Fewer Jobs Are Being Created and Being Destroyed

Job creation and destruction during expansions and recessions follow a perhaps intuitive pattern:

- During recessions, fewer jobs are created, and more are destroyed.

- During expansions, the opposite occurs.

However, about 7 million jobs are created in the U.S. every quarter on average, and almost as many are destroyed. A recent Economic Synopses essay from the Federal Reserve Bank of St. Louis shows that the pace of both job creation and job destruction has been slowing.

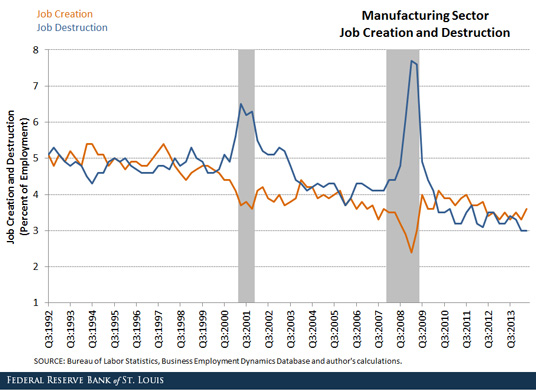

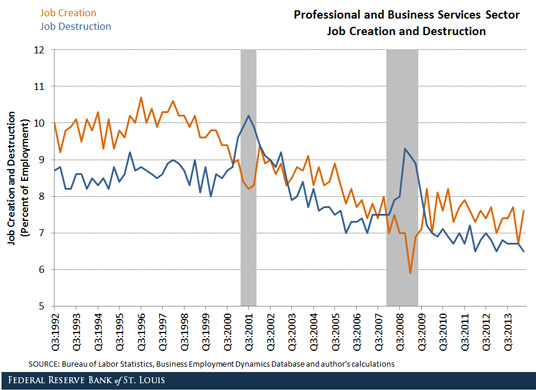

Maximiliano Dvorkin, an economist with the St. Louis Fed, examined the pace of job creation and destruction relative to employment for a select group of industries. The figures below show job creation and destruction for the manufacturing and the professional and business services sectors. (Figures showing job creation and destruction for other industries are also available.) The series are interpreted as the number of jobs created or destroyed in a quarter relative to the total number of jobs at the end of the quarter.

Dvorkin found that most industries exhibited a downward trend for job creation and destruction. He concluded, “This reduced dynamism in the labor market is consistent with more stable and longer-lasting employment relationships, given that fewer jobs are being destroyed. However, it is also consistent with a longer duration of joblessness and less job switching, as fewer jobs are being created.”

Additional Resources

- Economic Synopses: Jobs: More Slowly Created, More Slowly Destroyed

- On the Economy: How Long Until “Slack” Is Out of the Labor Market?

- On the Economy: How Should Labor Productivity Be Measured?

Citation

ldquoFewer Jobs Are Being Created and Being Destroyed,rdquo St. Louis Fed On the Economy, April 2, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions