Shaking the Third Rail: Reforming Social Security

U.S. politicians, policymakers and ordinary citizens are now talking openly about a topic that has long been taboo: altering the nation's Social Security system. Frequently called "the third rail of American politics"—touch it and you die—social security reform is an issue that prompts heated debates among its supporters and detractors. And although Social Security has been changed a number of times since its inception in 1935, the reforms being discussed today are much more substantial than those previously considered or undertaken.

And for good reason: It has become widely accepted that the long-term financial viability of the Social Security system is in doubt. Although the reasons are numerous, the key factor appears to be the enormous demands the aging of the baby boom population will place on the system early in the next century. To avert the financial crunch that most analysts see looming, a growing number of social security experts and policymakers are supporting the privatization of all or parts of the system.

Humble Beginnings

The U.S. Social Security system—formally Old Age, Survivors and Disability Insurance (OASDI)—was launched in response to the Great Depression, when the savings of a large portion of American families were wiped out. Even before the Depression, however, a number of policymakers recognized the need for government social insurance because of sweeping economic and demographic changes like increased urbanization and life expectancy, which threatened the traditional family-based support for the elderly. Social Security was introduced as a fully funded program; workers and their employers were each subject to a 1 percent payroll tax on earnings up to $3,000. The taxes went into a fund to pay future benefits, which were based on an individual's lifetime contribution.

But in 1939, recognizing that Americans nearing retirement age would never be able to contribute enough to finance a socially acceptable retirement income, Congress made a number of changes to the program. First, benefits for dependents—spouses and children—were introduced. Second, benefits became based on average earnings over some minimum period, rather than total lifetime contributions. Finally, and most important, to finance benefits for the newly eligible, as well as higher benefits for workers close to retirement, the program was changed to a "pay-as-you-go" system. Under pay-as-you-go, payroll tax contributions from future retirees and their employers are immediately paid out as benefits to current retirees.

Other modifications have also been made over the years. Disability benefits were added in 1954. Workers not previously covered—farmers, the self-employed, certain government employees—were added to the program. Per capita benefits and payroll taxes have been increased a number of times; the current payroll tax of 12.4 percent (employee and employer combined) is six times the original rate.1 Benefits have been indexed for inflation. They are also subject to an earnings test and taxed if income exceeds a given level, which redistributes benefits across income classes. Workers can retire as early as 62, but receive reduced benefits before age 65. The maximum level of earnings subject to the payroll tax has also risen over time, and currently stands at $62,700.

Under the Social Security Act amendments passed in 1983, benefits will be reduced beginning in the year 2000, and the retirement age will gradually increase, reaching 67 by 2022. A trust fund was also established in 1983 to help finance future benefits. Payroll taxes in excess of what's needed to pay current benefits go into the fund and are invested in U.S. Treasury securities—the only investments permitted under law. The fund currently has a surplus of $496 billion, which is expected to increase sharply over the next 15 years because of a larger number of workers and higher payroll tax contributions.

The Coming Crunch

The Social Security trust fund was established because of an increasing concern among policymakers about what demographics would do to the system. The number of workers supporting retirees and the disabled has been declining for decades and is expected to keep dipping well into the next century as the huge cohort of baby boomers begins to retire in 2010. The baby boom generation, defined as those born between 1946 and 1964, numbers 74 million and accounts for about 30 percent of the U.S. population.

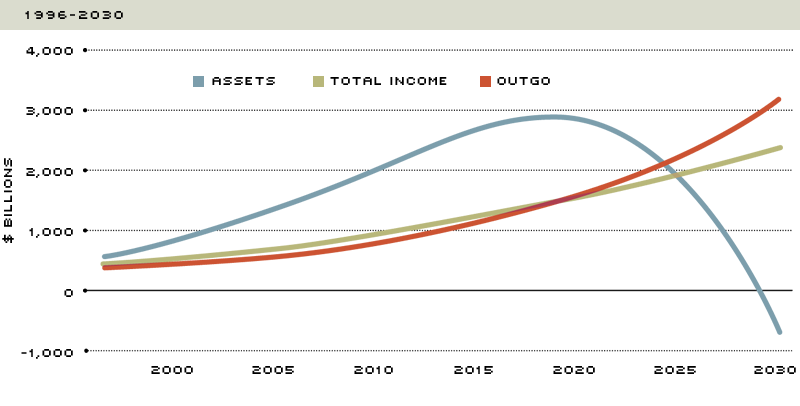

Compounding the problem is a continuing drop in the U.S. fertility rate and a continuing increase in life expectancy. The number of workers per supported retiree is expected to fall from about five today to 3.6 in 2010 and 2.4 in 2030.2 At that rate, according to the OASDI trust funds' board of trustees, benefits will exceed payroll tax income by 2012 and total income, which is payroll taxes plus interest income, by 2019. By 2029, the trust fund will be exhausted (see figure ).3 Although benefits still will be paid because tax revenue will continue to be collected, most social security analysts believe, barring government borrowing to cover the shortfall, that either taxes will need to be raised, benefits will need to be decreased—or both—to meet system obligations.

Social Security Income, Outgo and Assets

NOTE: Figures are for combined OASI and DI Trust Funds.

SOURCE: Board of Trustees of the Social Security Administration, June 1996

Unhappy Returns

In addition to the solvency concern, reform advocates also bemoan the low financial returns to be received by current and future generations under the current system. To date, each generation of recipients has received a lower rate of return than the previous one—a trend that is expected to continue well into the next century. Early program recipients received far more in benefits than they paid in, enjoying real (after inflation) returns of more than 12 percent by some estimates. In contrast, baby boomers can expect a real return of about 2 percent.4

Why the declining returns? First, the program's initial retirees received full benefits—retirement, spousal, dependent and survivor—regardless of either the number of years they paid in to the system or the size of their contributions following the switch from a fully funded to pay-as-you-go system. Large increases in benefits and the introduction of cost of living adjustments in the 1970s also boosted returns for earlier retirees. There was even a period in the mid-1970s when benefits were over-indexed for inflation because of a flaw in the indexing formula used.

These benefit increases meant that fewer dollars began accumulating in the trust fund when it was set up in 1983. And the dollars that were accumulating were invested in low-yielding Treasury securities.

How Radical Reform?

Given the mounting concerns about long-term solvency and the low returns being generated under the current system, momentum is gaining for social security reform. The United States is not alone in this predicament. Most industrialized nations, as well as a number of developing countries, also face aging populations and declining fertility rates and are saddled with pay-as-you-go systems that redistribute income across generations and income levels. Reform efforts of various sorts have been launched in a number of countries, including Australia, Chile and Sweden.5 What these reform movements have in common is an effort to more closely link benefits with actual contributions. For example, Chile's movement from a pay-as-you-go system to one that's mostly privatized has been closely scrutinized and touted as a model for the United States and other nations (see below).

In the United States, reform proposals that address the solvency issue and the benefits-contribution link are now being seriously contemplated. For example, Senators Bob Kerrey and Alan Simpson have introduced legislation that would increase the normal retirement age to 70 by 2029. More significantly, the senators have also introduced a bill that would direct a portion of payroll taxes to IRA-like personal investment plans—an approach that could be considered partial privatization of the system.

In its last several annual reports, the OASDI trust funds' board of trustees has forecasted that the system is failing the 75-year test for actuarial balance, which is the difference between annual income and annual costs, summed over the next 75 years. Every four years, an advisory council is appointed to review these forecasts and comment on policy issues related to Social Security. The council appointed in 1994 has tackled the imbalance issue and is expected to issue its policy recommendations by year-end. The council's stated goal was to bring the system into actuarial balance, while preserving its popularity, by minimizing benefit cuts and payroll tax increases.6

Although council members could not unanimously agree on one plan, the three drafted share two common features. First, each proposes a way of bridging the gap between benefits and income by raising taxes, trimming benefits, taxing benefits, gradually raising the retirement age or requiring mandatory private saving. Second, to address the low returns generated on workers' contributions, each plan has provisions for directing some portion of these savings into the stock market. The council notes that even after adjusting for risk, the stock market outperforms the bond market over long time horizons, a phenomena economists call "the equity premium."7 One substantial difference among the plans is the degree to which they move Social Security away from a pay-as-you-go system toward a fully funded one. According to economist Ed Gramlich, a University of Michigan economics professor and head of the council, these plans can be described as follows.

The Maintain Benefits Proposal

The objective of this proposal is preservation of the current system. To meet this objective, benefits would be subject to tougher tax treatment, and a portion of the OASDI trust funds would be invested in stocks. Currently, above certain income thresholds, 50 percent to 85 percent of benefits are taxable, with tax revenue divided between the OASDI and Medicare trust funds. Under this first proposal, however, all benefits in excess of previously taxed contributions (payroll tax payments) would be treated as taxable income, and all of that tax revenue would eventually be diverted to the OASDI funds. One controversial aspect of this tougher tax treatment is that it forces current retirees—who are receiving higher returns than future generations will receive—to pay for some of the system's actuarial imbalance.

The other provision of this plan would permit the OASDI trust funds to gradually hold up to 40 percent of their assets in stocks, a move that would be expected to raise the overall return on the portfolio by nearly 50 percent. The shift from government securities to stocks is a controversial one. Some analysts have expressed concerns about whether the equity premium will hold up; if it doesn't, the Social Security system would have new financial and credibility problems. Another concern is over government involvement in the stock market. A 40 percent investment in stocks would tally about $1 trillion, or one-seventh of GDP. Although the plan calls for the OASDI trust funds to hold passive investments, like index funds, there are still fears about political meddling in the management of these sizable accounts.8

The Individual Accounts Proposal

The primary objective of this proposal is to scale back benefits to eradicate the long-term actuarial deficit in the program. To accomplish this, three steps would be taken. First, the normal retirement age would gradually be raised. Second, the ratio of benefits to contributions for high-wage workers would be scaled back. Third, and most important, this plan would create mandatory individual savings accounts equivalent to 1.6 percent of payrolls.9 Although these accounts would be held in the Social Security system, individuals would direct their contributions to specific investments, choosing from among five to 10 index funds of stocks, bonds or both. The accumulations in these accounts would be packaged as an annuity and added to regular benefits at retirement.

The establishment of individual accounts would represent a radical departure from the current system, which is basically a defined benefit program that also partially redistributes income from high- to low-wage earners.10 Under this second plan, the system would be part defined benefit and part defined contribution. Because the individual account contributions are a fixed percentage of payroll, high earners would automatically accumulate more income than low earners, assuming the same investment choices.

Proponents of this plan cite several advantages, including decentralized decision-making, an increased sense of "ownership" of retirement funds because of the partial funding, and risk diversification through the combination of defined benefit and defined contribution components. However, this plan shares some of the same disadvantages as the first, such as the risks associated with equities and the political repercussions of having the federal government invest in the stock market. In addition, it raises concerns about poor investment choices by plan participants.

The Personal Security Accounts Proposal

The third proposal features even larger individual accounts and is closest in spirit to a privatized system like Chile's. Under this plan, 2.4 percentage points of the current 12.4 percent payroll tax would be earmarked for survivors and disability insurance, which would essentially be unchanged. The remaining 10 percentage points of the tax would be split equally and directed to: a flat Social Security benefit equal to two-thirds of the poverty line, which would be financed by employers and administered by the Social Security system; and an individual personal security account or PSA, which would be financed by employees. Unlike the second proposal, however, these PSAs would not be managed by the Social Security system and packaged as annuities. Rather, the accounts would be administered by private registered investment companies. At retirement, a PSA holder would be able to choose among an annuity, a lump sum payout or an addition to his estate. Under this proposal, the retirement age would also gradually rise, to match increases in life expectancy.

The biggest question this plan raises is how to finance the transition from the current system to the new system. The current generation is paying now for their parents' retirement, and, after the transition, this generation's children will be paying for their own retirement. But who would pay for this generation's retirement? The transition plan calls for all workers over 55 to remain in the present system and all workers under 25 to enter the new system (those under 25 may earn some credit for payroll taxes already paid). Workers between the ages of 25 and 55 would receive a two-tiered benefit. Tier 1 would consist of the benefit already accrued in the current system, plus a pro rata share of the flat benefit in the new system; Tier 2 would consist of the funds and returns from the PSA. But because these benefits would be greater than the 7.4 percent being paid into the OASDI trust funds (the 2.4 percent payment for disability and survivor's insurance, plus the 5 percent employer-paid payroll tax), a supplemental transition tax would need to be levied to make up for the shortfall.

The main advantages of the PSA plan are twofold: It encourages individual responsibility and ownership because the taxpayer essentially pays a tax to himself; and it guarantees a flat minimum benefit. In addition, its proponents, as well as proponents of other partially privatized plans, believe it would create positive macroeconomic effects by increasing national savings.11

But as with the other two plans, the PSA proposal is saddled with several disadvantages and unanswered questions. For starters, retirees would face even more risk in this plan than in the other two because of the larger share of tax payments being invested in the stock and bond markets. Secondly, lump sum withdrawals from PSAs could be problematic if retirees are short-sighted. There would be enormous political pressure to bail out these people, as well as those who did not make wise investment choices. Another concern is whether the administrative costs of managing all of these individual accounts would seriously erode the expected higher returns.

High Stakes, Tough Choices

Social Security is an enormously popular program among U.S. citizens. And for more than 60 years, it has largely met its goal of providing a socially adequate retirement for the nation's elderly, regardless of income. Unlike most private pension programs, it provides inflation protection. But despite all of these attributes, Social Security is also a program with serious long-term problems. Although pay-as-you-go financing solved the system's early shortcomings, it has proven to be financially unsound. Social security experts are divided, however, on whether the system needs only minor tinkering or more serious overhaul. Privatization proponents point to the prospect of increased returns and national savings—as well as the end of risky intergenerational transfer payments—as the major pluses of their reform thrust. But such sweeping changes would effectively end Social Security as we know it. Given the high stakes, this choice should not be made hastily or lightly.

Endnotes

- This rate includes the payroll tax deduction for disability insurance, but not for Medicare, which is currently 2.9 percent for employers and employees combined. [back to text]

- These forecasts are based on the projected working age population and the projected retirement age population. [back to text]

- These estimates are based on an "intermediate" forecast of economic and demographic factors. If fertility declines more than expected, or if people live longer than expected, the trust funds will be depleted earlier. See Board of Trustees (1996). [back to text]

- See Gokhale and Lansing (1996). [back to text]

- See Schieber and Shoven (1996). [back to text]

- See Gramlich (1996). [back to text]

- Since the 1920s, for example, the inflation-adjusted return on common stocks has averaged more than 7 percent, compared with a return of less than 2 percent on Treasury bonds. [back to text]

- An index fund is one that is tied to a fixed set of assets, like the stocks of the nation's top 500 companies. By definition, because the components of the fund are predesignated, there is no "stock picking" involved. [back to text]

- This 1.6 percent levy would be on top of the 12.4 percent payroll tax. [back to text]

- A defined benefit plan is one in which individuals in similar circumstances pay the same fixed contribution and receive the same fixed benefit; the traditional corporate pension is an example. A defined contribution plan is one in which individuals can choose how much, within limits, to contribute, with the benefit depending on the size of the contribution and the interest income earned on that contribution; 401(k) plans are defined contribution plans. [back to text]

- Of course, national savings would increase only if additional funds are saved because of these changes. Individuals could opt to reduce other private saving, leaving total savings unchanged. [back to text]

References

Board of Trustees, Federal Old-Age and Survivors Insurance and Disability Insurance Trust Funds. 1996 Annual Report (June 5, 1996).

Gokhale, Jagadeesh. "Should Social Security be Privatized?" Federal Reserve Bank of Cleveland Economic Commentary (September 15, 1995).

Gokhale, Jagadeesh and Kevin J. Lansing. "Social Security: Are We Getting Our Money's Worth?" Federal Reserve Bank of Cleveland Economic Commentary (January 1, 1996).

Gramlich, Edward M. "Different Approaches for Dealing with Social Security," Journal of Economic Perspectives, Vol. 10, No. 3 (Summer 1996), pp. 55-66.

Kerrey, Bob and Alan K. Simpson. "How to Save Social Security," The New York Times (May 23, 1995).

Santamaria, Marco. "Privatizing Social Security: The Chilean Case," Columbia Journal of World Business, Vol. 27, No. 1 (Spring 1992), pp. 38-51.

Schieber, Sylvester J., and John B. Shoven. "Social Security Reform: Around the World in 80 Ways," The American Economic Review, Vol. 86, No. 2 (May 1996), pp. 373-77.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us