How Many Unemployed People Are Jobless All Month?

The unemployment rate is often discussed as if it is either an observable fact or some mysterious bureaucratic drivel. In some circles, it is treated with the same definitiveness as stock prices that scroll across screens. Other tribes treat it with suspicion or muddle it together with many numbers between zero and one that supposedly describe the state of the world.

However, the unemployment rate is much more akin to counting raised hands. It is the product of a great deal of statistical science and knowhow applied to a nearly quixotic task of counting hands in a playground of children polled about whether or not they are currently on the slide. Among all of its difficulties, one is that the unemployment rate is counting moving objects.

The Bureau of Labor Statistics' (BLS) definition of unemployment is interestingly nuanced, and that perhaps affects how we interpret the numbers. In particular, the BLS categorizes people using their employment status in the week of the month in which it conducts its Current Population Survey (CPS). But there are potentially many short-lived changes in employment status that happen in between response weeks.

In this piece, I will discuss how only about seven out of 10 workers classified by the CPS as unemployed during a particular week of the month are actually unemployed for the entire month. This figure moves around with the business cycle, but maybe not as much as we might think.

Weekly Unemployment Statistics

To examine this aspect of the CPS, we need another dataset which gives higher-frequency labor force status but is still nationally representative. For this, we used the Survey of Income and Program Participation (SIPP), which provides weekly employment status.1 From this sample, we can create an analog to the measurement in the CPS, categorizing workers by their employment status in the second week of the month. Then, we examine their labor force status in the other weeks of the month.

On average over the period, 72 percent of workers that the CPS would have categorized as unemployed in a given month were unemployed in all of the other weeks of the month. This is to say, the CPS takes a particular snapshot within the month, looking at employment in the cross-section for one week. But it is not necessarily indicative of the employment status of many of these workers during the rest of the month, because many unemployment stints are quite short.

What Does 72 Percent Mean?

Is 72 percent a large or small number of people to be unemployed for the full month? One way to think about this is against a benchmark that all workers find jobs at the same rate every week. We cannot observe this weekly job finding rate, but we can estimate it using monthly CPS data similar to a 2009 paper examining cyclical unemployment,2 which was about 10 percent.

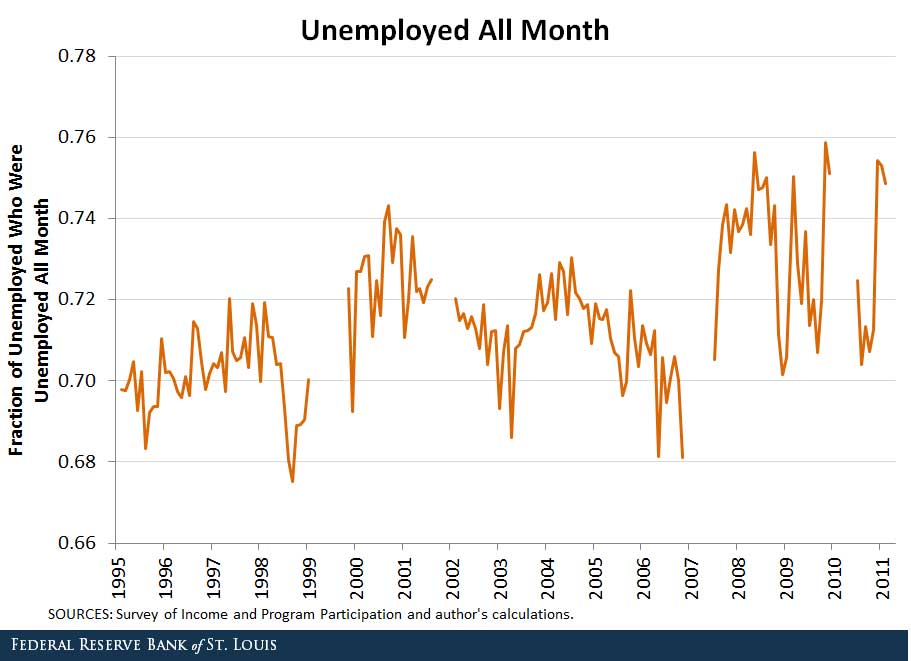

If this is the case, then conditional on being unemployed in the second week of the month, the probability of still being unemployed at the end of the month is about 75 percent if it is a five-week month and 82 percent if it is a four-week month. The rate at which workers exit unemployment within the month seems to be high, but not terribly unreasonable. The figure below shows the variation over time of the rate at which a CPS-unemployed worker will be unemployed for the entire month.

Because the SIPP is a relatively small sample, a monthly figure is relatively noisy. To deal with this and also control for seasonal factors, we used a 12-month moving average. Notice that the rate generally stayed between 70 percent and 75 percent and was higher during recession than expansion.

Under our assumption that everyone finds a job at the same weekly rate, we would expect fewer people to find jobs within the month they are counted as unemployed during recession. However, under this assumption, there should be far more variation. The weekly job finding rate fell by almost half during the Great Recession. This means that the number not finding a job before the end of the month should be between 85 percent and 90 percent, rather than the 75 percent we see. Rather than changes of 5 percentage points over the cycle, that fraction of CPS unemployed who remain unemployed the whole month should move by about 15 percentage points over the cycle, or three times as much.

Conclusion

What have we learned? The main source of unemployment statistics counts workers as unemployed based on their job status one week of the month. But as a notion of monthly unemployment, we also might reasonably ask whether the worker was unemployed for the whole month.

About seven in 10 workers unemployed in the CPS week were also unemployed the rest of the month. If we assume that all workers find jobs at the same weekly rate, then this level actually seems about correct, as we would expect about three-fourths of workers unemployed in the second week of the month to find a job before it ends.

What is surprising is how little the figure moves over the cycle. Despite large declines in the weekly job finding rate, which would imply that fewer should find a job before the end of the month, the fraction of CPS-unemployed workers remaining unemployed the entire month does not rise by much.

Notes and References

1 The SIPP covers a shorter time period and has a smaller sample than the CPS, but it provides weekly employment status comparable to the way the CPS categorizes workers in a particular week of the month. The SIPP is organized into several panels—a group of respondents who enter the survey in 1996, 2001, 2004 and 2008—who report their weekly employment status for about four years. We use all survey respondents who ever reported being a labor market participant during their panel's period.

2 Elsby, Michael W.; Michaels, Ryan; and Solon, Gary. “The Ins and Outs of Cyclical Unemployment,” American Economic Journal, 2009, Vol. 1, Issue 1, pp. 84-110.

Additional Resources

- On the Economy: Many Negative Labor Market Trends Started before the Great Recession

- On the Economy: Nearly Half of Job Switchers Earn Less in Their New Roles

- On the Economy: Looking beyond the Unemployment Rate

Citation

David G Wiczer, ldquoHow Many Unemployed People Are Jobless All Month?,rdquo St. Louis Fed On the Economy, May 12, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions