St. Louis Fed’s Housing Market Perspectives: How Many Mortgage Foreclosures Is Forbearance Preventing?

ST. LOUIS ― In stark contrast to the Great Recession, mortgage foreclosures amid the COVID-19 shock declined significantly in the early months of this recession. Mortgage forbearance programs may have helped. Unlike during the Great Recession, these programs were implemented ahead of elevated mortgage distress.

But how many foreclosures is forbearance preventing? In the latest edition of Housing Market Perspectives, William Emmons, an assistant vice president and economist at the St. Louis Fed, estimates that about 500,000 foreclosure initiations will have been prevented in the fourth quarter due to forbearance plans, a reduction of almost 98% compared to what they would have been without forbearance.

Citing data from the Mortgage Bankers Association, he calculates that about 2.2 million U.S. mortgage borrowers (4.8% of borrowers) were seriously delinquent at the end of third quarter 2020, and about 3.9 million homeowners (8.6% of borrowers) were in a forbearance plan. Because not all delinquent borrowers are in forbearance—and not all borrowers in forbearance are delinquent—this makes it challenging to assess the current state of mortgage distress.

To better estimate how many foreclosures current forbearance plans may be preventing, Emmons looks at the historical relationship between delinquency and foreclosure, including transition rates for different kinds of mortgages.

However, he cautions it is too soon to know how many of these foreclosures will be permanently avoided, and how many have merely been postponed: “One thing is clear: Forbearance is not a permanent solution to mortgage distress. Instead, forbearance merely buys time for other actions and policies to be undertaken.”

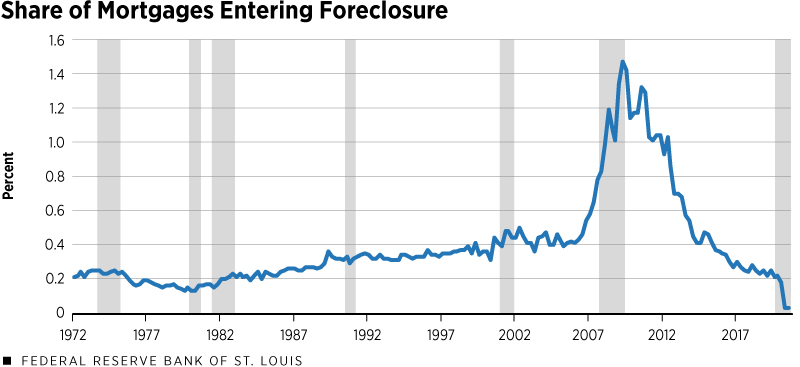

SOURCE: Mortgage Bankers Association.

NOTES: The data are the share of existing first-lien mortgages entering the foreclosure process each quarter. The data begin in the first quarter of 1972 and run through the third quarter of 2020.

DESCRIPTION: The share of mortgages entering foreclosure usually increases around recessions. This was particularly true around the Great Recession of 2007-09. More than 11 million mortgages entered the foreclosure process between 2008 and 2012. At the peak in the second quarter of 2009, 1.47% of existing mortgages entered foreclosure. In contrast, the share of mortgages entering foreclosure was only 0.03% in both the second and third quarters of 2020, the lowest rates ever recorded by the MBA.

-

Anthony Kiekow

314-949-9739

-

Shera Dalin

314-591-3457

-

Tim Lloyd

314-202-1381