons also examined housing affordability in four major metropolitan areas (one in each census region):

- Atlanta, representing the South

- Chicago, representing the Midwest

- Los Angeles, representing the West

- New York, representing the Northeast

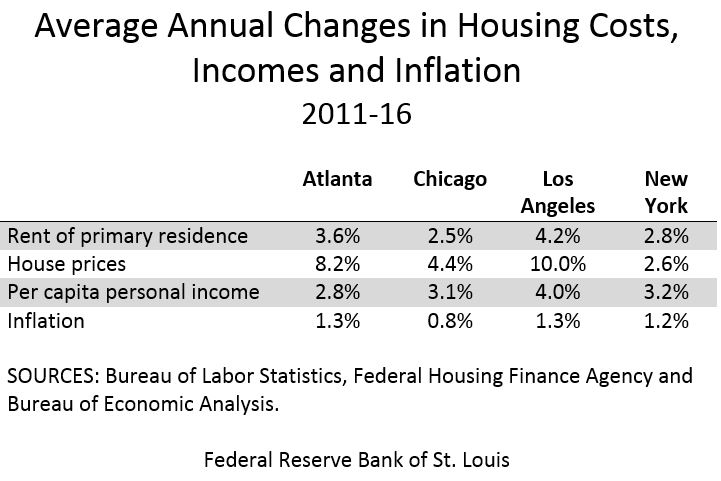

The table below shows annual changes in apartment rents, house prices, incomes and inflation for the past five years in those four metro areas.

Emmons noted that only Atlanta and Los Angeles clearly showed declines in housing affordability. House prices grew faster than incomes in Chicago, while rents grew more slowly. Both house prices and rents grew more slowly than incomes in New York. He wrote: “Thus, while housing costs increased in real terms in all four cities during the last five years, trends in housing affordability were mixed.”

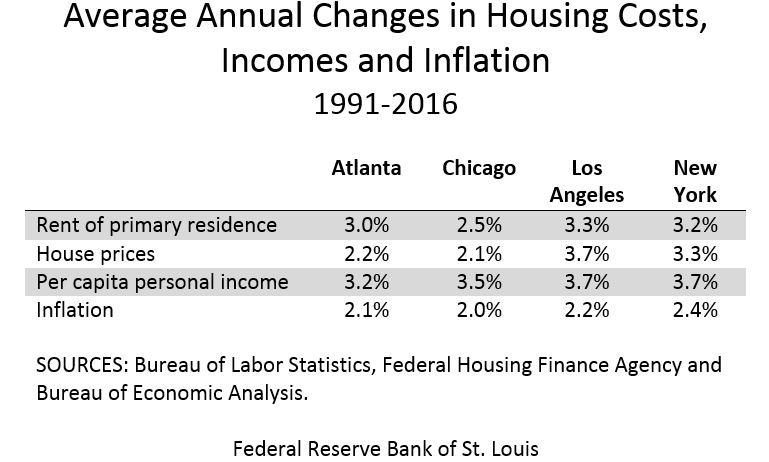

Longer-term, however, the picture is much less mixed. The table below shows the same information over the period 1991-2016.

Emmons noted that apartment rents and house prices increased faster than inflation in every city examined. Still, per capita personal income grew faster than apartment rents and house prices in every case except one: Los Angeles, where house prices and income grew at essentially the same rate.

Conclusion

Emmons concluded by saying that the recent rise in housing costs has not reversed the trend of housing’s becoming more affordable over the past 25 years. He wrote: “To be sure, some families and some regions face significant housing affordability challenges. But long-term data suggest that housing markets in most major cities remain reasonably effective in providing affordable rented and owned housing for the average family.”

Notes and References

1 Inflation was measured using the all-items consumer price index.

Additional Resources

- Housing Market Perspectives: Recent Rise in Housing Costs Belies Long-Term Affordability

- On the Economy: What Was Behind the Boom and Bust in House Prices?

- On the Economy: Employment, Capacity Utilization and Business Cycles

Citation

ldquoHousing Has Become More Affordable over the Long Term,rdquo St. Louis Fed On the Economy, Nov. 17, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions