Who Holds the U.S. Public Debt?

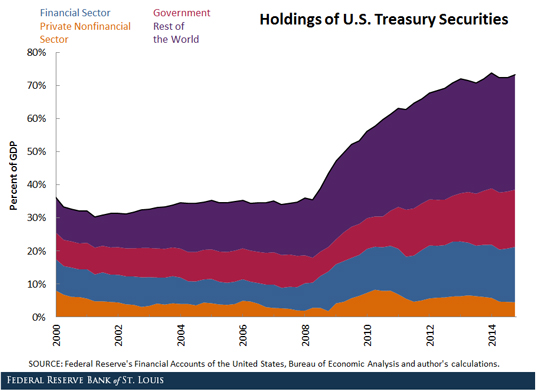

By the fourth quarter of 2014, total U.S. federal government debt held by the public reached about $13 trillion or 73.4 percent of gross domestic product (GDP).1 In the period before the most recent recession,2 government debt was significantly lower, averaging 34 percent of GDP between the first quarter of 2000 and the fourth quarter of 2007. Which sectors acquired this increase in government debt? That is, who holds the U.S. public debt?

The chart below shows debt in the hands of the public in terms of GDP by type of holder from the first quarter of 2000 through the fourth quarter of 2014, according to the Fed’s Financial Accounts of the United States and my calculations. The chart identifies four major types of debt holders:

- The private nonfinancial sector, which consists of households and nonfinancial corporations

- The financial sector, which includes chartered banks, insurance companies, retirement funds, pension funds and mutual funds, among other institutions

- The government, which consists of Fed banks and state and local governments

- The rest of the world

Households and nonfinancial corporations do not directly hold a significant share of U.S. debt. Most of their bond holdings are through retirement, pension and mutual funds. In the past, the private nonfinancial sector (particularly households) held a larger share of U.S. debt. For example, this sector held about 40 percent of the debt in 1955 and about 25 percent as recently as the mid-1990s.

Since the beginning of the last recession, bond holdings by financial institutions have grown by about 10 percentage points in terms of GDP. However, the share of their holdings has remained relatively stable, at around a fifth of total debt. Currently, the largest holders of U.S. government debt in this sector are chartered banks and retirement, pension and mutual funds.

Government holdings have also increased, but kept pace with the overall rise. Although Fed banks currently hold a large stock of U.S. debt, their share of holdings has not increased dramatically. Right up to the beginning of the last recession, Fed banks held an average of about 15 percent of the total debt. As of the fourth quarter of 2014, this proportion was around 19 percent.

The rest of the world is, by far, the biggest holder of U.S. government debt. The ownership share of this sector grew steadily from the mid-1990s until 2008, from slightly below one-fifth to almost half. This share has remained relatively stable since. Information provided by the U.S. Treasury reveals that roughly 40 percent of foreign holdings as of the fourth quarter of 2014 were concentrated in Japan and mainland China, with each holding similar amounts.

In sum, U.S. government debt rose sharply since the beginning of the last recession. However, ownership shares by major sectors have not varied significantly.

Notes and References

[1] Debt held by the public excludes holdings by federal agencies, most notably Social Security trust funds. Also, “public” includes the Federal Reserve banks.

2 As dated by the National Bureau of Economic Research, the most recent recession lasted from December 2007 to June 2009.

Additional Resources

- On the Economy: Why Has International Trade Increased So Much?

- On the Economy: A Breakdown of Bank Failures in 2014

- On the Economy: By One Measure, Deflationary Pressure Seems To Be Subsiding

Citation

Fernando M. Martin, ldquoWho Holds the U.S. Public Debt?,rdquo St. Louis Fed On the Economy, May 11, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions