Many Households Remain Underwater on Their Mortgages

By Juan Sánchez, Senior Economist, and Lijun Zhu, Technical Research Associate

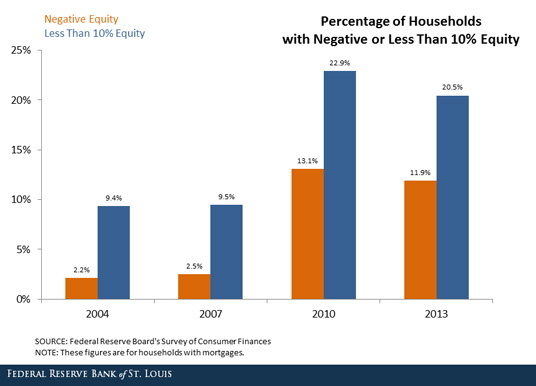

Default on mortgage debt played an important role in the recent financial crisis. Research at the Federal Reserve Bank of St. Louis shows that the decline in house prices was the fundamental driving force behind the increase in defaults. After the decline in house prices, many households owned homes worth less than their mortgage. (That is, they had negative home equity.) In general, while only a small fraction of households with negative equity actually default on their mortgages, negative equity is a necessary condition for default. Otherwise, households would sell their houses, pay back their mortgages and keep any remaining funds.

The Federal Reserve Board of Governors collects data every three years regarding family incomes, net worth, balance sheet components, credit use and other financial outcomes. We used the recently released 2013 Survey of Consumer Finances to compute the percent of households with higher risk of default:

- Those underwater (or those with negative home equity)

- Those with home equity smaller than 10 percent of the value of the house.1

Since the values of the houses included in the survey are self-reported, the numbers should be interpreted carefully, because households living in their houses for long time may not have a good estimate of their house’s value.

The findings show that the percent of households with negative equity decreased only slightly from 2010 to 2013, and the levels look different than in 2004 and 2007, when the percent of households with negative equity was smaller than 3 percent. These findings imply that conditions in the housing market remain fragile and further improvement in house prices will be necessary to return to healthy mortgage market.

Notes and References

1 It is important to note that the denominator is not the number of homeowners but the number of homeowners with mortgages.

Additional Resources

Citation

ldquoMany Households Remain Underwater on Their Mortgages,rdquo St. Louis Fed On the Economy, Nov. 3, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions