Do Revisions to GDP Follow Patterns?

Gross domestic product (GDP) is a quarterly economic indicator that reflects the amount of output produced in a country. In the U.S., the Bureau of Economic Analysis (BEA) releases two estimates of quarterly GDP, known as the advance and preliminary estimates, in the two months before the release of the final number:

- The advance estimate of GDP is generally available in the first month after each quarter and is compiled from estimates of economic activity for some portion of the quarter (often two of the three months).

- The preliminary estimate is released in the month following the advance estimate, accounts for revisions of the economic data from the months used to compile the advance estimate and incorporates new data.

In a recent Economic Synopses essay, we examined the pattern of revisions for payroll employment data. We found that the sign of the revision to payroll employment, released by the Bureau of Labor Statistics is more likely to be positive (revised up) during expansions and more likely to be negative (revised down) during recessions. We argued that this created a conundrum for policymakers who rely on the just-in-time release of the economic indicators to enact appropriate policies.

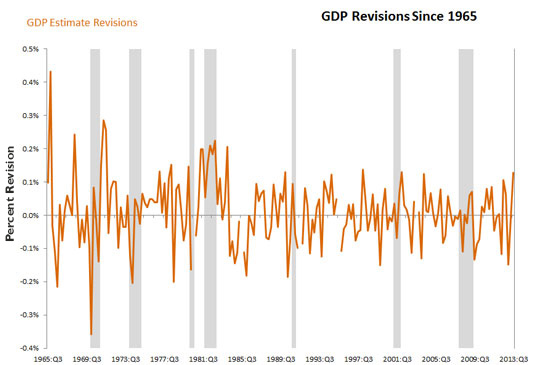

We wondered whether the same asymmetry occurred for the GDP releases—that is, whether there was a systematic difference between the final number and, say, the preliminary release. The figure below shows the difference between the final release and the preliminary release, with recessions shaded in gray.

While there are no obvious patterns, there are typically large negative revisions from the preliminary releases to the final releases at the beginning of recessions.

What accounts for the differences between the preliminary and final estimates of GDP? The differences may lie in the period over which they are measuring or in the methods used for their collection.

Additional Resources

- On the Economy: How Important Have Employment Revisions Been the Past Two Years?

- On the Economy: Why News of China’s Economy Surpassing the U.S.’s Should Be Met with Caution

- Economic Synopses: Employment Revision Asymmetries

Citation

Michael T. Owyang, ldquoDo Revisions to GDP Follow Patterns?,rdquo St. Louis Fed On the Economy, May 26, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions