Why Is Credit Card Delinquency Declining?

Credit card delinquency has decreased significantly since the end of the Great Recession. An Economic Synopses essay, published by the Federal Reserve Bank of St. Louis, breaks down the factors behind this decrease.

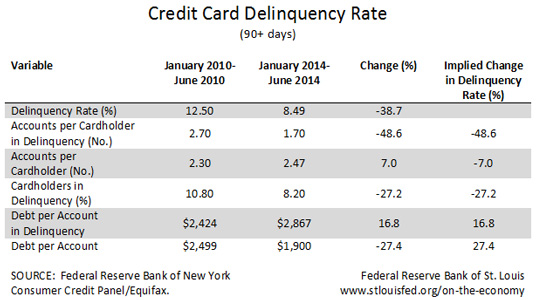

Juan Sánchez, a senior economist with the St. Louis Fed, noted that the delinquency rate for credit cards fell 38.7 percent from the period January-June 2010 to the period January-June 2014.1 He broke down the overall change into five individual components:

- Accounts per cardholder in delinquency

- Accounts per cardholder

- Cardholders in delinquency

- Debt per delinquent account

- Debt per account

The table below shows the contributions of each component to the overall decline. The last column corresponds to the change in the delinquency rate that would be observed during this period if only that component had changed.

Sanchez concluded that the decline in the number of cardholders in delinquency and the reduction in the number of accounts per cardholder in delinquency were the primary factors affecting the fall in the delinquency rate. He noted, “These factors are strong enough to dominate other changes that might have pushed up the delinquency rate, such as the rise in the debt per account in delinquency and the aggregate reduction in credit card debt.”

Notes and References

1 All changes here are computed as the difference of the natural logarithm to facilitate analysis. Numbers may not add up precisely due to rounding.

Additional Resources

- Economic Synopses: Why Is Credit Card Delinquency Declining?

- On the Economy: Credit Card Delinquency Rates Falling Faster for Younger Households

- On the Economy: Many Households Remain Underwater on Their Mortgages

Citation

ldquoWhy Is Credit Card Delinquency Declining?,rdquo St. Louis Fed On the Economy, Nov. 13, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions