Five Simple Questions That Reveal Your Financial Health

In the years since the financial crisis, households across the U.S. have undergone a period of significant deleveraging, with many working to strengthen their household balance sheets. An implicit question being considered by households during this period is: “How financially healthy are we?” The St. Louis Fed’s Center for Household Financial Stability has devised a scorecard that may help households with an answer.

In the most recent issue of In the Balance, William Emmons and Bryan Noeth, both with the center, unveiled the financial health scorecard, which is based on questions asked of families participating in the Federal Reserve’s Survey of Consumer Finances (SCF). The scorecard’s five questions are:

- Did you save any money last year?

- Did you miss any payments on any obligations in the past year?

- Did you have a balance on your credit card after the last payment was due?

- Including all of your assets, was more than 10 percent of the value in liquid assets?

- Is your total debt service (principal and interest) less than 40 percent of your income?

Answers were given a score of 0 or 1. The highest possible score, indicating strong financial health was 5. Over the period 1992-2013, the average total score among SCF survey respondents was 3.01. (The specific questions asked in the survey and how they were scored are available in the In the Balance issue.)

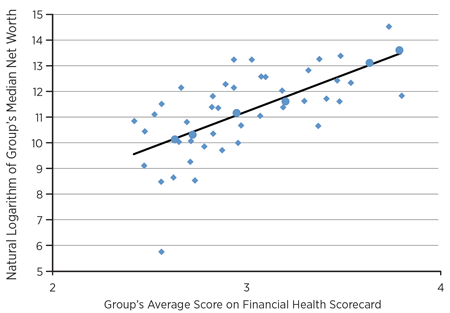

To gauge possible links between financial health and wealth, Emmons and Noeth split survey respondents into 48 groups based on age, education, and race or ethnicity. They then calculated the correlation coefficient between group scores and their net worths, also reported in the SCF. The resulting correlation was 0.67, indicating a very strong relationship between the scorecard’s measure of financial health and households’ actual net worth. The figure below plots the 48 groups’ average scorecard results against the natural logarithm of their median net worths.

Emmons and Noeth wrote that they couldn’t be sure which way causation ran—from financial health to wealth or vice versa—and offered other factors that could be responsible for the correlation, such as life cycle effects, challenges unique to race or ethnicity, or disparate access to wealth-building financial institutions and policies.

They concluded, “Whatever the causal mechanisms, our simple financial health scorecard provides a surprisingly accurate prediction of the median wealth of groups of families defined by their age, educational attainment, and race or ethnicity.”

Additional Resources

- In the Balance: Five Simple Questions That Reveal Your Financial Health and Wealth

- On the Economy: Beige Book: Economic Activity Continued To Expand

- On the Economy: Serious Mortgage Delinquencies Fell during Third Quarter

Citation

ldquoFive Simple Questions That Reveal Your Financial Health,rdquo St. Louis Fed On the Economy, Dec. 16, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions