Emerging Economies' Vulnerability to Monetary Policy Changes

Monetary policy changes by advanced economies may affect emerging economies, but not all emerging economies feel the same effects. Historically, those with weaker fundamentals have been more intensely affected. A recent Economic Synopses essay examined how vulnerable emerging market economies are to changes in monetary policies of advanced economies, which can affect capital flows and the value of their currencies.

To measure this effect, Ana Maria Santacreu, an economist with the Federal Reserve Bank of St. Louis, constructed an indicator using six fundamental economic variables of each country studied:

- Its short-term debt

- Its foreign reserves

- Its current-account deficit, as a percentage of gross domestic product (GDP)

- Its inflation rate

- Its cyclically adjusted public budget

- Its government debt

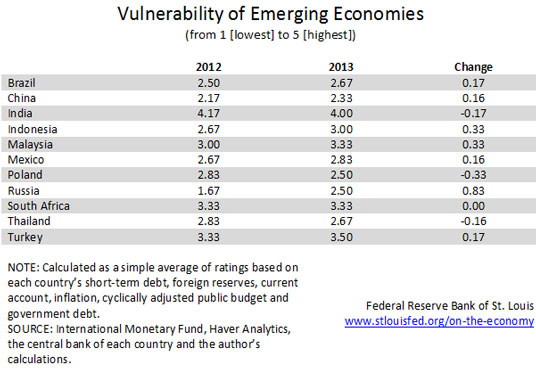

The table below shows the indicator for various emerging economies. The last column shows the changes in each country’s vulnerability, with a positive number implying an increase in vulnerability.

The most vulnerable countries appear to be India, Turkey and South Africa. Santacreu noted that India’s vulnerability is mostly due to its high inflation rate (more than 9 percent) and its cyclically adjusted public budget (-2.6 percent of potential GDP in 2013). The main sources of vulnerability for Turkey and South Africa are their current account deficits (around -7 percent of GDP) and having fewer foreign reserves than needed to avoid a depreciation of their currencies. Russia experienced an increase in vulnerability between 2012 and 2013 especially due to low economic growth and a deterioration of its balance of payments.

Santacreu concluded, “As the empirical evidence shows, countries with weaker economic fundamentals experienced higher currency volatility following policy announcements in advanced economies and subsequent changes in capital flows. This evidence calls for structural reforms in such countries to strengthen their macroeconomic conditions.”

Additional Resources

- Economic Synopses: The Economic Fundamentals of Emerging Market Volatility

- On the Economy: Where Is the “Peril” of Deflation Striking Back?

- On the Economy: Monetary Policy and the Output Gap

Citation

ldquoEmerging Economies' Vulnerability to Monetary Policy Changes,rdquo St. Louis Fed On the Economy, Feb. 3, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions