Use of St. Louis Fed Economic Education Materials Grows

As National Financial Literacy Month draws to a close, the messages conveyed during this period are on top of the minds of policymakers, school administrators, teachers and parents alike. Numerous studies, including the one by St. Louis Fed Assistant Vice President Mary Suiter and Economic Education Specialist Erin Yetter, have shown the practical benefits of increasing financial literacy.

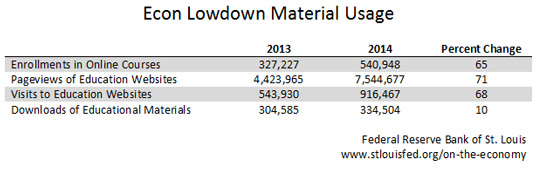

Implementing a personal finance curriculum, or even parents simply speaking to their children about money, doesn’t have to involve elaborate or expensive materials. The materials produced by our economic education program, Econ Lowdown, are available to anyone free of charge and range from simple chats to full lessons with exercises and answer guides to fun videos. These materials have seen a significant rise in usage in just the past year.

Econ Lowdown materials cover personal finance topics—such as credit, budgeting and saving—and economic topics—such as supply and demand, opportunity cost, comparative advantage, and present value. There are materials not only for teachers, but also for parents and their children to use together.

Additional Resources

- Press Release: St. Louis Fed Receives 2015 Excellence in Financial Literacy Education Award

- On the Economy: The Impact of Financial Education

- On the Economy: Five Simple Questions That Reveal Your Financial Health

Citation

ldquoUse of St. Louis Fed Economic Education Materials Grows,rdquo St. Louis Fed On the Economy, April 30, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions