St. Louis Fed Offers New Look at the Real State of Family Wealth

Millennials have narrowed the gap in average inflation-adjusted household wealth with Gen Xers at similar ages, according to new data analysis on family wealth.

That finding and others—including an early look at how the COVID-19 pandemic has impacted family wealth—were released Thursday from the St. Louis Fed in the Center for Household Financial Stability’s newest quarterly data assessment, the Real State of Family Wealth.

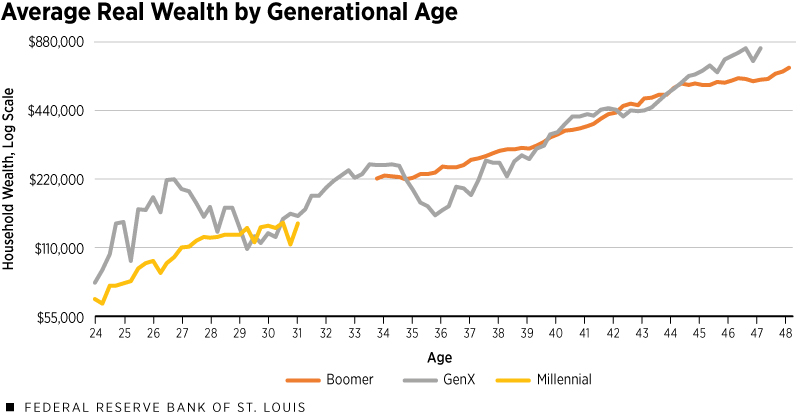

Millennials, who have suffered through two recessions in their careers, have faced lasting consequences for their financial well-being, especially in terms of lifetime savings goals. The figure above shows their average wealth has nearly caught up to Gen Xers’ over the past five years, suggesting that some millennial families have overcome past economic hurdles.

As of the most recent observation, millennials in 2020 had average wealth of $140,600 at age 31—close to Gen Xers’ average wealth of $152,000 at age 31 but below boomers’ average wealth of $221,100 at roughly age 34.

The authors took quarterly data (1989 to 2020) from the Federal Reserve Board’s Distributional Financial Accounts (DFAs) and adjusted the data to account for inflation and household population. This allows the Center to examine long-term trends and the pandemic’s impact on average real family wealth and wealth inequality in the U.S.

Other key findings show:

- Wealth gaps between white families and both Black and Hispanic families remain wide.

- Average household wealth dropped for nearly all racial/ethnic, generational and educational groups from the fourth quarter of 2019 to the first quarter of 2020, but then rebounded by the second quarter of 2020—this reflects the volatility of the coronavirus recession.

- Families headed by four-year college graduates have become much wealthier, on average, than families headed by those with less education.

- The overall effect on wealth inequality from the pandemic remains unclear based on the most recent data.

The new look at data is authored by Ana Hernández Kent, policy analyst, Center for Household Financial Stability; Lowell R. Ricketts, lead analyst, Center for Household Financial Stability; William R. Emmons, economist and assistant vice president, St. Louis Fed; and Ray Boshara, director, Center for Household Financial Stability.

Stay informed of updates to these figures and others by subscribing to the Center for Household Financial Stability e-mail alert and bookmarking The Real State of Family Wealth webpage.

-

Anthony Kiekow

314-949-9739

-

Shera Dalin

314-591-3457

-

Tim Lloyd

314-202-1381