The Connection between Commodity Prices and Output

The business cycles of many emerging economies depend pretty heavily on fluctuations in global commodity prices, according to an article in The Regional Economist.

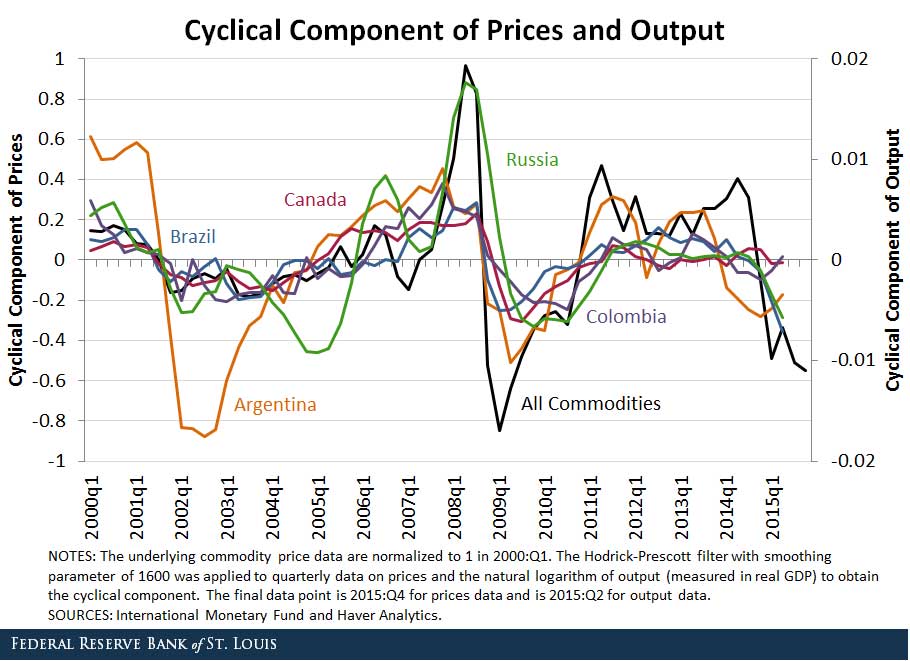

Research Officer and Economist Alexander Monge-Naranjo and Technical Research Associate Faisal Sohail examined a quarterly commodity price index as well as output for Argentina, Brazil, Canada, Colombia and Russia over the period 2000-15. Specifically, they looked at deviations from trend for commodity prices and output. They estimated and removed the trend from each variable, leaving the cyclical component shown in the figure below.

The authors noted that commodity prices have experienced significant volatility over the past 16 years. In particular:

- During 2000-06, commodity prices trended upward with frequent fluctuations around that trend.

- Prices increased dramatically the year before the Great Recession.

- They decreased significantly during the recession, then recovered sharply by early 2009 and recovered or exceeded prerecession levels by 2011.

- They were relatively stable during 2011-14.

Energy Prices

Monge-Naranjo and Sohail also discussed the drop in commodity prices since 2014, most notably in energy prices, and explained that some of the drop was due to supply factors. They wrote: “In particular, the newfound abundance of energy in the U.S. and resulting fight for market share by the Organization of the Petroleum Exporting Countries have led to plentiful supply and falling prices.”

Output and Commodity Prices

Monge-Naranjo and Sohail examined the connection between deviations in commodity prices and in output from trend. In the figure above, deviations of output from trend are measured on the right axis, and it shows that the two are highly correlated. They wrote: “Indeed, the dramatic, fast and sustained recovery in commodity prices must be credited as a major source of the relatively stronger, faster and sustained recovery of emerging markets following the recession, relative to the recoveries in the U.S., Europe, Japan and other major economies.”

They concluded: “One or two years after the collapse in 2009, a tidal wave in rising commodities prices pushed emerging economies to quickly recover and grow. Nowadays, the tidal wave has receded, and many emerging markets are in danger of capsizing.”

Additional Resources

- Regional Economist: Many Countries Sink or Swim on Commodity Prices—and on Orders from China

- On the Economy: The Great Recession’s Effect on the Federal Budget

- On the Economy: Trade in the U.S., Eighth District by Commodity

Citation

ldquoThe Connection between Commodity Prices and Output,rdquo St. Louis Fed On the Economy, June 7, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions