Are Oil Price Declines Good for the Economy?

With oil prices down by more than 50 percent since June 2014, attention has turned to the impact this may have on the macroeconomy. While it’s generally accepted that sharp increases in the price of oil have a negative effect, research isn’t as conclusive when it comes to falling oil prices. A recent Economic Synopses essay adds to the discussion by accounting for various measures of economic activity and shows that falling oil prices appear to have a positive impact on the economy.

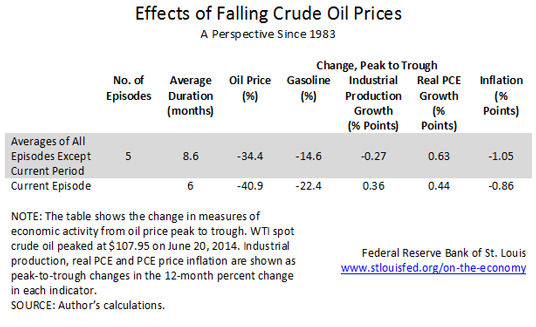

Kevin Kliesen, a business economist and research officer with the Federal Reserve Bank of St. Louis, examined the economic effects of falling crude oil prices over five nonrecession periods since 1983.1 Oil prices fell at least 12 percent in nominal terms during each period. The table below shows the results.

As might be expected, falling crude oil prices led to falling gasoline prices, lower inflation and faster growth of real consumer spending. On the other hand, growth of real industrial production declined by an average of 0.3 percent during these episodes. The current episode, shown on the bottom line of the table, covers the period June through December and seems to be following a similar pattern to the previous ones, though growth in industrial production has instead strengthened. Kliesen concluded, “Significant declines in oil prices during expansions appear to be a net positive for the economy.”

Notes and References

1 The five periods were November 1985 through July 1986, January 1997 through December 1998, July 2006 through January 2007, March 2012 through June 2012 and August 2013 through November 2013. Also, oil prices in the table are calculated by the peak-to-trough change in the refiners’ acquisition cost for crude oil, rather than by spot oil prices.

Additional Resources

- Economic Synopses: Are Oil Price Declines Good for the Economy?

- On the Economy: Oil Prices: Is Supply or Demand behind the Slump?

- On the Economy: Why Don’t Gas Prices Always Move in Sync with Oil Prices?

Citation

ldquoAre Oil Price Declines Good for the Economy?,rdquo St. Louis Fed On the Economy, Feb. 10, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions