St. Louis Fed Study: When You Were Born Affected Your Wealth During and After the Great Recession

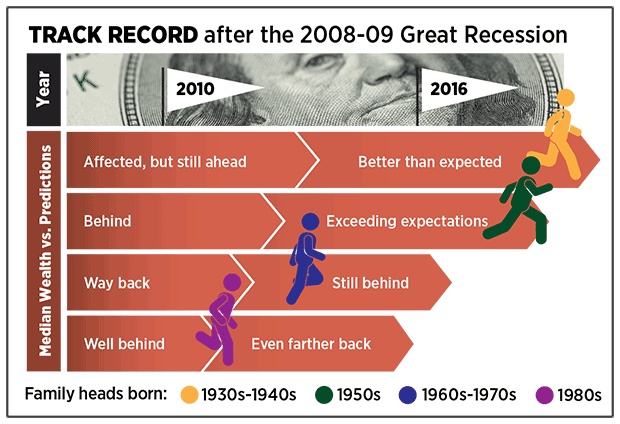

ST. LOUIS - A new study by the St. Louis Fed’s Center for Household Financial Stability (HFS) found that the Great Recession hit groups born in certain decades harder than others. The study focused on six groups of families based on their decade of birth, starting in the 1930s and ending in the 1980s. Researchers found that families born in the 1960s and later suffered the biggest wealth losses and have rebounded slowly. Families born in the 1980s are at risk of becoming a lost generation as far as wealth accumulation is concerned.

The essay is the second in a series the center is producing titled “The Demographics of Wealth: How Education, Race and Birth Year Shape Financial Outcomes.” The series is based on an analysis of the Federal Reserve’s triennial Survey of Consumer Finances (SCF). The essays are based on the recently released 2016 SCF data. The authors are William R. Emmons, St. Louis Fed assistant vice president and HFS lead economist; Ana H. Kent, HFS policy analyst and Lowell R. Ricketts, HFS lead analyst. In this essay, the Center explores the connections between a person’s birth year and measures of his or her family’s financial well-being, including income and wealth.

The examination of the links between birth year and wealth revealed three important findings:

- There is a pronounced life cycle of wealth.

The authors found there was an upward sloping arc through most of the typical family’s life cycle. The range of actual wealth accumulation across families is very large, but the typical family’s experience starts with rapid initial growth in percentage terms followed by steady deceleration and eventual decline.

- Members of all birth cohorts lost wealth around the Great Recession, but only typical families headed by someone born in 1960 or later had failed to get back on track by 2016.

Families of all six decades were doing well in 2007. The Great Recession reduced median wealth substantially among all six groups. The four youngest groups (born in the 1950s and later) dropped below their age-specific wealth benchmarks as a result of the recession. The three youngest groups (1960s and later) remained below those benchmarks in 2016.

- The 1980s cohort is at greatest risk of becoming a “lost generation” for wealth accumulation.

For the median family headed by someone born in the 1980s, wealth in 2016 remained 34 percent below the level the authors predicted based on the experience of earlier generations at the same age. In contrast to all other groups, the typical 1980s family lost ground between 2010 and 2016, falling even further behind the typical wealth life cycle. This represents a missed opportunity because asset appreciation is unlikely to be as rapid in the near future as it was during the recent period.

The data in this essay are drawn from nearly 48,000 families born throughout the 20th century. The focus is on families headed by someone who was between 24 and 80 years of age both before and after the financial crisis of 2008-09. The authors compared the median inflation-adjusted wealth of families born in each decade to levels achieved by earlier generations at the same ages based on data from all families responding to the Survey of Consumer Finances between 1989 and 2016.

For more information about the report, visit the Center for Household Financial Stability.

-

Anthony Kiekow

314-949-9739

-

Shera Dalin

314-591-3457

-

Tim Lloyd

314-202-1381